Priceline 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

from multiple companies providing a similar service and instead prefer to use one or a limited number of apps for their mobile travel and restaurant research and

reservation activity. As a result, the consumer experience with mobile apps as well as brand recognition and loyalty are likely to become increasingly important.

Our mobile offerings have received generally strong reviews and are driving a material and increasing share of our business. We believe that mobile bookings

present an opportunity for growth and are necessary to maintain and grow our business as consumers increasingly turn to mobile devices instead of a personal

computer. If we are unable to continue to rapidly innovate and create new, user-friendly and differentiated mobile offerings and efficiently and effectively advertise

and distribute on these platforms, or if our mobile offerings are not used by consumers, we could lose market share to existing competitors or new entrants and our

business, future growth and results of operations could be adversely affected.

In addition, we have observed an increase in promotional pricing to closed user groups (such as loyalty program participants or consumers with registered

accounts), including through mobile apps. If we are not as effective as our competitors in offering discounted prices to closed user groups or if we are unable to

entice members of our competitors' closed user groups to use our services, our ability to grow and compete could be harmed. If we need to fund discounts out of

our gross profit, our profitability could be adversely affected. Further, growth in discounted closed user group retail prices for hotel rooms lessens the price

difference for members of closed user groups between a retail hotel reservation and an opaque hotel reservation, which we believe has led to fewer consumers

using our opaque hotel reservation services. In addition, hotels typically make available only a limited number of hotel rooms for opaque services like those of our

priceline.com business, especially during periods of high occupancy. Recent high hotel occupancy levels in the United States (which have had an adverse impact

on our access to hotel rooms for our opaque hotel reservation services) and, we believe, the increased use by consumers of discounted closed user group retail

prices for hotel rooms have negatively affected our opaque hotel reservation gross profit.

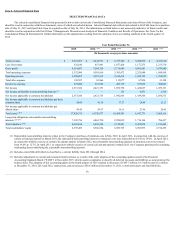

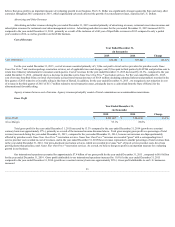

We have established widely used and recognized e-commerce brands through aggressive marketing and promotional campaigns. Both our online and

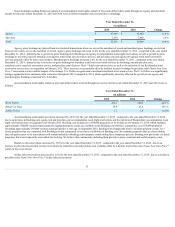

offline advertising expense has increased significantly in recent years, a trend we expect to continue. During 2015, our total online advertising expense was

approximately $2.8 billion , primarily related to the use of online search engines (primarily Google), meta-search and travel research services and affiliate

marketing to generate traffic to our websites. We also invested approximately $215 million in offline advertising during that period. We intend to continue a

strategy of aggressively promoting brand awareness, primarily through online means although we also intend to increase our offline advertising efforts, including

by expanding offline campaigns into additional markets. For example, building on its first offline advertising campaign, which it launched in the United States in

2013, Booking.com has begun offline advertising campaigns in other markets, including Australia, Canada, the United Kingdom, Germany, France, Brazil and

Japan. We have observed increased offline advertising by OTCs, meta-search services and travel service providers, particularly in North America, South America

and Europe, which may make our offline advertising efforts more expensive and less effective.

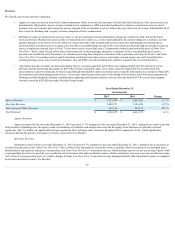

Online advertising efficiency, expressed as online advertising expense as a percentage of gross profit, is impacted by a number of factors that are subject

to variability and that are, in some cases, outside of our control, including ADRs, costs per click, cancellation rates, foreign exchange rates, our ability to convert

paid traffic to booking customers and the extent to which consumers come directly to our websites or mobile apps for bookings. For example, competition for

desired rankings in search results and/or a decline in ad clicks by consumers could increase our costs-per-click and reduce our online advertising efficiency. From

2011 to 2013, our online advertising expense grew faster than our gross profit due to (1) year-over-year declines in online advertising returns on investment

("ROIs") and (2) brand mix within The Priceline Group as our international brands grew faster than our U.S. brands and spent a higher percentage of gross profit

on online advertising. In 2014, these long-term trends continued, but were more than offset by the inclusion of KAYAK and OpenTable because they spend a

lower percentage of gross profit on online advertising than our other brands. Also, our consolidated results exclude intercompany advertising by our brands on

KAYAK since our acquisition of KAYAK in May 2013. In 2015, online advertising efficiency declined compared to the prior year, mainly due to lower ROIs. If

Google changes how it presents travel search results or the manner in which it conducts the auction for placement among search results in a manner that is

competitively disadvantageous to us, whether to support its own travel-related services or otherwise, our ability to efficiently generate traffic to our websites could

be harmed. See Part I Item 1A Risk Factors - " We rely on online advertising channels to enhance our brand awareness and to generate a significant amount of

traffic to our websites. " and " Our business could be negatively affected by changes in Internet search engine algorithms and dynamics or traffic-generating

arrangements. "

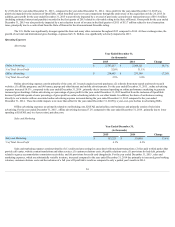

The national competition authorities ("NCAs") of many governments have begun investigations into competitive practices within the online travel

industry, and we may be involved or affected by such investigations and their results. Various NCAs, including those in France, Germany, Italy, Austria, Sweden,

Ireland and Switzerland, opened investigations of Booking.com's contractual parity arrangements with accommodation providers in those jurisdictions, and a

number of other NCAs are looking at these issues. It is uncertain how these issues will finally be resolved. For example, the French, Italian and Swedish NCAs

accepted commitments offered by Booking.com to resolve and close their investigations and Booking.com

44