Priceline 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

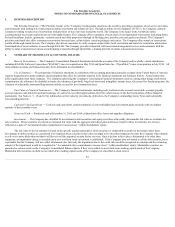

Merchant Retail Services : Merchant revenues for the Company's merchant retail services are derived from transactions where consumers book

accommodation reservations or rental car reservations from travel service providers at disclosed rates which are subject to contractual arrangements. Charges are

billed to consumers by the Company at the time of booking and are included in deferred merchant bookings until the consumer completes the accommodation stay

or returns the rental car. Such amounts are generally refundable upon cancellation, subject to cancellation penalties in certain cases. Merchant revenues and

accounts payable to the travel service provider are recognized at the conclusion of the consumer's stay at the accommodation or return of the rental car. The

Company records the difference between the reservation price to the consumer and the travel service provider cost to the Company of its merchant retail

reservation services on a net basis in merchant revenue.

Pursuant to the terms of the Company's opaque and retail merchant services, its travel service providers are permitted to bill the Company for the

underlying cost of the service during a specified period of time. In the event that the Company is not billed by the travel provider within the specified time period,

the Company reduces its cost of revenues by the unbilled amounts.

Opaque Services : The Company describes its priceline.com Name Your Own Price ® and Express Deals ® travel services as "opaque" because certain

elements of the service, including the identity of the travel service provider, are not disclosed to the consumer prior to making a reservation. The Name Your Own

Price ® service connects consumers that are willing to accept a level of flexibility regarding their travel itinerary with travel service providers that are willing to

accept a lower price in order to sell their excess capacity without disrupting their existing distribution channels or retail pricing structures. The Company's Name

Your Own Price ® services use a pricing system that allows consumers to "bid" the price they are prepared to pay when submitting an offer for a particular leisure

travel service. The Company accesses databases in which participating travel service providers file secure discounted rates, not generally available to the public, to

determine whether it can fulfill the consumer's offer. The Company selects the travel service provider and determines the price it will accept from the consumer.

Merchant revenues and cost of revenues include the selling price and cost, respectively, of the Name Your Own Price ® travel services and are reported on a gross

basis.

Express Deals ® allows consumers to select hotel, rental car and airline ticket reservations with price and certain information regarding amenities

disclosed prior to making the reservation. The identity of the travel service provider is not known prior to committing to the non-refundable reservation. The

Company records the difference between the reservation price to the consumer and the travel service provider cost to the Company of its merchant Express Deals ®

reservation services on a net basis in merchant revenue.

The Company recognizes revenues and costs for these services when it confirms the customer's non-refundable offer. In very limited circumstances, the

Company makes certain customer concessions to satisfy disputes and complaints. The Company accrues for such estimated losses and classifies the resulting

expense as adjustments to merchant revenue and cost of merchant revenues.

Advertising and Other Revenues

Advertising and other revenues are primarily earned by KAYAK and OpenTable and to a lesser extent by priceline.com for advertising placements on its

website. KAYAK earns advertising revenue primarily by sending referrals to travel service providers and online travel companies ("OTCs") and from advertising

placements on its websites and mobile applications. Generally, revenue related to referrals is earned based upon the completion of travel by a consumer or when a

consumer clicks on a referral placement and revenue for advertising placements is earned based upon when a consumer clicks on an advertisement or when the

Company displays an advertisement. OpenTable earns revenue primarily by facilitating restaurant reservations and providing computerized host-stand operations

to restaurants through proprietary restaurant management reservation services. The Company recognizes other revenues related to OpenTable for reservation

revenues when diners are seated and for subscription revenues on a straight-line basis during the contractual period over which the service is delivered.

Loyalty Programs

The Company provides various loyalty programs. Participating customers earn loyalty points on current transactions that can be redeemed for future

qualifying transactions. When the points are earned, the Company estimates the amount of loyalty points expected to be redeemed and records a reduction in

revenue. At both December 31, 2015 and 2014 , a liability of $71.1 million for loyalty points programs was included in "Accrued expenses and other current

liabilities" in the Consolidated Balance Sheets.

86