Priceline 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

remaining unamortized debt issuance costs. As of December 31, 2014 , there were no borrowings outstanding and approximately $4.0 million of letters of credit

issued under this revolving credit facility.

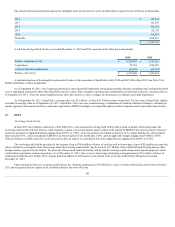

Outstanding Debt

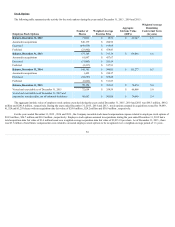

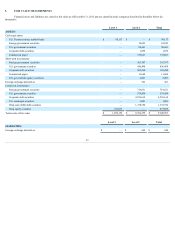

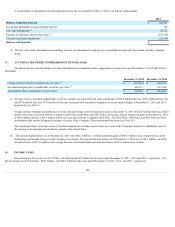

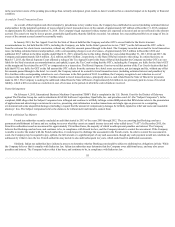

Outstanding debt as of December 31, 2015 consisted of the following (in thousands):

December 31, 2015

Outstanding

Principal

Amount

Unamortized Debt

Discount and Debt

Issuance Cost

Carrying

Value

Long-term debt:

1.0% Convertible Senior Notes due March 2018

$ 1,000,000

$ (58,929)

$ 941,071

0.35% Convertible Senior Notes due June 2020

1,000,000

(114,898)

885,102

0.9% Convertible Senior Notes due September 2021

1,000,000

(125,258)

874,742

2.375% (€1 Billion) Senior Notes due September 2024

1,086,957

(14,688)

1,072,269

3.65% Senior Notes due March 2025

500,000

(4,160)

495,840

1.8% (€1 Billion) Senior Notes due March 2027

1,086,957

(6,200)

1,080,757

2.15% (€750 Million) Senior Notes due November 2022

815,217

(6,555)

808,662

Total long-term debt

$ 6,489,131

$ (330,688)

$ 6,158,443

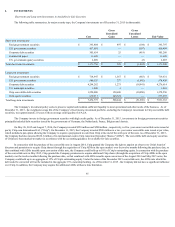

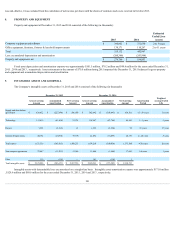

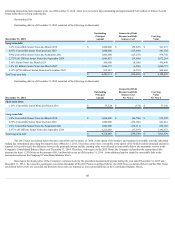

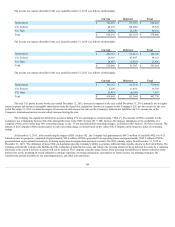

Outstanding debt as of December 31, 2014 consisted of the following (in thousands):

December 31, 2014

Outstanding

Principal

Amount

Unamortized Debt

Discount and Debt

Issuance Cost

See Note 2

Carrying

Value

See Note 2

Short-term debt:

1.25% Convertible Senior Notes due March 2015

$ 37,524

$ (374)

$ 37,150

Long-term debt:

1.0% Convertible Senior Notes due March 2018

$ 1,000,000

$ (84,708)

$ 915,292

0.35% Convertible Senior Notes due June 2020

1,000,000

(138,786)

861,214

0.9% Convertible Senior Notes due September 2021

1,000,000

(145,311)

854,689

2.375% (€1 Billion) Senior Notes due September 2024

1,210,068

(17,393)

1,192,675

Total long-term debt

$ 4,210,068

$ (386,198)

$ 3,823,870

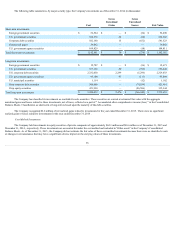

The 2015 Notes (as defined below) became convertible on December 15, 2014, at the option of the holders, and remained convertible until the scheduled

trading day immediately preceding the maturity date of March 15, 2015. Since these notes were convertible at the option of the holders and the principal amount is

required to be paid in cash, the difference between the principal amount and the carrying value was reflected as convertible debt in the mezzanine section in the

Company's Consolidated Balance Sheet as of December 31, 2014. Therefore, with respect to the 2015 Notes, the Company reclassified the unamortized debt

discount for these 1.25% Notes in the amount of $0.3 million before tax as of December 31, 2014 , from additional paid-in capital to convertible debt in the

mezzanine section in the Company's Consolidated Balance Sheet.

Based upon the closing price of the Company's common stock for the prescribed measurement periods during the year ended December 31, 2015 and

December 31, 2014 , the respective contingent conversion thresholds of the 2018 Notes (as defined below), the 2020 Notes (as defined below) and the 2021 Notes

(as defined below) were not exceeded and therefore these notes are reported as non-current liabilities in the Consolidated Balance Sheets.

103