Priceline 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

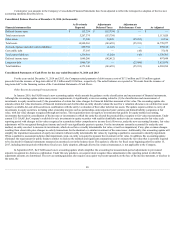

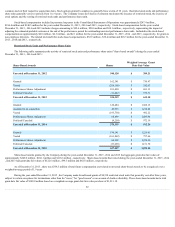

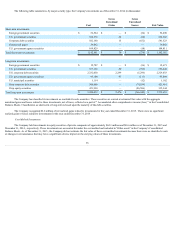

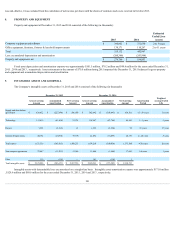

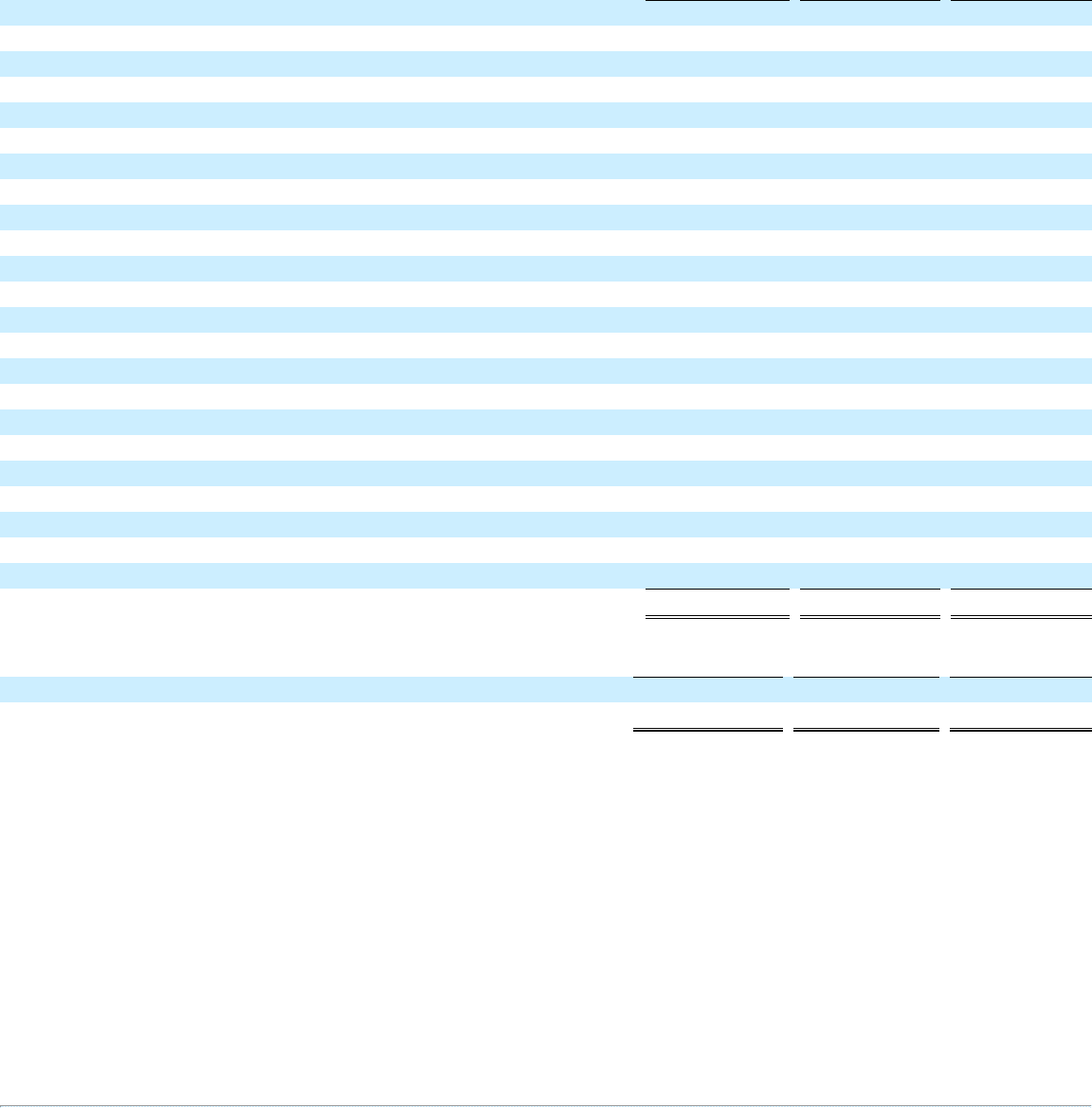

Financial assets and liabilities are carried at fair value as of December 31, 2014 and are classified in the categories described in the tables below (in

thousands):

Level 1

Level 2

Total

ASSETS:

Cash equivalents:

U.S. Treasury money market funds

$ 155,608

$ —

$ 155,608

Foreign government securities

—

974,855

974,855

U.S. government securities

—

676,503

676,503

Corporate debt securities

—

45,340

45,340

Commercial paper

—

382,544

382,544

U.S. government agency securities

—

10,000

10,000

Short-term investments:

Foreign government securities

—

52,490

52,490

U.S. government securities

—

364,266

364,266

Corporate debt securities

—

581,523

581,523

Commercial paper

—

39,092

39,092

U.S. government agency securities

—

104,811

104,811

Foreign exchange derivatives

—

336

336

Long-term investments:

Foreign government securities

—

12,671

12,671

U.S. government securities

—

556,448

556,448

Corporate debt securities

—

2,329,033

2,329,033

U.S. government agency securities

—

95,094

95,094

U.S. municipal securities

—

1,102

1,102

Ctrip convertible debt securities

—

425,961

425,961

Ctrip equity securities

335,344

—

335,344

Total assets at fair value

$ 490,952

$ 6,652,069

$ 7,143,021

Level 1

Level 2

Total

LIABILITIES:

Foreign exchange derivatives

$ —

$ 129

$ 129

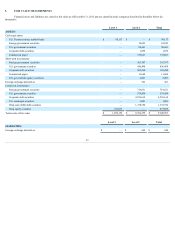

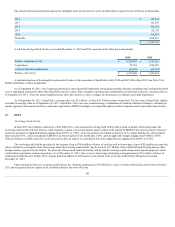

There are three levels of inputs to measure fair value. The definition of each input is described below:

Level 1 : Quoted prices in active markets that are accessible by the Company at the measurement date for identical assets and liabilities.

Level 2 : Inputs are observable, either directly or indirectly. Such prices may be based upon quoted prices for identical or comparable securities

in active markets or inputs not quoted on active markets, but corroborated by market data.

Level 3 : Unobservable inputs are used when little or no market data is available.

Investments in corporate debt securities, U.S. and foreign government securities, commercial paper, government agency securities, convertible debt

securities and municipal securities are considered "Level 2 " valuations because the Company has access to quoted prices, but does not have visibility to the

volume and frequency of trading for all of these investments. For the Company's investments, a market approach is used for recurring fair value measurements and

the valuation techniques use inputs that are observable, or can be corroborated by observable data, in an active marketplace.

The Company's derivative instruments are valued using pricing models. Pricing models take into account the contract terms as well as multiple inputs

where applicable, such as interest rate yield curves, option volatility and currency rates.

98