Priceline 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

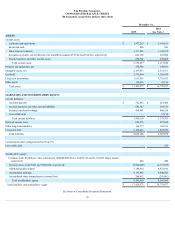

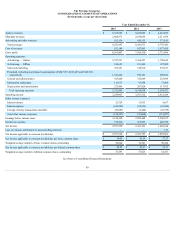

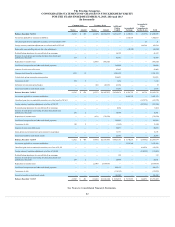

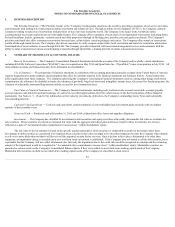

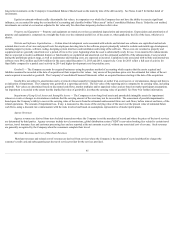

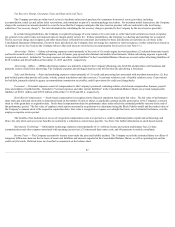

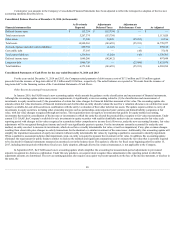

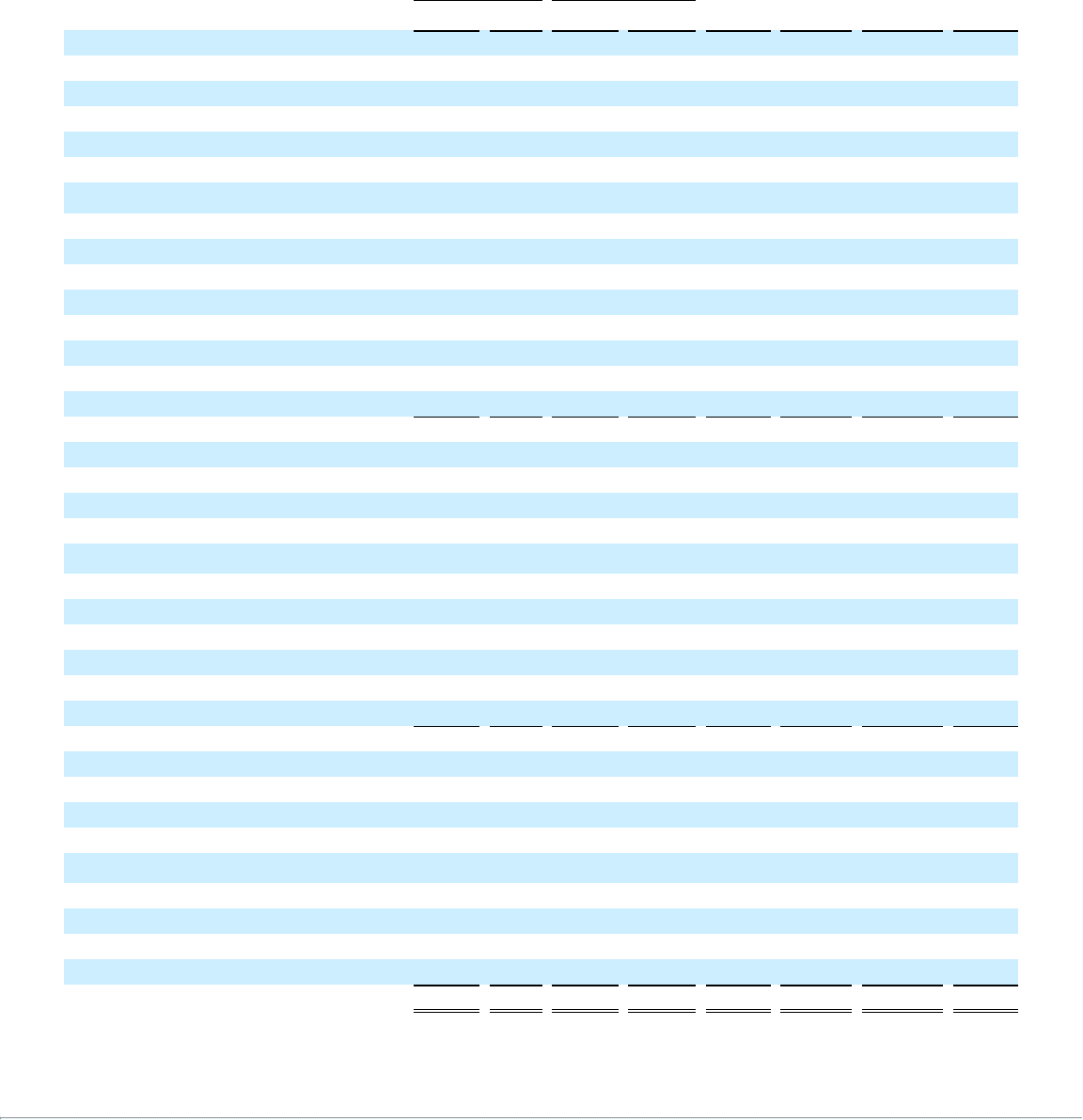

The Priceline Group Inc.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2015, 2014 and 2013

(In thousands)

Common Stock

Treasury Stock

Additional

Paid-in

Capital

Accumulated

Earnings

Accumulated

Other

Comprehensive

Income (Loss)

Total Shares

Amount

Shares

Amount

Balance, December 31, 2012 58,056

$ 450

(8,185)

$(1,060,607)

$ 2,612,197

$ 2,368,611

$ (23,676)

$ 3,896,975

Net income applicable to common stockholders —

—

—

—

—

1,892,663

—

1,892,663

Unrealized gain (loss) on marketable securities, net of tax benefit of $43 —

—

—

—

—

—

21

21

Foreign currency translation adjustments, net of tax benefit of $55,001 —

—

—

—

—

—

108,384

108,384

Redeemable noncontrolling interests fair value adjustments —

—

—

—

—

(42,522)

—

(42,522)

Reclassification adjustment for convertible debt in mezzanine —

—

—

—

46,122

—

—

46,122

Exercise of stock options and vesting of restricted stock units and

performance share units 715

6

—

—

91,601

—

—

91,607

Repurchase of common stock —

—

(1,030)

(883,515)

—

—

—

(883,515)

Stock-based compensation and other stock-based payments —

—

—

—

142,098

—

—

142,098

Issuance of senior convertible notes

93,402

93,402

Common stock issued in an acquisition 1,522

12

1,281,122

1,281,134

Vested stock options assumed in an acquisition

264,423

264,423

Conversion of debt 972

8

—

—

1,224

—

—

1,232

Settlement of conversion spread hedges —

—

(42)

(43,085)

43,104

—

—

19

Excess tax benefits on stock-based awards —

—

—

—

17,686

—

—

17,686

Balance, December 31, 2013 61,265

$ 476

(9,257)

$(1,987,207)

$ 4,592,979

$ 4,218,752

$ 84,729

$ 6,909,729

Net income applicable to common stockholders —

—

—

—

—

2,421,753

—

2,421,753

Unrealized gain (loss) on marketable securities, net of tax benefit of $7,621 —

—

—

—

—

—

(157,275)

(157,275)

Foreign currency translation adjustment, net of tax of $55,597 —

—

—

—

—

—

(187,356)

(187,356)

Reclassification adjustment for convertible debt in mezzanine —

—

—

—

8,204

—

—

8,204

Exercise of stock options and vesting of restricted stock units and

performance share units 256

2

—

—

16,389

—

—

16,391

Repurchase of common stock —

—

(631)

(750,378)

—

—

—

(750,378)

Stock-based compensation and other stock-based payments —

—

—

—

189,292

—

—

189,292

Conversion of debt 300

2

—

—

(1,658)

—

—

(1,656)

Issuance of senior convertible notes —

—

—

—

80,873

—

—

80,873

Stock options and restricted stock units assumed in acquisitions —

—

—

—

13,751

—

—

13,751

Excess tax benefits on stock-based awards —

—

—

—

23,366

—

—

23,366

Balance, December 31, 2014 61,821

$ 480

(9,888)

$(2,737,585)

$ 4,923,196

$ 6,640,505

$ (259,902)

$ 8,566,694

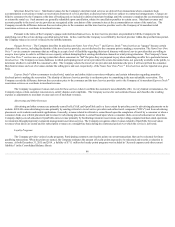

Net income applicable to common stockholders —

—

—

—

—

2,551,360

—

2,551,360

Unrealized gain (loss) on marketable securities, net of tax of $1,551 —

—

—

—

—

—

619,259

619,259

Foreign currency translation adjustment, net of tax of $60,418 —

—

—

—

—

—

(114,505)

(114,505)

Reclassification adjustment for convertible debt in mezzanine —

—

—

—

329

—

—

329

Exercise of stock options and vesting of restricted stock units and

performance share units 219

2

—

—

20,849

—

—

20,851

Repurchase of common stock —

—

(2,540)

(3,089,055)

—

—

—

(3,089,055)

Stock-based compensation and other stock-based payments —

—

—

—

249,133

—

—

249,133

Conversion of debt —

—

—

—

(110,105)

—

—

(110,105)

Excess tax benefits on stock-based awards —

—

—

—

101,508

—

—

101,508

Balance, December 31, 2015 62,040

$ 482

(12,428)

$(5,826,640)

$ 5,184,910

$ 9,191,865

$ 244,852

$ 8,795,469

See Notes to Consolidated Financial Statements.

82