Priceline 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

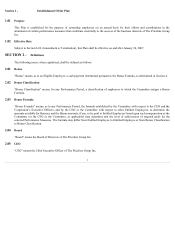

Exhibit 10.10

THE PRICELINE GROUP INC.

ROCKET TRAVEL, INC. 2012 STOCK INCENTIVE PLAN

(AS ASSUMED BY THE PRICELINE GROUP INC. ON FEBRUARY 27, 2015 AND

AS AMENDED AND RESTATED AS OF FEBRUARY 4, 2016)

1. Purpose

The purpose of this Rocket Travel, Inc. 2012 Stock Incentive Plan (the “ Plan ”), which was assumed by The Priceline

Group Inc. (the “ Company ”) in connection with its acquisition (the “ Merger ”) of Rocket Travel, Inc. (“ Rocket Travel ”) on

February 27, 2015 (the “ Closing Date ”) and is hereby being amended and restated to reflect such assumption pursuant to the terms

of the Agreement and Plan of Merger among the Company, Starship Acquisition Corp., Rocket Travel, Fortis Advisors LLC, as the

Representative, and Jay Hoffman, as the Earnout Representative, dated February 20, 2015, and to reflect changes to certain terms of

the Plan authorized by the Board (as defined below), is to provide stock options and other equity interests (including restricted stock,

restricted stock units and other stock-based interests) in the Company (each, an “ Award ”) to certain employees, officers, directors,

consultants and advisors of Rocket Travel and, after the Closing Date, certain employees of the Company and its Subsidiaries, and to

allow holders of stock options that were assumed by the Company in connection with the Merger to acquire shares of common stock,

par value $0.008 per share, of the Company (“ Stock ”), upon exercise. Any person to whom an Award has been granted under the

Plan is deemed a “ Participant ”. Additional definitions are contained in Section 9.

2. Administration

a. Administration by the Compensation Committee . Prior to the Closing Date, the Plan was administered by the Board of

Directors of Rocket Travel, and in connection with the assumption of the Plan by the Company, the authorities and responsibilities

of the Board of Directors of Rocket Travel under the Plan were assigned to the Company. On and after the Closing Date, the Plan

will be administered by the Compensation Committee (the “ Committee ”) of the Board of Directors of the Company (the “ Board

”). The Committee, in its sole discretion, shall have the authority to grant and amend Awards, to adopt, amend and repeal rules

relating to the Plan, to interpret, reconcile inconsistencies and correct the provisions of the Plan and of any Award and, subject to the

limitations of the Plan, to modify and amend any Award. All decisions by the Committee shall be made in the Committee’s sole

discretion and shall be final and binding on all interested persons. Neither the Company nor any member of the Committee shall be

liable for any action or determination relating to the Plan made in good faith.

b. Appointment of Subcommittees . To the extent permitted by applicable law, the Committee may delegate any or all of

its powers under the Plan to one or more subcommittees of the Committee. All references in the Plan to the “Committee” shall mean

such subcommittee or the Committee. Furthermore, the Committee may, to the extent permitted by applicable law, delegate to one or

more of its members or to one or more officers of the Company, or to one or more agents or advisors, such duties or powers as it

may deem advisable, and the Committee, or any person to whom duties or powers have been delegated as aforesaid, may employ

one or more persons to render advice with respect to any responsibility the Board, the Committee or such person may have under the

Plan.

3. Stock Available for Awards

a. Number of Shares . Subject to adjustment under Section 3(c), the aggregate number of shares of Stock that may be

issued pursuant to Awards granted under the Plan is 5,674 shares (which number was adjusted from 524,321 shares of common

stock of Rocket Travel in connection with the Merger). If any Award expires unexercised or is terminated, surrendered or forfeited,

in whole or in part, the unissued Stock covered by such Award shall again be available for the grant of Awards under the Plan. If

shares of Stock issued pursuant to the Plan are repurchased by, or are surrendered or forfeited to, the Company at no more than cost,

such shares of Stock shall again be available for the grant of Awards under the Plan. Notwithstanding the foregoing, on or after the

Closing Date, the following shares of Stock will not be added back to the aggregate number of shares of Stock available for

issuance: (i) shares of Stock delivered to or withheld by the Company to pay the exercise price of an Option, (ii) shares delivered to

or withheld by the Company to pay the withholding taxes related to an Option, or (iii) shares repurchased on the open market with

cash proceeds from the exercise of an Option. Further, notwithstanding the foregoing, the cumulative number of shares that may be

issued under the Plan pursuant to the exercise of Incentive Stock Options shall not exceed 5,674 shares (which number was adjusted

from 524,321 shares of common stock of Rocket Travel in connection with the Merger). Shares issued under the Plan may consist in

whole or in part of authorized but unissued shares or treasury shares.

b. Per-Participant Limit . Subject to adjustment under Section 3(c), no Participant may be granted Awards during any one

fiscal year to purchase more than 5,674 shares of Stock (which number was adjusted from 524,321 shares of common stock of