Priceline 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Critical Accounting Policies and Estimates

Management's Discussion and Analysis of Financial Condition and Results of Operations is based upon our Consolidated Financial Statements, which

have been prepared in accordance with accounting principles generally accepted in the United States. Our significant accounting policies and estimates are more

fully described in Note 2 to the Consolidated Financial Statements. Certain of our accounting policies and estimates are particularly important to our financial

position and results of operations and require us to make difficult and subjective judgments, often as a result of the need to make estimates of matters that are

inherently uncertain. In applying those policies, our management uses its judgment to determine the appropriate assumptions to be used in the determination of

certain estimates. On an ongoing basis, we evaluate our estimates, including those related to the items described below. Those estimates are based on, among other

things, historical experience, terms of existing contracts, our observance of trends in the travel industry and on various other assumptions that we believe to be

reasonable under the circumstances. Our actual results may differ from these estimates under different assumptions or conditions. Our critical accounting policies

that involve significant estimates and judgments of management include the following:

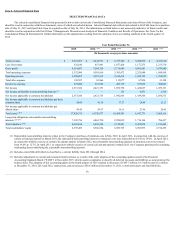

•Stock-Based Compensation. We record stock-based compensation expense for equity-based awards over the recipient's service period based

upon the grant date fair value of the award. A number of our equity awards have performance targets (a performance "contingency") which, if

satisfied, can increase the number of shares issued to the recipients at the end of the performance period or, in certain instances, if not satisfied,

reduce the number of shares issued to the recipients, sometimes to zero, at the end of the performance period. The performance periods for our

performance based equity awards are typically three years. We record stock-based compensation expense for these performance-based awards

based upon our estimate of the probable outcome at the end of the performance period (i.e., the estimated performance against the performance

targets). We periodically adjust the cumulative stock-based compensation recorded when the probable outcome for these performance-based

awards is updated based upon changes in actual and forecasted operating results. Stock-based compensation for the years ended December 31,

2015 , 2014 and 2013 includes charges amounting to $22.6 million , $20.6 million and $24.1 million , respectively, representing the impact of

adjusting the estimated probable outcome of unvested performance share units. Our actual performance against the performance targets could

differ materially from our estimates.

We record stock-based compensation expense net of estimated forfeitures. In determining the estimated forfeiture rates, we periodically review

actual forfeitures. To the extent that actual forfeiture rates differ from current estimates, such amounts are recorded as a cumulative adjustment

in the period in which the estimate is revised.

•Valuation of Goodwill, Long-Lived Assets and Intangibles . The application of the purchase method of accounting for business combinations

requires the use of significant estimates and assumptions to determine the fair value of the assets acquired and liabilities assumed. Our estimates

of the fair value are based upon assumptions that we believe are reasonable and, when we deem appropriate, include assistance from a third party

valuation firm. The purchase price consideration is allocated to the assets acquired and liabilities assumed based on their respective fair values at

the acquisition date. The excess of the purchase price consideration over the net of the amounts allocated to the assets acquired and liabilities

assumed is recognized as goodwill. Goodwill is assigned to reporting units that are expected to benefit from the synergies of the business

combination as of the acquisition date.

We review goodwill for impairment annually and whenever events or changes in circumstances indicate the carrying amount of goodwill may

not be recoverable. As of September 30, 2015, we performed a quantitative test for all of our reporting units using standard valuation techniques

and concluded that there was no impairment of goodwill. A substantial portion of our intangibles and goodwill relates to our acquisitions of

OpenTable in July 2014 and KAYAK in May 2013. Other than OpenTable, the fair values of our reporting units substantially exceeded their

respective carrying values as of September 30, 2015. Since the annual impairment test in September 2015, there have been no events or changes

in circumstances to indicate a potential impairment.

As of September 30, 2015, OpenTable’s carrying value was $2.5 billion , of which $1.5 billion relates to goodwill. The fair value of OpenTable

slightly exceeded its carrying value as of September 30, 2015. OpenTable’s fair value was determined using a combination of standard valuation

techniques, including an income approach (discounted cash flows) and market approaches (EBITDA multiples of comparable

46