Priceline 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company, from time to time, utilizes derivative instruments to hedge the impact of changes in currency exchange rates on the net assets of its foreign

subsidiaries. These instruments are designated as net investment hedges. Hedge ineffectiveness is assessed and measured based on changes in forward exchange

rates. The Company records gains and losses on these derivative instruments as currency translation adjustments, which offset a portion of the translation

adjustments related to the foreign subsidiaries' net assets. Gains and losses are recognized in the Consolidated Balance Sheet in " Accumulated other

comprehensive income (loss) " and will be realized upon a partial sale or liquidation of the investment. The Company formally documents all derivatives

designated as hedging instruments for accounting purposes, both at hedge inception and on an on-going basis. These net investment hedges expose the Company

to liquidity risk as the derivatives have an immediate cash flow impact upon maturity, which is not offset by the translation of the underlying hedged equity. The

cash flows from these contracts are classified within " Net cash used in investing activities " on the cash flow statement.

The Company does not use derivative instruments for trading or speculative purposes. The Company recognizes all derivative instruments on the balance

sheet at fair value and its derivative instruments are generally short-term in duration. The derivative instruments do not contain leverage features.

The Company is exposed to the risk that counterparties to derivative instruments may fail to meet their contractual obligations. The Company regularly

reviews its credit exposure as well as assessing the creditworthiness of its counterparties. See Note 5 for further detail on derivatives.

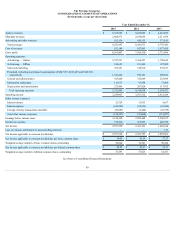

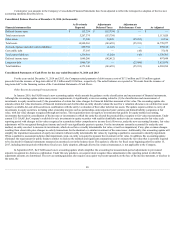

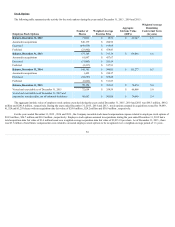

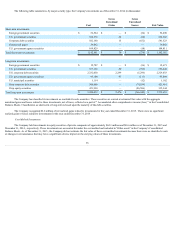

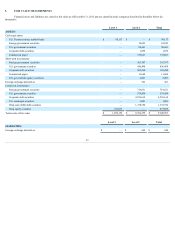

Recent Accounting Pronouncements: Classification of Deferred Taxes and Presentation of Debt Issuance Costs

In November 2015, the Financial Accounting Standards Board (“FASB”) issued a new accounting update which requires companies to classify all

deferred tax assets and liabilities as noncurrent in the balance sheet instead of separating deferred taxes into current and noncurrent amounts. This update is

effective for public business entities for fiscal years beginning after December 15, 2016, including interim periods within those fiscal years. Early adoption of this

update is permitted and an entity may choose to adopt this update on either a prospective or retrospective basis. The Company adopted this accounting update in

the fourth quarter of 2015 and applied it retrospectively to prior periods. The impact on the Company's Consolidated Financial Statements is summarized below.

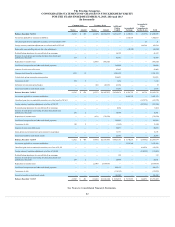

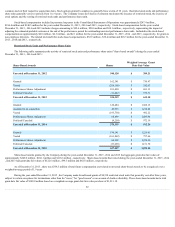

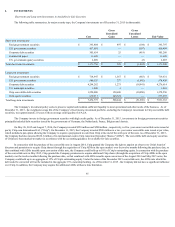

In April 2015, the FASB issued a new accounting update which changes the presentation of debt issuance costs in the financial statements. Under this

new guidance, debt issuance costs, excluding costs associated with a revolving credit facility, will be presented in the balance sheets as a direct deduction from the

related debt liability rather than as an asset. This accounting change is consistent with the current presentation under U.S. GAAP for debt discounts and it also

converges the guidance under U.S. GAAP with that in the International Financial Reporting Standards ("IFRS"). Debt issuance costs will reduce the proceeds from

debt borrowings in the cash flow statement instead of being presented as a separate line in the financing section of that financial statement. Amortization of debt

issuance costs will continue to be reported as interest expense in the income statement. This accounting update does not affect the current accounting guidance for

the recognition and measurement of debt issuance costs. This update is effective for public business entities for fiscal years, and interim periods within those fiscal

years, beginning after December 15, 2015. Early adoption is allowed for all entities for financial statements that have not been previously issued. The Company

adopted this new accounting standard in the fourth quarter of 2015 and applied it retrospectively to prior periods. The impact on the Company's Consolidated

Financial Statements is summarized below.

89