Priceline 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

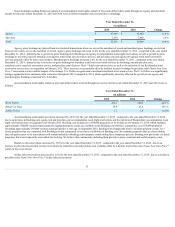

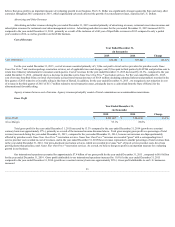

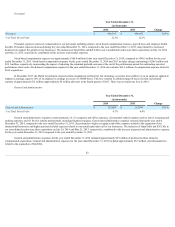

Income Taxes

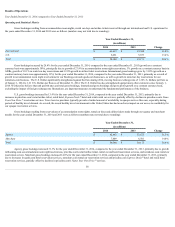

Year Ended December 31,

(in thousands)

2015

2014

Change

Income Tax Expense $ 576,960

$ 567,695

1.6%

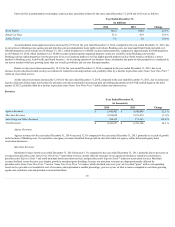

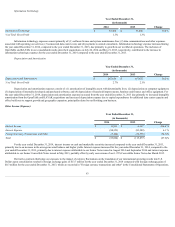

Our effective tax rates for the years ended December 31, 2015 and 2014 were 18.4% and 19.0% , respectively. Our effective tax rate differs from the U.S.

federal statutory tax rate of 35%, due to lower tax rates outside the United States, partially offset by U.S. state income taxes and certain non-deductible expenses.

Our effective tax rate was lower for the year ended December 31, 2015 , compared to the year ended December 31, 2014 , due to an increased proportion of our

income being taxed at lower international tax rates. According to Dutch corporate income tax law, income generated from qualifying innovative activities is taxed

at a rate of 5% ("Innovation Box Tax") rather than the Dutch statutory rate of 25%. A portion of Booking.com's earnings during the year ended December 31, 2015

and 2014 qualified for Innovation Box Tax treatment, which had a significant beneficial impact on the Company's effective tax rate for those periods. While we

expect Booking.com to continue to qualify for Innovation Box Tax treatment with respect to a portion of its earnings for the foreseeable future, the loss of the

Innovation Box Tax benefit, whether due to a change in tax law or a determination by the Dutch government that Booking.com's activities are not "innovative" or

for any other reason, would substantially increase our effective tax rate and adversely impact our results of operations.

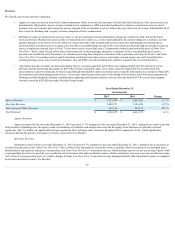

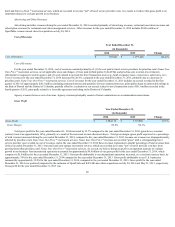

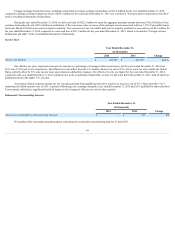

Until our U.S. net operating loss carryforwards are utilized or expire, most of our U.S. income will not be subject to a cash tax liability, other than federal

alternative minimum tax and state income taxes. However, we expect to pay foreign taxes on our international income except in countries where we have operating

loss carryforwards. We expect that our international operations will grow their pretax income faster than the U.S. business over the long term and, therefore, it is

our expectation that our cash tax payments will increase as our international businesses generate an increasing share of our pretax income.

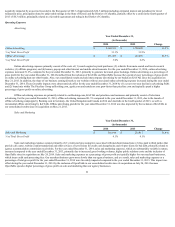

We will be subject to increased income taxes in the event that our cash balances held outside the United States are remitted to the United States. As of

December 31, 2015 , we held approximately $9.8 billion of cash, cash equivalents, short-term investments and long-term investments outside of the United States.

We currently intend to use our cash held outside the United States to reinvest in our international operations. If our cash balances outside the United States

continue to grow and our ability to reinvest those balances outside the United States diminishes, under U.S. GAAP we will be obligated to record additional

income tax expense in the United States with respect to our unremitted international earnings. We would not make additional income tax payments unless we were

to actually repatriate our international cash to the United States. We would pay only U.S. federal alternative minimum tax and certain U.S. state income taxes as

long as we have net operating loss carryforwards available to offset our U.S. taxable income. This could result in us being subject to a cash income tax liability on

the earnings of our U.S. businesses sooner than would otherwise have been the case.

57