Priceline 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

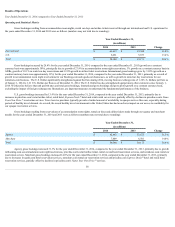

Foreign exchange transaction losses, including costs related to foreign exchange transactions, of $17.6 million for the year ended December 31, 2014,

compared to foreign exchange transaction losses of $10.2 million for the year ended December 31, 2013, are recorded in "Foreign currency transactions and other"

in the Consolidated Statements of Operations.

During the year ended December 31, 2014, we delivered cash of $122.9 million to repay the aggregate principal amount and issued 300,256 shares of our

common stock and paid cash of $2.2 million in satisfaction of the conversion value in excess of the principal amount associated with our 1.25% Convertible Senior

Notes due March 2015 that were converted prior to maturity. The conversion of our convertible debt prior to maturity resulted in a non-cash loss of $6.3 million for

the year ended December 31, 2014, compared to a non-cash loss of $26.7 million for the year ended December 31, 2013, which is recorded in "Foreign currency

transactions and other" in the Consolidated Statements of Operations.

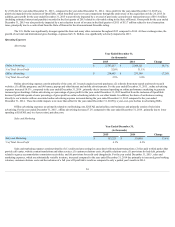

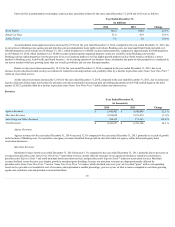

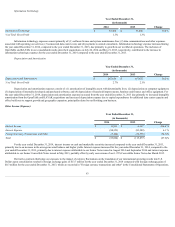

Income Taxes

Year Ended December 31,

(in thousands)

2014

2013

Change

Income Tax Expense $ 567,695

$ 403,739

40.6%

Our effective tax rates, expressed as income tax expense as a percentage of earnings before income taxes, for the years ended December 31, 2014 and

2013 were 19.0% and 17.6%, respectively. Our effective tax rate differs from the U.S. federal statutory tax rate of 35%, due to lower tax rates outside the United

States, partially offset by U.S. state income taxes and certain non-deductible expenses. Our effective tax rate was higher for the year ended December 31, 2014,

compared to the year ended December 31, 2013, primarily due to the acquisitions of OpenTable on July 24, 2014 and KAYAK on May 21, 2013, both of which are

principally taxed at the higher U.S. tax rates.

According to Dutch corporate income tax law, income generated from qualifying innovative activities is taxed at a rate of 5% ("Innovation Box Tax")

rather than the Dutch statutory rate of 25%. A portion of Booking.com's earnings during the years ended December 31, 2014 and 2013 qualified for Innovation Box

Tax treatment, which had a significant beneficial impact on the Company's effective tax rate for those periods.

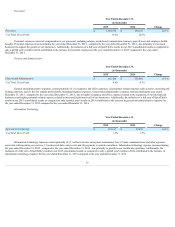

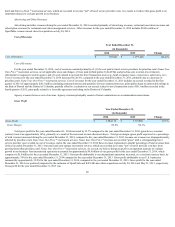

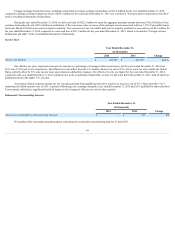

Redeemable Noncontrolling Interests

Year Ended December 31,

(in thousands)

2014

2013

Change

Net Income Attributable to Noncontrolling Interests $ —

$ 135

NA

We purchased the remaining outstanding shares underlying the redeemable noncontrolling interests in April 2013.

64