Priceline 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

was anti-dilutive, it was excluded from the calculation of net income per share until the shares of common stock were received in October 2013.

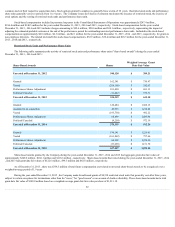

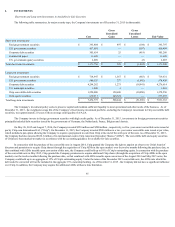

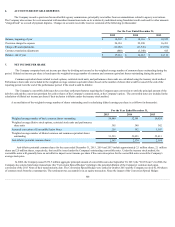

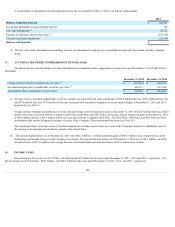

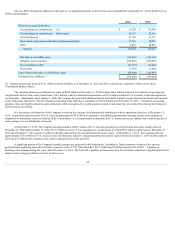

8. PROPERTY AND EQUIPMENT

Property and equipment at December 31, 2015 and 2014 consisted of the following (in thousands):

2015

2014

Estimated

Useful Lives

(years)

Computer equipment and software $ 396,961

$ 332,650

2 to 5 years

Office equipment, furniture, fixtures & leasehold improvements 138,171

110,297

2 to 11 years

Total 535,132

442,947

Less: accumulated depreciation and amortization (260,346)

(243,994)

Property and equipment, net $ 274,786

$ 198,953

Fixed asset depreciation and amortization expense was approximately $101.5 million , $78.2 million and $48.4 million for the years ended December 31,

2015 , 2014 and 2013 , respectively. Asset retirements in the amount of $75.0 million during 2015 impacted the December 31, 2015 balances for gross property

and equipment and accumulated depreciation and amortization.

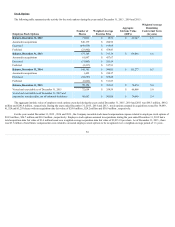

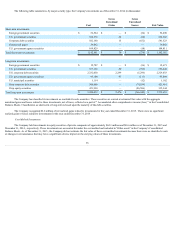

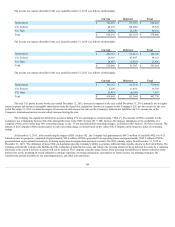

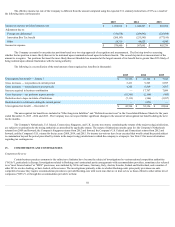

9. INTANGIBLE ASSETS AND GOODWILL

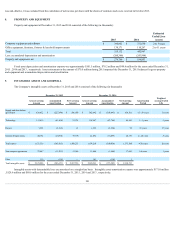

The Company's intangible assets at December 31, 2015 and 2014 consisted of the following (in thousands):

December 31, 2015

December 31, 2014

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Gross Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Amortization

Period

Weighted

Average Useful

Life

Supply and distribution

agreements $ 824,932

$(227,994)

$ 596,938

$ 842,642

$(188,441)

$ 654,201

10 - 20 years

16 years

Technology 112,639

(61,404)

51,235

108,987

(43,746)

65,241

1 - 5 years

5 years

Patents 1,623

(1,562)

61

1,623

(1,524)

99

15 years

15 years

Internet domain names 40,352

(20,954)

19,398

41,652

(16,895)

24,757

2 - 20 years

8 years

Trade names 1,671,356

(183,101)

1,488,255

1,674,218

(100,850)

1,573,368

4-20 years

20 years

Non-compete agreements 22,847

(11,201)

11,646

21,000

(3,908)

17,092

3-4 years

3 years

Other 135

(135)

—

141

(138)

3

Total intangible assets $ 2,673,884

$(506,351)

$ 2,167,533

$ 2,690,263

$(355,502)

$ 2,334,761

Intangible assets with determinable lives are amortized on a straight-line basis. Intangible assets amortization expense was approximately $171.0 million

, $129.6 million and $69.6 million for the years ended December 31, 2015 , 2014 and 2013 , respectively.

101