Priceline 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

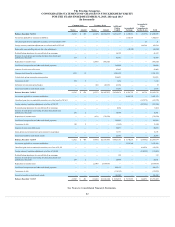

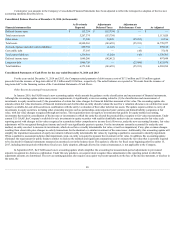

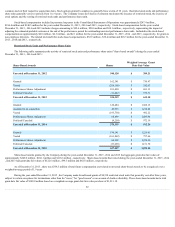

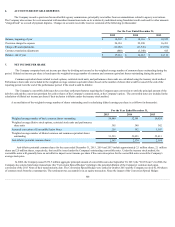

Certain prior year amounts in the Company’s Consolidated Financial Statements have been adjusted to reflect the retrospective adoption of the two new

accounting standards described above.

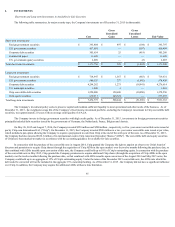

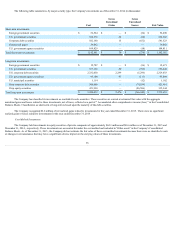

Consolidated Balance Sheet as of December 31, 2014 (in thousands):

Financial statement line

As Previously

Reported

Adjustments

Deferred Taxes

Adjustments

Debt Issuance Costs

As Adjusted

Deferred income taxes

$ 153,754

$ (153,754)

$ —

$ —

Total current assets

5,267,374

(153,754)

—

5,113,620

Other assets

57,348

10,099

(25,931)

41,516

Total assets

14,940,563

(143,655)

(25,931)

14,770,977

Accrued expenses and other current liabilities

600,758

(1,243)

—

599,515

Convertible debt

37,195

—

(45)

37,150

Total current liabilities

1,379,991

(1,243)

(45)

1,378,703

Deferred income taxes

1,040,260

(142,412)

—

897,848

Long-term debt

3,849,756

—

(25,886)

3,823,870

Total liabilities

6,373,540

(143,655)

(25,931)

6,203,954

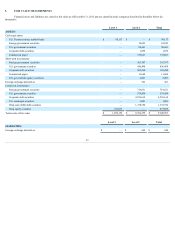

Consolidated Statements of Cash Flows for the year ended December 31, 2014 and 2013

For the years ended December 31, 2014 and 2013, the Company netted payments of debt issuance costs of $17.5 million and $1.0 million against

proceeds from the issuance of long-term debt of $2.3 billion and $1.0 billion , respectively. The netted balances are reported as "Proceeds from the issuance of

long-term debt" in the financing section of the Consolidated Statements of Cash Flows.

Other Recent Accounting Pronouncements

In January 2016, the FASB issued a new accounting update which amends the guidance on the classification and measurement of financial instruments.

Although the accounting update retains many current requirements, it significantly revises accounting related to (1) the classification and measurement of

investments in equity securities and (2) the presentation of certain fair value changes for financial liabilities measured at fair value. The accounting update also

amends certain fair value disclosures of financial instruments and clarifies that an entity should evaluate the need for a valuation allowance on a deferred tax asset

related to available-for-sale debt securities in combination with the entity’s evaluation of their other deferred tax assets. The update requires entities to carry all

investments in equity securities, including other ownership interests such as partnerships, unincorporated joint ventures and limited liability companies at fair

value, with fair value changes recognized through net income. This requirement does not apply to investments that qualify for equity method accounting,

investments that result in consolidation of the investee or investments in which the entity has elected the practicability exception to fair value measurement. Under

current U.S. GAAP, the Company's available-for-sale investments in equity securities with readily identifiable market value are remeasured to fair value each

reporting period with changes in fair value recognized in accumulated other comprehensive income (loss). However, under the new accounting literature, fair value

adjustments will be recognized through net income and could vary significantly quarter to quarter. For the investments currently accounted for under the cost

method, an entity can elect to measure its investments, which do not have a readily determinable fair value, at cost less impairment, if any, plus or minus changes

resulting from observable price changes in orderly transactions for the identical or a similar investment of the same issuer. Additionally, this accounting update will

simplify the impairment assessment of equity investments without readily determinable fair values by requiring a qualitative assessment to identify impairment.

When a qualitative assessment indicates that impairment exists, an entity is required to measure the investment at fair value. In addition, this accounting update

eliminates the requirement for public business entities to disclose the methods and significant assumptions used to estimate the fair value that is currently required

to be disclosed for financial instruments measured at amortized cost in the balance sheet. This update is effective for fiscal years beginning after December 15,

2017, including interim periods within those fiscal years. Early adoption, although allowed in certain circumstances, is not applicable to the Company.

In September 2015, the FASB issued a new accounting update which simplifies the accounting for measurement-period adjustments to provisional

amounts recognized in a business combination. Under this new guidance, an acquirer must recognize these adjustments in the reporting period in which the

adjustment amounts are determined. The new accounting guidance also requires an acquirer to present separately on the face of the income statement, or disclose in

the notes, the

90