Priceline 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

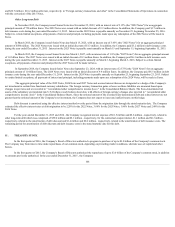

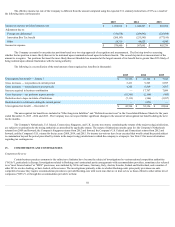

and $26.7 million ( $16.2 million after tax), respectively, in "Foreign currency transactions and other" in the Consolidated Statements of Operations in connection

with the conversion of the 2015 Notes.

Other Long-term Debt

In November 2015, the Company issued Senior Notes due November 25, 2022, with an interest rate of 2.15% (the "2022 Notes") for an aggregate

principal amount of 750 million Euros. The 2022 Notes were issued with an initial discount of 2.2 million Euros. In addition, the Company paid $3.7 million in

debt issuance costs during the year ended December 31, 2015 . Interest on the 2022 Notes is payable annually on November 25, beginning November 25, 2016.

Subject to certain limited exceptions, all payments of interest and principal, including payments made upon any redemption of the 2022 Notes will be made in

Euros.

In March 2015, the Company issued Senior Notes due March 15, 2025, with an interest rate of 3.65% (the "2025 Notes") for an aggregate principal

amount of $500 million . The 2025 Notes were issued with an initial discount of $1.3 million . In addition, the Company paid $3.2 million in debt issuance costs

during the year ended December 31, 2015 . Interest on the 2025 Notes is payable semi-annually on March 15 and September 15, beginning September 15, 2015.

In March 2015, the Company issued Senior Notes due March 3, 2027, with an interest rate of 1.8% (the "2027 Notes") for an aggregate principal amount

of 1.0 billion Euros. The 2027 Notes were issued with an initial discount of 0.3 million Euros. In addition, the Company paid $6.3 million in debt issuance costs

during the year ended December 31, 2015 . Interest on the 2027 Notes is payable annually on March 3, beginning March 3, 2016. Subject to certain limited

exceptions, all payments of interest and principal for the 2027 Notes will be made in Euros.

In September 2014, the Company issued Senior Notes due September 23, 2024, with an interest rate of 2.375% (the "2024 Notes") for an aggregate

principal amount of 1.0 billion Euros. The 2024 Notes were issued with an initial discount of 9.4 million Euros. In addition, the Company paid $6.5 million in debt

issuance costs during the year ended December 31, 2014 . Interest on the 2024 Notes is payable annually on September 23, beginning September 23, 2015. Subject

to certain limited exceptions, all payments of interest and principal, including payments made upon any redemption of the 2024 Notes, will be made in Euros.

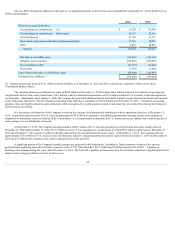

The aggregate principal value of the 2022 Notes, 2024 Notes and 2027 Notes and accrued interest thereon are designated as a hedge of the Company's

net investment in certain Euro functional currency subsidiaries. The foreign currency transaction gains or losses on these liabilities are measured based upon

changes in spot rates and are recorded in " Accumulated other comprehensive income (loss) " in the Consolidated Balance Sheets. The Euro-denominated net

assets of the subsidiary are translated into U.S. Dollars at each balance sheet date, with effects of foreign currency changes also reported in " Accumulated other

comprehensive income (loss) " in the Consolidated Balance Sheets. Since the notional amount of the recorded Euro-denominated debt and related interest are not

greater than the notional amount of the Company's net investment, the Company does not expect to incur any ineffectiveness on this hedge.

Debt discount is amortized using the effective interest method over the period from the origination date through the stated maturity date. The Company

estimated the effective interest rates at debt origination to be 2.20% for the 2022 Notes, 3.68% for the 2025 Notes, 1.80% for the 2027 Notes and 2.48% for the

2024 Notes.

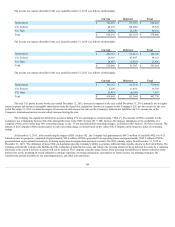

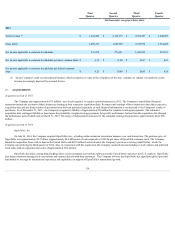

For the years ended December 31, 2015 and 2014 , the Company recognized interest expense of $61.5 million and $8.6 million , respectively, related to

other long-term debt which was comprised of $59.0 million and $8.1 million , respectively, for the contractual coupon interest, $1.1 million and $0.3 million ,

respectively, related to the amortization of debt discount and $1.4 million and $0.2 million , respectively, related to the amortization of debt issuance costs. The

remaining period for amortization of debt discount and debt issuance costs is the stated maturity date for this debt.

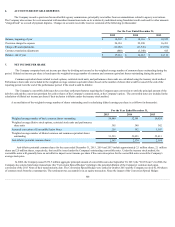

11 . TREASURY STOCK

In the first quarter of 2016, the Company's Board of Directors authorized a program to purchase of up to $3.0 billion of the Company's common stock.

The Company may from time to time make repurchases of our common stock, depending on prevailing market conditions, alternate uses of capital and other

factors.

In the first quarter of 2015, the Company's Board of Directors authorized the repurchase of up to $3.0 billion of the Company's common stock, in addition

to amounts previously authorized. In the year ended December 31, 2015 , the Company

106