Priceline 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

results from the acquisition of Company Voting Securities pursuant to a Non-Qualifying Transaction (as defined in

Section 8(e)(B)(III));

(II) individuals who, on the date an Award is granted (the “ Grant Date ”), constitute

the Board (the “ Incumbent Directors ”) cease for any reason to constitute at least a majority of the Board; provided

, however , that any person becoming a director subsequent to the Grant Date, whose election or nomination for

election was approved (either by a specific vote or by approval of the proxy statement of the Company in which such

person is named as a nominee for director, without written objection to such nomination) by a vote of at least two-

thirds of the directors who were, as of the date of such approval, Incumbent Directors, shall be an Incumbent

Director; provided , further, that no individual initially appointed, elected or nominated as a director of the Company

as a result of an actual or threatened election contest with respect to the election or removal of directors or as a result

of any other actual or threatened solicitation of proxies or consents by or on behalf of any person other than the Board

shall be deemed to be an Incumbent Director;

(III) the consummation of a merger, consolidation, statutory share exchange or similar

form of corporate transaction involving (x) the Company or (y) any of its wholly owned subsidiaries pursuant to

which, in the case of this clause (y), Company Voting Securities are issued or issuable (any event described in the

immediately preceding clause (x) or (y), a “ Reorganization ”) or the sale or other disposition of all or substantially

all of the assets of the Company to an entity that is not an affiliate of the Company (a “ Sale ”), unless immediately

following such Reorganization or Sale: (a) more than 50% of the total voting power (in respect of the election of

directors, or similar officials in the case of an entity other than a corporation) of (1) the Company (or, if the Company

ceases to exist, the entity resulting from such Reorganization), or, in the case of a Sale, the entity which has acquired

all or substantially all of the assets of the Company (in either case, the “ Surviving Entity ”), or (2) if applicable, the

ultimate parent entity that directly or indirectly has Beneficial Ownership of more than 50% of the total voting power

(in respect of the election of directors, or similar officials in the case of an entity other than a corporation) of the

Surviving Entity (the “ Parent Entity ”), is represented by Company Voting Securities that were outstanding

immediately prior to such Reorganization or Sale (or, if applicable, is represented by shares into which such

Company Voting Securities were converted pursuant to such Reorganization or Sale), (b) no Person is or becomes the

Beneficial Owner, directly or indirectly, of 35% or more of the total voting power (in respect of the election of

directors, or similar officials in the case of an entity other than a corporation) of the outstanding voting securities of

the Parent Entity (or, if there is no Parent Entity, the Surviving Entity) and (c) at least a majority of the members of

the board of directors (or similar officials in the case of an entity other than a corporation) of the Parent Entity (or, if

there is no Parent Entity, the Surviving Entity) following the consummation of the Reorganization or Sale were, at the

time of the approval by the Board of the execution of the initial agreement providing for such Reorganization or Sale,

Incumbent Directors (any Reorganization or Sale which satisfies all of the criteria specified in (1), (2) and (3) above

being deemed to be a “ Non-Qualifying Transaction ”); or

(IV) the stockholders of the Company approve a plan of complete liquidation or dissolution

of the Company.

Notwithstanding the foregoing, if any Person becomes the Beneficial Owner, directly or indirectly, of 35% or more of the combined

voting power of Company Voting Securities solely as a result of the acquisition of Company Voting Securities by the Company

which reduces the number of Company Voting Securities outstanding, such increased amount shall be deemed not to result in an

Acquisition; provided , however , that if such Person subsequently becomes the Beneficial Owner, directly or indirectly, of

additional Company Voting Securities that increases the percentage of outstanding Company Voting Securities Beneficially Owned

by such Person to a percentage equal to or greater than 35, an Acquisition shall then be deemed to occur.

(C) Assumption of Options Upon Certain Events . In connection with a merger or consolidation of an entity with

the Company or the acquisition by the Company of property or stock of an entity, the Committee may grant Awards under the Plan

in substitution for stock and stock-based awards issued by such entity or an affiliate thereof. The substitute Awards shall be granted

on such terms and conditions as the Board considers appropriate in the circumstances.

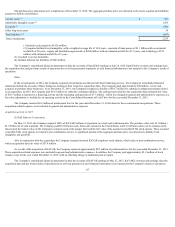

f. Withholding . Each Participant shall pay to the Company, or make provisions satisfactory to the Company for payment

of, any taxes required by law to be withheld in connection with Awards to such Participant no later than the date of the event

creating the tax liability. The Committee may allow Participants to satisfy such tax obligations in whole or in part by transferring

shares of Stock, including shares retained from the Award creating the tax obligation, valued at their fair market value (as

determined by the Committee or as determined pursuant to the applicable option agreement). The Company may, to the extent

permitted by law, deduct any such tax obligations from any payment of any kind, including salary or wages, otherwise due to a

Participant.