Target 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporation beginning in fiscal 2010 and adoption is not anticipated to affect our consolidated net earnings,

cash flows or financial position.

In June 2009, the FASB issued SFAS No. 167, ‘‘Amendments to FASB Interpretation No. 46(R)’’

(SFAS 167), codified in the Consolidation accounting principles, which amends the consolidation guidance

applicable to variable interest entities. The amendments will significantly affect the overall consolidation

analysis under former FASB Interpretation No. 46(R). This guidance will be effective for the Corporation

beginning in fiscal 2010 and adoption is not anticipated to affect our consolidated net earnings, cash flows or

financial position.

Outlook

In the Retail Segment, we expect to generate increases in comparable-store sales, likely in the range of 2

to 4 percent for the year, including an expected 1 percentage point lift from our remodel program. While our

comparable-store sales comparisons are easier in the spring than the fall, the expected incremental sales

resulting from remodels will grow as the year progresses. Additionally, we expect total sales to increase by a

mid-single digit percentage.

In 2010 we expect to generally preserve our 2009 EBIT margin rate in our Retail Segment, which if

achieved would result in our Retail Segment EBIT increasing in line with total sales growth.

In our Credit Card Segment, we expect the lower consumer usage of credit and our risk management

strategies to continue throughout 2010, resulting in a low double-digit percentage decline in gross credit card

receivables by the end of the year. We also expect to maintain segment profit on a dollar basis at generally the

level earned in 2009, generating a higher pretax segment ROIC in 2010 than in 2009.

We expect our 2010 book effective tax rate to approximate our long-term structural rate, likely in the range

of 37.0 to 37.5 percent.

We also expect to continue to execute against our share repurchase authorization.

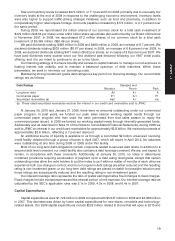

We expect our 2010 capital expenditures to be in the range of $2 to $2.5 billion, reflective of projects we

will complete in 2010 as well as initial spending for our 2011 and 2012 new store programs. Our expectation is

that our 2010 new store program will result in approximately 13 new stores and that our 2011 new store

program will be in the range of 20 to 30 stores.

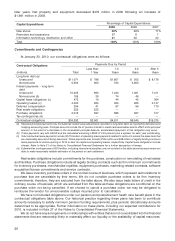

Due to the early repayment of an August 2010 debt maturity, the only significant remaining 2010 maturity,

prior to our seasonal working capital peak (which typically occurs in October or November), is the $900 million

public series borrowing collateralized by our credit card receivables due in October.

Forward-Looking Statements

This report contains forward-looking statements, which are based on our current assumptions and

expectations. These statements are typically accompanied by the words ‘‘expect,’’ ‘‘may,’’ ‘‘could,’’ ‘‘believe,’’

‘‘would,’’ ‘‘might,’’ ‘‘anticipates,’’ or words of similar import. The principal forward looking statements in this

report include: For our Retail Segment, our outlook for sales, expected merchandise returns, comparable-

store sales trends and EBIT margin rates; for our Credit Card Segment, our outlook for year-end gross credit

card receivables, portfolio size, future write-offs of current receivables, profit, ROIC, and the allowance for

doubtful accounts; on a consolidated basis, the expected effective income tax rate, the continued execution of

our share repurchase program, our expected capital expenditures and the number of stores to be opened in

2010 and 2011, the expected compliance with debt covenants, our intentions regarding future dividends, the

anticipated impact of new accounting pronouncements, our expected future share-based compensation

expense, our expected contributions and benefit payments related to our pension and postretirement health

care plans, and the adequacy of our reserves for general liability, workers’ compensation, property loss, and

team member medical and dental, the expected outcome of claims and litigation, and the resolution of tax

uncertainties.

All such forward-looking statements are intended to enjoy the protection of the safe harbor for forward-

looking statements contained in the Private Securities Litigation Reform Act of 1995, as amended. Although

we believe there is a reasonable basis for the forward-looking statements, our actual results could be

materially different. The most important factors which could cause our actual results to differ from our forward-

looking statements are set forth on our description of risk factors in Item 1A to this Form 10-K, which should be

read in conjunction with the forward-looking statements in this report. Forward-looking statements speak only

as of the date they are made, and we do not undertake any obligation to update any forward-looking

statement.

23

PART II