Target 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.securities represent undivided interests in the Trust assets. TRC uses the proceeds from the sale of debt

securities and its share of collections on the receivables to pay the purchase price of the receivables to the

Corporation.

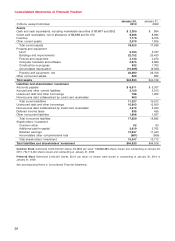

We consolidate the receivables within the Trust and any debt securities issued by the Trust, or a related

trust, in our Consolidated Statements of Financial Position based upon the applicable accounting guidance.

The receivables transferred to the Trust are not available to general creditors of the Corporation. The

payments to the holders of the debt securities issued by the Trust or the related trust are made solely from the

assets transferred to the Trust or the related trust and are nonrecourse to the general assets of the

Corporation. Upon termination of the securitization program and repayment of all debt securities, any

remaining assets could be distributed to the Corporation in a liquidation of TRC.

In the second quarter of 2008, we sold an interest in our credit card receivables to JPMC. The interest sold

represented 47 percent of the receivables portfolio at the time of the transaction. This transaction was

accounted for as a secured borrowing, and accordingly, the credit card receivables within the Trust and the

note payable issued are reflected in our Consolidated Statements of Financial Position. Notwithstanding this

accounting treatment, the accounts receivable assets that collateralize the note payable supply the cash flow

to pay principal and interest to the note holder; the receivables are not available to general creditors of the

Corporation; and the payments to JPMC are made solely from the Trust and are nonrecourse to the general

assets of the Corporation. Interest and principal payments due on the note are satisfied provided the cash

flows from the Trust assets are sufficient. If the cash flows are less than the periodic interest, the available

amount, if any, is paid with respect to interest. Interest shortfalls will be paid to the extent subsequent cash

flows from the assets in the Trust are sufficient. Future principal payments will be made from JPMC’s prorata

share of cash flows from the Trust assets.

In the event of a decrease in the receivables principal amount such that JPMC’s interest in the entire

portfolio would exceed 47 percent for three consecutive months, TRC (using the cash flows from the assets in

the Trust) would be required to pay JPMC a prorata amount of principal collections such that the portion

owned by JPMC would not exceed 47 percent, unless JPMC provides a waiver. Conversely, at the option of

the Corporation, JPMC may be required to fund an increase in the portfolio to maintain their 47 percent

interest up to a maximum JPMC principal balance of $4.2 billion. If a three-month average of monthly finance

charge excess (JPMC’s prorata share of finance charge collections less write-offs and specified expenses) is

less than 2 percent of the outstanding principal balance of JPMC’s interest, the Corporation must implement

mutually agreed upon underwriting strategies. If the three-month average finance charge excess falls below

1 percent of the outstanding principal balance of JPMC’s interest, JPMC may compel the Corporation to

implement underwriting and collections activities, provided those activities are compatible with the

Corporation’s systems, as well as consistent with similar credit card receivable portfolios managed by JPMC.

If the Corporation fails to implement the activities, JPMC would cause the accelerated repayment of the note

payable issued in the transaction. As noted in the preceding paragraph, payments would be made solely from

the Trust assets.

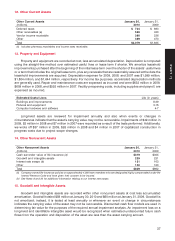

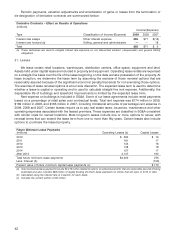

11. Inventory

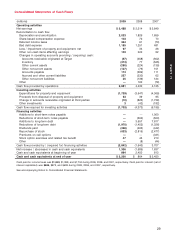

Substantially all of our inventory and the related cost of sales are accounted for under the retail inventory

accounting method (RIM) using the last-in, first-out (LIFO) method. Inventory is stated at the lower of LIFO cost

or market. Cost includes purchase price as reduced by vendor income. Inventory is also reduced for

estimated losses related to shrink and markdowns. The LIFO provision is calculated based on inventory

levels, markup rates and internally measured retail price indices.

Under RIM, inventory cost and the resulting gross margins are calculated by applying a cost-to-retail ratio

to the retail value inventory. RIM is an averaging method that has been widely used in the retail industry due to

its practicality. The use of RIM will result in inventory being valued at the lower of cost or market because

permanent markdowns are currently taken as a reduction of the retail value of inventory.

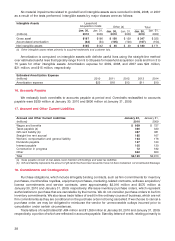

We routinely enter into arrangements with vendors whereby we do not purchase or pay for merchandise

until the merchandise is ultimately sold to a guest. Revenues under this program are included in sales in the

Consolidated Statements of Operations, but the merchandise received under the program is not included in

inventory in our Consolidated Statements of Financial Position because of the virtually simultaneous purchase

and sale of this inventory. Sales made under these arrangements totaled $1,820 million in 2009, $1,524 million

in 2008, and $1,643 million in 2007.

36