Priceline 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

amount recorded in current-period earnings by line item that would have been recorded in previous reporting periods if the adjustment to provision amounts had

been recognized as of the acquisition date. This update is effective for fiscal years beginning after December 15, 2015, including interim periods within those fiscal

years. Early adoption is permitted for financial statements that have not been issued. The Company adopted this update in the fourth quarter of 2015 and this

accounting update did not have an impact to the Company's Consolidated Financial Statements.

In April 2015, the FASB issued a new accounting update which requires an entity that enters into a cloud computing arrangement to determine if the

arrangement contains a software license. The accounting update cites software as a service, platform as a service, infrastructure as a service and other similar

hosting arrangements as examples of cloud computing arrangements. A software license arrangement exists if both of the following criteria are met: (1) the

customer has a contractual right to take possession of the underlying software without significant penalty and (2) it is feasible for the customer to run the software

on their own hardware or to contract with another party unrelated to the vendor to run the software. If the arrangement meets both of these criteria, the customer

would need to identify what portion of the cost relates to purchasing the software and what portion relates to paying for the service of hosting the software. The

purchased software would be accounted for using the internal-use software guidance and the service costs would be accounted for as an operating expense. If the

arrangement does not meet both of the criteria, the cost is an operating expense for a service contract. The guidance in this update does not change the accounting

for a service contract. The update is effective for public business entities for fiscal years, and interim periods within those fiscal years, beginning after December

15, 2015. Early adoption is allowed for all entities. The Company adopted this update in the fourth quarter of 2015 and this accounting update did not have an

impact to the Company's Consolidated Financial Statements.

In May 2014, the FASB and the International Accounting Standards Board ("IASB") issued a new accounting standard on the recognition of revenue from

contracts with customers that is designed to create greater comparability for financial statement users across industries and jurisdictions. The core principle of the

standard is that an "entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which

the entity expects to be entitled in exchange for those goods or services." Additionally, the new guidance specified the accounting for some costs to obtain or fulfill

a contract with a customer. The new standard will also require enhanced disclosures. The accounting standard was initially effective for public entities for annual

and interim periods beginning after December 15, 2016. In July 2015, the FASB agreed to defer the effective date of the new revenue standard to annual periods

beginning after December 15, 2017 with early adoption permitted as of the original effective date. The Company is currently evaluating the impact to its

Consolidated Financial Statements of adopting this new guidance.

In April 2014, the FASB issued an accounting update which amended the definition of a discontinued operation. The new definition limits discontinued

operations reporting to disposals of components of an entity that represent strategic shifts that have or will have a major effect on an entity's operations and

financial results. The new definition includes an acquired business that is classified as held for sale at the date of acquisition. The accounting update requires new

disclosures of both discontinued operations and a disposal of an individually significant component of an entity. The accounting update is effective for annual and

interim periods beginning on or after December 15, 2014. The Company adopted this update in the first quarter of 2015 and this accounting update did not have an

impact to the Company's Consolidated Financial Statements.

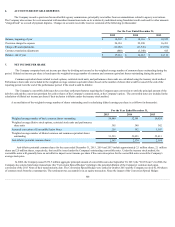

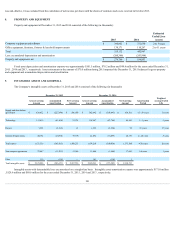

3. STOCK-BASED COMPENSATION

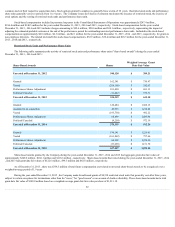

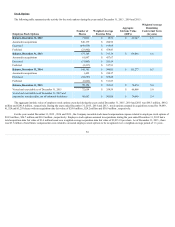

The Company's 1999 Omnibus Plan, as amended and restated effective June 6, 2013, (the "1999 Plan") is the primary stock compensation plan from

which broad-based employee equity awards may be made. As of December 31, 2015 , there were 2,425,519 shares of common stock available for future grant

under the 1999 Plan. In addition, in connection with the acquisition of KAYAK in May 2013, Buuteeq, Inc. in June 2014, OpenTable in July 2014 and Rocket

Travel, Inc. in February 2015, the Company assumed the KAYAK Software Corporation 2012 Equity Incentive Plan (the "KAYAK Plan"), the Buuteeq, Inc.

Amended and Restated 2010 Stock Plan (the "Buuteeq Plan"), the OpenTable, Inc. 2009 Equity Incentive Award Plan (the "OpenTable Plan") and the Rocket

Travel, Inc. 2012 Stock Incentive Plan (the “Rocketmiles Plan”). As of December 31, 2015 , there were 145,392 shares of common stock available for future grant

under the OpenTable Plan.

Stock-based compensation issued under the plans generally consists of restricted stock units, performance share units and stock options. Stock-based

compensation is recognized in the financial statements based upon fair value. Fair value is recognized as expense on a straight-line basis, net of estimated

forfeitures, over the employee's requisite service period. The fair value of restricted stock units and performance share units is determined based on the number of

units granted and the quoted price of the Company's common stock as of the grant date. Stock-based compensation related to performance share units reflects the

estimated probable outcome at the end of the performance period. The fair value of the employee stock options assumed in acquisitions was determined using the

Black-Scholes model and the market value of the Company's

91