Priceline 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

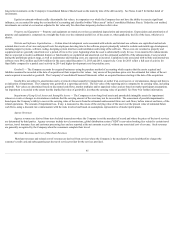

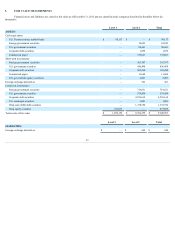

4. INVESTMENTS

Short-term and Long-term Investments in Available for Sale Securities

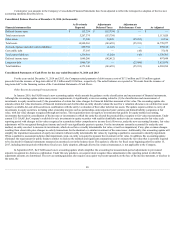

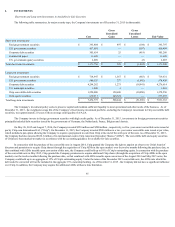

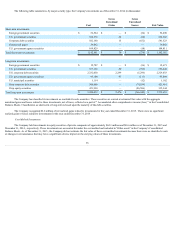

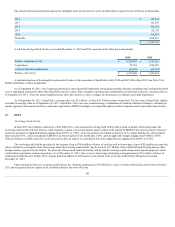

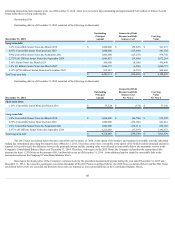

The following table summarizes, by major security type, the Company's investments as of December 31, 2015 (in thousands):

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair Value

Short-term investments:

Foreign government securities $ 395,404

$ 497

$ (104)

$ 395,797

U.S. government securities 457,001

—

(507)

456,494

Corporate debt securities 305,654

25

(419)

305,260

Commercial paper 11,688

—

—

11,688

U.S. government agency securities 2,009

—

(2)

2,007

Total short-term investments $ 1,171,756

$ 522

$ (1,032)

$ 1,171,246

Long-term investments:

Foreign government securities $ 718,947

$ 1,367

$ (683)

$ 719,631

U.S. government securities 580,155

277

(1,982)

578,450

Corporate debt securities 4,294,282

1,273

(18,941)

4,276,614

U.S. municipal securities 1,080

3

—

1,083

Ctrip convertible debt securities 1,250,000

158,600

(30,050)

1,378,550

Ctrip equity securities 630,311

346,724

—

977,035

Total long-term investments $ 7,474,775

$ 508,244

$ (51,656)

$ 7,931,363

The Company's investment policy seeks to preserve capital and maintain sufficient liquidity to meet operational and other needs of the business. As of

December 31, 2015 , the weighted-average life of the Company’s fixed income investment portfolio, excluding the Company's investment in Ctrip convertible debt

securities, was approximately 2.0 years with an average credit quality of A/A2/A.

The Company invests in foreign government securities with high credit quality. As of December 31, 2015 , investments in foreign government securities

principally included debt securities issued by the governments of Germany, the Netherlands, France, Belgium and Austria.

On May 26, 2015 and August 7, 2014, the Company invested $250 million and $500 million , respectively, in five -year senior convertible notes issued at

par by Ctrip.com International Ltd. ("Ctrip"). On December 11, 2015, the Company invested $500 million in a ten -year senior convertible note issued at par value,

which included a put option allowing the Company to require a prepayment in cash from Ctrip at the end of the sixth year of the note. As of December 31, 2015 ,

the Company had also invested $630.3 million of its international cash in Ctrip American Depositary Shares ("ADSs"). The convertible debt and equity securities

of Ctrip have been marked-to-market in accordance with the accounting guidance for available-for-sale securities.

In connection with the purchase of the convertible note in August 2014, Ctrip granted the Company the right to appoint an observer to Ctrip's board of

directors and permission to acquire Ctrip shares (through the acquisition of Ctrip ADSs in the open market) over the twelve months following the purchase date, so

that combined with ADSs issuable upon conversion of this note, the Company could hold up to 10% of Ctrip's outstanding equity. In connection with the purchase

of the convertible note in May 2015, Ctrip granted the Company permission to acquire additional Ctrip shares (through the acquisition of Ctrip ADSs in the open

market) over the twelve months following the purchase date, so that combined with ADSs issuable upon conversion of the August 2014 and May 2015 notes, the

Company could hold up to an aggregate of 15% of Ctrip's outstanding equity. Under the terms of the December 2015 convertible note, the ADSs into which this

debt could be converted will not be included in the aggregate 15% ownership holding. As of December 31, 2015 , the Company did not have a significant influence

over Ctrip. In addition, the Company may acquire the additional ADSs without a time limitation.

95