Target 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

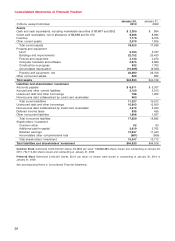

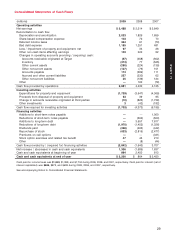

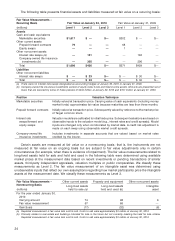

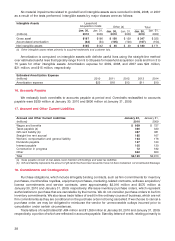

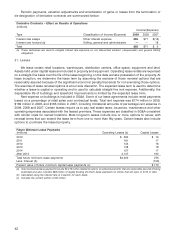

The following table presents the carrying amounts and estimated fair values of financial instruments not

measured at fair value in the Consolidated Statements of Financial Position. The fair value of marketable

securities is determined using available market prices at the reporting date. The fair value of debt is generally

measured using a discounted cash flow analysis based on our current market interest rates for similar types of

financial instruments.

Financial Instruments Not Measured at Fair Value January 30, 2010

Carrying Fair

(millions) Amount Value

Financial assets

Other current assets

Marketable securities (a) $27 $27

Other noncurrent assets

Marketable securities (a) 55

Total $32 $32

Financial liabilities

Total debt (b) $16,447 $17,487

Total $16,447 $17,487

(a) Amounts include held-to-maturity government and money market investments that are held to satisfy the capital requirements of

Target Bank and Target National Bank.

(b) Represents the sum of nonrecourse debt collateralized by credit card receivables and unsecured debt and other borrowings

excluding unamortized swap valuation adjustments and capital lease obligations.

The carrying amounts of credit card receivables, net of allowance, accounts payable, and certain accrued

and other current liabilities approximate fair value at January 30, 2010.

9. Cash Equivalents

Cash equivalents include highly liquid investments with an original maturity of three months or less from

the time of purchase. Cash equivalents also include amounts due from credit card transactions with

settlement terms of less than five days. Receivables resulting from third-party credit card sales within our

Retail Segment are included within cash equivalents and were $313 million and $323 million at January 30,

2010 and January 31, 2009, respectively. Payables resulting from the use of the Target Visa at third-party

merchants are included within cash equivalents and were $40 million and $53 million at January 30, 2010 and

January 31, 2009, respectively.

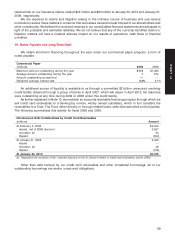

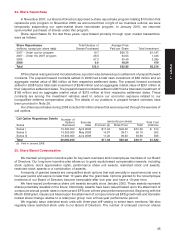

10. Credit Card Receivables

Credit card receivables are recorded net of an allowance for doubtful accounts. The allowance,

recognized in an amount equal to the anticipated future write-offs of existing receivables, was $1,016 million at

January 30, 2010 and $1,010 million at January 31, 2009. This allowance includes provisions for uncollectible

finance charges and other credit-related fees. We estimate future write-offs based on historical experience of

delinquencies, risk scores, aging trends, and industry risk trends. Substantially all accounts continue to

accrue finance charges until they are written off. Total receivables past due ninety days or more and still

accruing finance charges were $371 million at January 30, 2010 and $393 million at January 31, 2009.

Accounts are written off when they become 180 days past due.

Under certain circumstances, we offer cardholder payment plans that modify finance charges and

minimum payments, which meet the accounting definition of a troubled debt restructuring (TDRs). These

concessions are made on an individual cardholder basis for economic or legal reasons specific to each

individual cardholder’s circumstances. As a percentage of period-end gross receivables, receivables

classified as TDRs were 6.7 percent at January 30, 2010 and 4.9 percent at January 31, 2009. Receivables

classified as TDRs are treated consistently with other aged receivables in determining our allowance for

doubtful accounts.

As a method of providing funding for our credit card receivables, we sell on an ongoing basis all of our

consumer credit card receivables to Target Receivables Corporation (TRC), a wholly owned, bankruptcy

remote subsidiary. TRC then transfers the receivables to the Target Credit Card Master Trust (the Trust), which

from time to time will sell debt securities to third parties either directly or through a related trust. These debt

35

PART II