Priceline 2015 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in the near term in more of the pending proceedings than currently anticipated, given results to date it would not have a material impact on its liquidity or financial

condition.

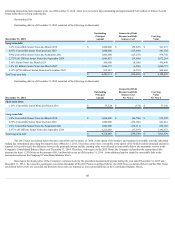

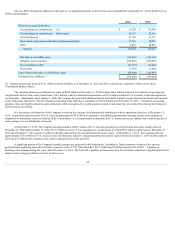

Accrual for Travel Transaction Taxes

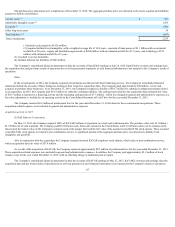

As a result of this litigation and other attempts by jurisdictions to levy similar taxes, the Company has established an accrual (including estimated interest

and penalties) for the potential resolution of issues related to travel transaction taxes in the amount of approximately $27 million at December 31, 2015 compared

to approximately $52 million at December 31, 2014 . The Company's legal expenses for these matters are expensed as incurred and are not reflected in the amount

accrued. The actual cost may be less or greater, potentially significantly, than the liabilities recorded. An estimate for a reasonably possible loss or range of loss in

excess of the amount accrued cannot be reasonably made.

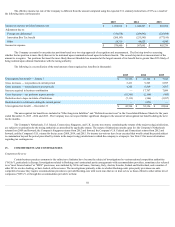

In January 2013, the Tax Appeal Court for the State of Hawaii held that the Company and other OTCs are not liable for the State's transient

accommodations tax, but held that the OTCs, including the Company, are liable for the State's general excise tax (“GET”) on the full amount the OTC collects

from the customer for a hotel room reservation, without any offset for amounts passed through to the hotel. The Company recorded an accrual for travel transaction

taxes (including estimated interest and penalties), with a corresponding charge to cost of revenues, of approximately $16.5 million in December 2012 and

additional $18.7 million in the three months ended March 31, 2013, primarily due to this ruling. During the years ended December 31, 2013, 2014 and 2015, the

Company paid approximately $20.6 million , $2.2 million and $0.6 million , respectively, to the State of Hawaii related to this ruling. In a mixed decision, on

March 17, 2015, the Hawaii Supreme Court affirmed a ruling of the Tax Appeal Court for the State of Hawaii holding that the Company and other OTCs are not

liable for the State's transient accommodations tax and upheld, in part, the Tax Court's ruling that the OTCs, including the Company, are liable for the State's GET

on the margin and fee retained by an OTC as compensation in a transaction. The Hawaii Supreme Court reversed that portion of the Tax Court's decision that had

held that OTCs are liable for GET on the full amount the OTC collects from the customer for a hotel room reservation, not just margin and fee, without any offset

for amounts passed through to the hotel. As a result, the Company reduced its accrual for travel transaction taxes (including estimated interest and penalties) by

$16.4 million with a corresponding reduction to cost of revenues in the first quarter of 2015. In addition, the Company recognized a net reduction in cost of

revenue in the third quarter of 2015 of $13.7 million related to travel transaction taxes, principally due to a cash refund from the State of Hawaii for payments

made in 2013. The Company is seeking the additional refund from the State of Hawaii of approximately $4 million in tax previously paid in excess of its actual

liability, which will be recorded as a reduction in cost of revenues in the periods in which the cash refunds are received.

Patent Infringement

On February 9, 2015, International Business Machines Corporation ("IBM") filed a complaint in the U.S. District Court for the District of Delaware

against The Priceline Group Inc. and its subsidiaries KAYAK Software Corporation, OpenTable, Inc. and priceline.com LLC (the "Subject Companies"). In the

complaint, IBM alleges that the Subject Companies have infringed and continue to willfully infringe certain IBM patents that IBM claims relate to the presentation

of applications and advertising in an interactive service, preserving state information in online transactions and single sign-on processes in a computing

environment and seeks unspecified damages (including a request that the amount of compensatory damages be trebled), injunctive relief and costs and reasonable

attorneys’ fees. The Subject Companies believe the claims to be without merit and intend to contest them.

French and Italian Tax Matters

French tax authorities recently concluded an audit that started in 2013 of the years 2003 through 2012. They are asserting that Booking.com has a

permanent establishment in France and are seeking to recover what they assert are unpaid income taxes and value-added taxes ("VAT"). In December 2015, the

French tax authorities issued an assessment for approximately 356 million Euros, the majority of which would represent penalties and interest. The Company

believes that Booking.com has been, and continues to be, in compliance with French tax law, and the Company intends to contest the assessment. If the Company

is unable to resolve the matter with the French authorities, it would expect to challenge the assessment in the French courts. In order to contest the assessment in

court, the Company may be required to pay, upfront, the full amount or a significant part of any such assessment, though any such payment would not constitute an

admission by it that it owes the tax. French authorities may decide to also audit subsequent tax years, which could result in additional assessments.

Similarly, Italian tax authorities have initiated a process to determine whether Booking.com should be subject to additional tax obligations in Italy. While

the Company believes that it complies with Italian tax law, Italian tax authorities may determine that the Company owes additional taxes, and may also assess

penalties and interest. The Company believes that it has been, and continues to be, in compliance with Italian tax law.

113