Priceline 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

common stock at their respective acquisition dates. Stock options granted to employees generally have a term of 10 years. Restricted stock units and performance

share units generally vest over periods from 1 to 4 years. The Company issues new shares of common stock upon the issuance of restricted stock, the exercise of

stock options and the vesting of restricted stock units and performance share units.

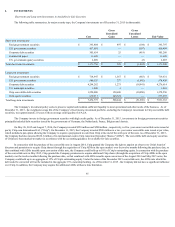

Stock-based compensation included in personnel expenses in the Consolidated Statements of Operations was approximately $247.4 million ,

$186.4 million and $140.5 million for the years ended December 31, 2015 , 2014 and 2013 , respectively. Stock-based compensation for the years ended

December 31, 2015 , 2014 and 2013 includes charges amounting to $22.6 million , $20.6 million and $24.1 million , respectively, representing the impact of

adjusting the estimated probable outcome at the end of the performance period for outstanding unvested performance share units. Included in the stock-based

compensation are approximately $2.6 million , $2.3 million , and $2.1 million for the years ended December 31, 2015 , 2014 , and 2013 , respectively, for grants to

non-employee directors. The related tax benefit for stock-based compensation is $52.9 million , $38.4 million and $18.5 million for the years ended December 31,

2015 , 2014 and 2013 , respectively.

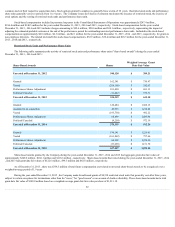

Restricted Stock Units and Performance Share Units

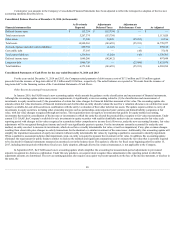

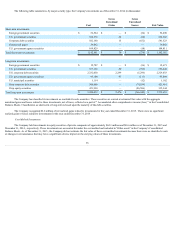

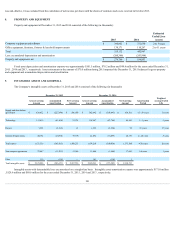

The following table summarizes the activity of restricted stock units and performance share units ("share-based awards") during the years ended

December 31, 2013 , 2014 and 2015 :

Share-Based Awards

Shares

Weighted Average Grant

Date Fair Value

Unvested at December 31, 2012

540,128

$ 389.21

Granted

162,341

$ 730.47

Vested

(258,198)

$ 242.63

Performance Shares Adjustment

101,490

$ 681.13

Forfeited/Canceled

(11,442)

$ 579.71

Unvested at December 31, 2013

534,319

$ 615.10

Granted

128,484

$ 1,308.13

Assumed in an acquisition

43,993

$ 1,238.68

Vested

(195,730)

$ 492.22

Performance Shares Adjustment

68,499

$ 1,085.94

Forfeited/Canceled

(9,250)

$ 972.19

Unvested at December 31, 2014

570,315

$ 912.26

Granted

198,141

$ 1,226.41

Vested

(161,862)

$ 757.66

Performance Shares Adjustment

64,328

$ 1,238.30

Forfeited/Canceled

(33,665)

$ 1,151.70

Unvested at December 31, 2015

637,257

$ 1,070.10

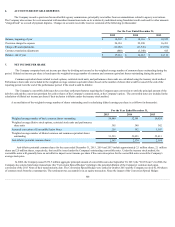

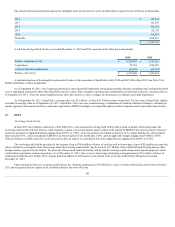

Share-based awards granted by the Company during the years ended December 31, 2015 , 2014 and 2013 had aggregate grant date fair values of

approximately $243.0 million , $168.1 million and $118.6 million , respectively. Share-based awards that vested during the years ended December 31, 2015 , 2014

, and 2013 had grant date fair values of $122.6 million , $96.3 million and $62.6 million , respectively.

As of December 31, 2015 , there was $336.5 million of total future compensation cost related to unvested share-based awards to be recognized over a

weighted-average period of 1.9 years .

During the year ended December 31, 2015 , the Company made broad-based grants of 90,518 restricted stock units that generally vest after three years,

subject to certain exceptions for terminations other than for "cause," for "good reason" or on account of death or disability. These share-based awards had a total

grant date fair value of $109.8 million based on a weighted-average grant date fair value per share of $1,213.18 .

92