Priceline 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

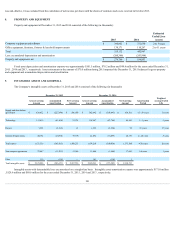

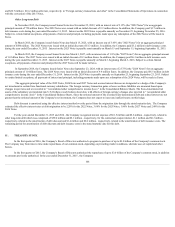

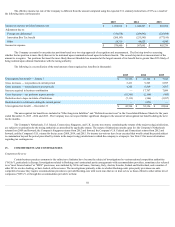

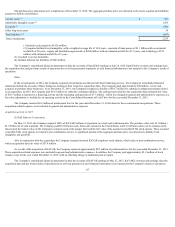

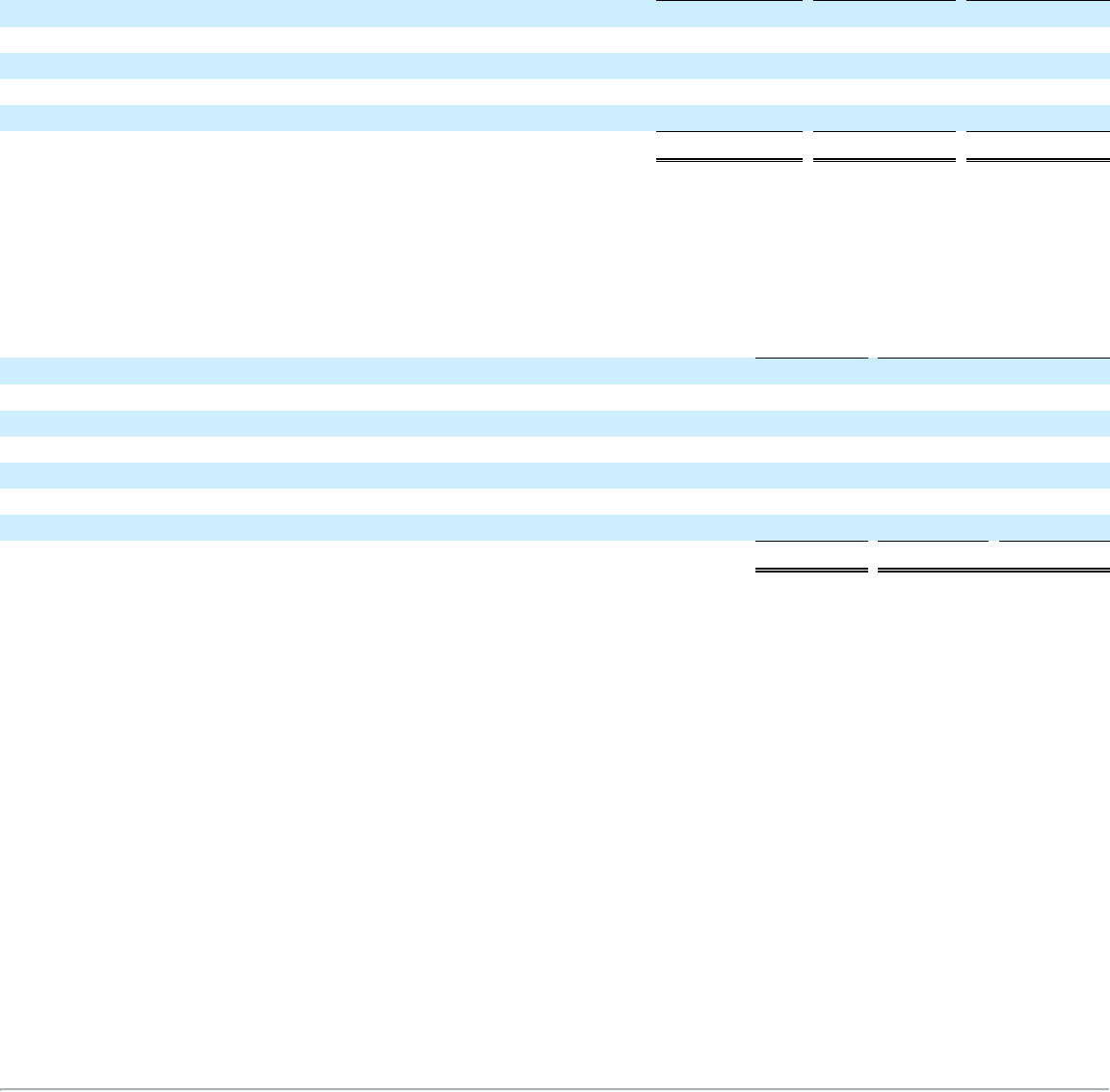

The effective income tax rate of the Company is different from the amount computed using the expected U.S. statutory federal rate of 35% as a result of

the following items (in thousands):

2015

2014

2013

Income tax expense at federal statutory rate $ 1,094,912

$ 1,046,307

$ 803,788

Adjustment due to:

Foreign rate differential (316,078)

(289,692)

(226,894)

Innovation Box Tax benefit (260,193)

(233,545)

(177,195)

Other 58,319

44,625

4,040

Income tax expense $ 576,960

$ 567,695

$ 403,739

The Company accounts for uncertain tax positions based on a two step approach of recognition and measurement. The first step involves assessing

whether the tax position is more likely than not to be sustained upon examination based upon its technical merits. The second step involves measurement of the

amount to recognize. Tax positions that meet the more likely than not threshold are measured at the largest amount of tax benefit that is greater than 50% likely of

being realized upon ultimate finalization with the taxing authority.

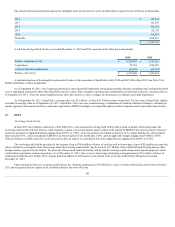

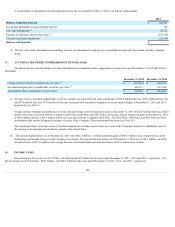

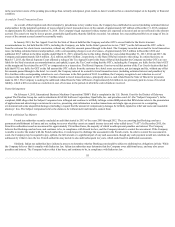

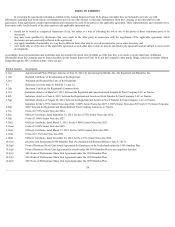

The following is a reconciliation of the total amount of unrecognized tax benefits (in thousands):

2015

2014

2013

Unrecognized tax benefit — January 1 $ 52,356

$ 22,104

$ 7,343

Gross increases — tax positions in current period 3,411

9,305

8,597

Gross increases — tax positions in prior periods 4,305

6,569

3,507

Increase acquired in business combination —

17,767

7,089

Gross decreases — tax positions in prior periods (10,365)

(2,164)

(495)

Reduction due to lapse in statute of limitations (7,113)

(346)

(3,937)

Reduction due to settlements during the current period —

(879)

—

Unrecognized tax benefit — December 31 $ 42,594

$ 52,356

$ 22,104

The unrecognized tax benefits are included in "Other long-term liabilities" and "Deferred income taxes" in the Consolidated Balance Sheets for the years

ended December 31, 2015 , 2014 and 2013 . The Company does not expect further significant changes in the amount of unrecognized tax benefits during the next

twelve months.

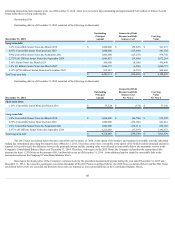

The Company's Netherlands, U.S. federal, Connecticut, Singapore, and U.K. income tax returns, constituting the returns of the major taxing jurisdictions,

are subject to examination by the taxing authorities as prescribed by applicable statute. The statute of limitations remains open for: the Company's Netherlands

returns from 2009 and forward; the Company's Singapore returns from 2012 and forward; the Company's U.S. Federal and Connecticut returns from 2012 and

forward; and the Company's U.K. returns for the tax years 2008, 2014, and 2015. No income tax waivers have been executed that would extend the period subject

to examination beyond the period prescribed by statute in the major taxing jurisdictions in which the company is a taxpayer. See Note 15 for more information

regarding tax contingencies.

15 . COMMITMENTS AND CONTINGENCIES

Competition Reviews

Certain business practices common to the online travel industry have become the subject of investigations by various national competition authorities

("NCAs"), particularly in Europe. Investigations related to Booking.com's contractual parity arrangements with accommodation providers, sometimes also referred

to as "most favored nation" or "MFN" provisions, were initiated by NCAs in France, Germany, Italy, Austria, Sweden, Ireland and Switzerland, and a number of

other NCAs are also looking, or have looked, at these issues. The investigations primarily relate to whether Booking.com's price parity provisions are anti-

competitive because they require accommodation providers to provide Booking.com with room rates that are at least as low as those offered to other online travel

companies ("OTCs") or through the accommodation provider's website.

111