Priceline 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other

The Company accrues for certain legal contingencies where it is probable that a loss has been incurred and the amount can be reasonably estimated. Such

accrued amounts are not material to the Company's consolidated balance sheets and provisions recorded have not been material to the Company's consolidated

results of operations or cash flows. An estimate for a reasonably possible loss or range of loss in excess of the amount accrued cannot be reasonably made.

From time to time, the Company has been, and expects to continue to be, subject to legal proceedings and claims in the ordinary course of business,

including claims of alleged infringement of third-party intellectual property rights. Such claims, even if not meritorious, could result in the expenditure of

significant financial and managerial resources, divert management's attention from the Company's business objectives and adversely affect the Company's

business, results of operations, financial condition and cash flows.

Contingent Consideration for Business Acquisitions (see Note 19 )

Employment Contracts

The Company has employment agreements with certain members of senior management that provide for cash severance payments of up to approximately

$24.8 million , accelerated vesting of equity instruments, including without limitation, stock options, restricted stock units and performance share units upon,

among other things, death or termination without "cause" or "good reason," as those terms are defined in the agreements. In addition, certain of the agreements

provide for the extension of health and insurance benefits after termination for periods up to three years.

Operating Leases

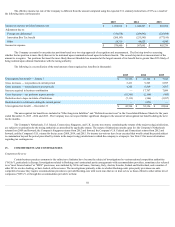

The Company leases certain facilities and equipment through operating leases. Rental expense for leased office space was approximately $64.8 million ,

$57.2 million and $40.0 million for the years ended December 31, 2015 , 2014 and 2013 , respectively. Rental expense for data center space was approximately

$21.6 million , $14.9 million and $12.5 million for the years ended December 31, 2015 , 2014 and 2013 , respectively.

The Company's headquarters and the headquarters of the priceline.com business are located in Norwalk, Connecticut, United States of America, where the

Company leases approximately 102,000 square feet of office space. The Booking.com business is headquartered in Amsterdam, Netherlands, where the Company

leases approximately 258,000 square feet of office space; the KAYAK business is headquartered in Stamford, Connecticut, United States of America, where the

Company leases approximately 18,000 square feet of office space; the agoda.com business has significant support operations in Bangkok, Thailand, where the

Company leases approximately 95,000 square feet of office space; the OpenTable business is headquartered in San Francisco, California, United States of

America, where the Company leases approximately 51,000 square feet of office space; and the rentalcars.com business is headquartered in Manchester, England,

where the Company leases approximately 45,000 square feet of office space. The Company leases additional office space to support its operations in various

locations around the world, including hosting and data center facilities in the United States, the United Kingdom, Switzerland, the Netherlands, Germany,

Singapore and Hong Kong and sales and support facilities in numerous locations.

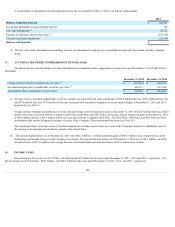

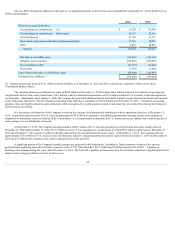

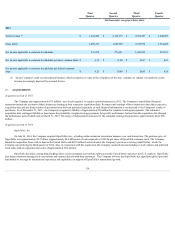

The Company does not own any real estate as of December 31, 2015 . Minimum payments for operating leases for office space, data centers and

equipment having initial or remaining non-cancellable terms in excess of one year have been translated into U.S. Dollars at the December 31, 2015 spot exchange

rates, as applicable, and are as follows (in thousands):

2016

2017

2018

2019

2020

After

2020

Total

$92,552

$80,262

$71,612

$61,286

$52,957

$106,859

$465,528

16 . BENEFIT PLANS

The Company maintains a defined contribution 401(k) savings plan (the "Plan") covering certain U.S. employees. In connection with acquisitions,

effective as of the date of such acquisitions, the Company assumed defined contribution plans covering the U.S. employees of the acquired companies. The

Company also maintains certain other defined contribution plans outside of the United States for which it provides contributions for participating employees. The

Company's matching

114