Priceline 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145

|

|

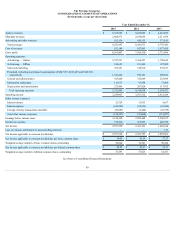

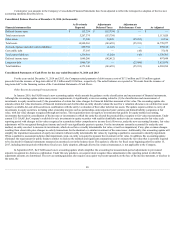

The Priceline Group Inc.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In thousands)

Year Ended December 31,

2015

2014

2013

Net income

$ 2,551,360

$ 2,421,753

$ 1,892,798

Other comprehensive income (loss), net of tax

Foreign currency translation adjustments (1)

(114,505)

(187,356)

97,970

Unrealized gain (loss) on marketable securities (2)

619,259

(157,275)

21

Comprehensive income

3,056,114

2,077,122

1,990,789

Less: Comprehensive loss attributable to redeemable noncontrolling interests

—

—

(10,279)

Comprehensive income attributable to common stockholders

$ 3,056,114

$ 2,077,122

$ 2,001,068

(1) Foreign currency translation adjustments includes a tax of $60,418 and $55,597 for the years ended December 31, 2015 and 2014 , respectively, and a tax

benefit of $55,001 for the year ended December 31, 2013 , associated with net investment hedges (See Note 13 ). The remaining balance in foreign currency

translation adjustments excludes income taxes due to the Company's practice and intention to reinvest the earnings of its foreign subsidiaries in those operations

(See Note 14 ).

(2) Net of tax of $1,551 for the year ended December 31, 2015 and net of tax benefits of $7,621 and $43 for the years ended December 31, 2014 and 2013 ,

respectively.

See Notes to Consolidated Financial Statements.

81