Target 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Target annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

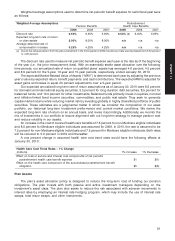

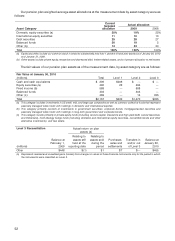

The settlement dates of these instruments are regularly renegotiated with the counterparty.

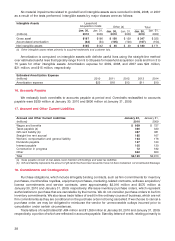

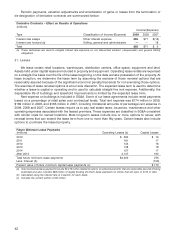

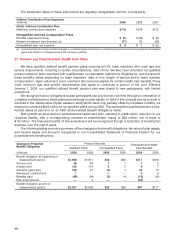

Defined Contribution Plan Expenses

(millions) 2009 2008 2007

401(k) Defined Contribution Plan

Matching contributions expense $178 $178 $172

Nonqualified Deferred Compensation Plans

Benefits expense/(income) $83 $ (80) $ 46

Related investment loss/(income) (a) (77) 83 (26)

Nonqualified plan net expense $6 $3 $20

(a) Investment loss/(income) includes changes in unrealized gains and losses on prepaid forward contracts and unrealized and realized

gains and losses on company-owned life insurance policies.

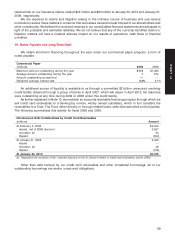

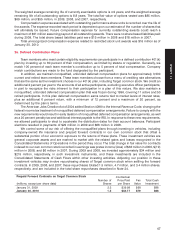

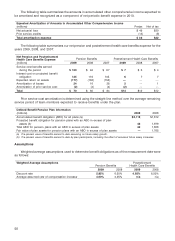

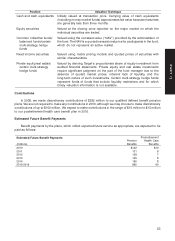

27. Pension and Postretirement Health Care Plans

We have qualified defined benefit pension plans covering all U.S. team members who meet age and

service requirements, including in certain circumstances, date of hire. We also have unfunded nonqualified

pension plans for team members with qualified plan compensation restrictions. Eligibility for, and the level of,

these benefits varies depending on team members’ date of hire, length of service and/or team member

compensation. Upon retirement, team members also become eligible for certain health care benefits if they

meet minimum age and service requirements and agree to contribute a portion of the cost. Effective

January 1, 2009, our qualified defined benefit pension plan was closed to new participants, with limited

exceptions.

We recognize that our obligations to plan participants can only be met over time through a combination of

company contributions to these plans and earnings on plan assets. In light of this concept and as a result of

declines in the market value of plan assets in 2008 (which were only partially offset by increases in 2009), we

elected to contribute $252 million to our qualified plans during 2009. This restored the qualified plans to a fully-

funded status at year-end on an ABO (Accumulated Benefit Obligation) basis.

During 2009 we amended our postretirement health care plan, resulting in a $46 million reduction to our

recorded liability, with a corresponding increase to shareholders’ equity of $28 million, net of taxes of

$18 million. The financial benefits of this amendment will be recognized though a reduction of benefit plan

expense over the next 6 years.

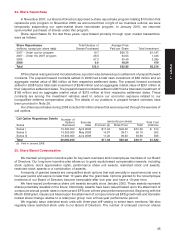

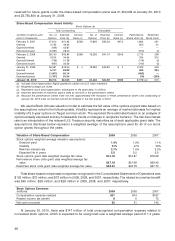

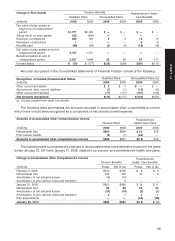

The following tables provide a summary of the changes in the benefit obligations, fair value of plan assets,

and funded status and amounts recognized in our Consolidated Statement of Financial Position for our

postretirement benefit plans:

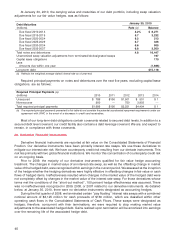

Pension Benefits

Change in Projected Postretirement Health

Benefit Obligation Qualified Plans Nonqualified Plans Care Benefits

(millions) 2009 2008 2009 2008 2009 2008

Benefit obligation at beginning of

measurement period $1,948 $1,811 $36 $33 $117 $108

Service cost 99 93 1175

Interest cost 123 114 2267

Actuarial (gain)/loss 155 21 (3) 433 10

Participant contributions 1———66

Benefits paid (99) (94) (3) (4) (18) (19)

Plan amendments —3——(64) —

Benefit obligation at end of

measurement period $2,227 $1,948 $33 $36 $87 $117

48