Priceline 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

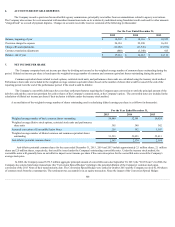

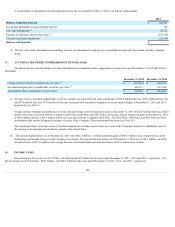

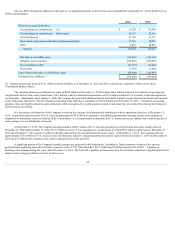

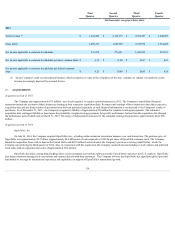

The tax effects of temporary differences that give rise to significant portions of deferred tax assets and liabilities at December 31, 2015 and 2014 are as

follows (in thousands):

2015

2014

Deferred tax assets/(liabilities):

Net operating loss carryforward — U.S. $ 59,220

$ 176,786

Net operating loss carryforward — International 18,153

22,353

Accrued expenses 61,703

41,117

Stock-based compensation and other stock based payments 77,761

54,935

Other 8,001

24,456

Subtotal 224,838

319,647

Discount on convertible notes (112,886)

(141,193)

Intangible assets and other (822,685)

(856,807)

Euro denominated debt (92,230)

(35,441)

Fixed assets (3,658)

(3,409)

Less valuation allowance on deferred tax assets (64,845)

(161,997)

Net deferred tax liabilities (1) $ (871,466)

$ (879,200)

(1) Includes deferred tax assets of $21.1 million and $20.9 million as of December 31, 2015 and 2014 , respectively, reported in "Other assets" in the

Consolidated Balance Sheets.

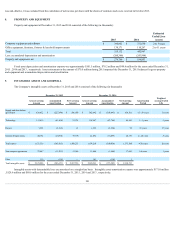

The valuation allowance on deferred tax assets of $64.8 million at December 31, 2015 includes $44.8 million related to U.S. federal net operating loss

carryforwards derived from equity transactions, $18.2 million related to international operations and $1.9 million related to U.S. research credits and capital loss

carryforwards. Additionally, since January 1, 2006, the Company has generated additional federal tax benefits related to equity transactions that are not included

in the deferred tax table above. The tax benefits not included in the table above amounted to $242.6 million as of December 31, 2015 . Pursuant to accounting

guidance, these tax benefits related to equity deductions will be recognized by crediting paid-in capital, if and when they are realized by reducing the Company's

current income tax liability.

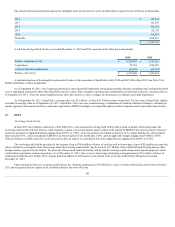

It is the practice and intention of the Company to reinvest the earnings of its international subsidiaries in those operations; therefore, at December 31,

2015 , no provision had been made for U.S. taxes on approximately $9.9 billion of cumulative undistributed international earnings because such earnings are

intended to be indefinitely reinvested outside of the United States. It is not practicable to determine the U.S. federal income tax liability that would be payable if

such earnings were not indefinitely reinvested.

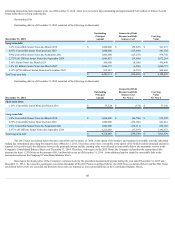

At December 31, 2015 , the Company has approximately $620.9 million of U.S. state net operating loss carryforwards that expire mainly between

December 31, 2020 and December 31, 2034, $122.5 million of non-U.S. net operating loss carryforwards, of which $49.0 million expire between December 31,

2019 and December 31, 2021, and $1.3 million of foreign capital allowance carryforwards that do not expire. At December 31, 2015 , the Company also had

approximately $32.4 million of U.S. research credit carryforwards, subject to annual limitation, that mainly expire between December 31, 2033 and December 31,

2034 and $2.0 million state enterprise zone credits expiring between 2024 and 2026.

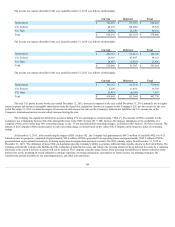

A significant portion of the Company's taxable earnings are generated in the Netherlands. According to Dutch corporate income tax law, income

generated from qualifying innovative activities is taxed at a rate of 5% ("Innovation Box Tax") rather than the Dutch statutory rate of 25% . A portion of

Booking.com's earnings during the years ended December 31, 2015 , 2014 and 2013 qualifies for Innovation Box Tax treatment, which had a significant beneficial

impact on the Company's effective tax rate for those years.

110