Priceline 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

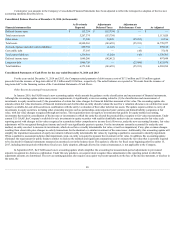

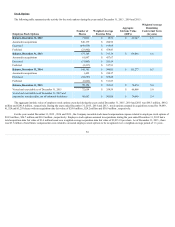

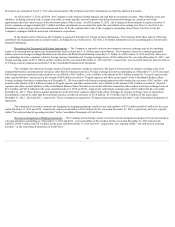

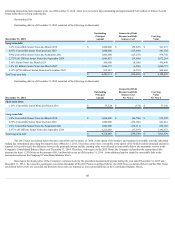

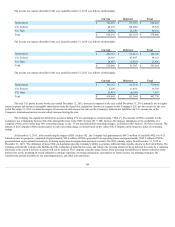

6. ACCOUNTS RECEIVABLE RESERVES

The Company records a provision for uncollectible agency commissions, principally receivables from accommodations related to agency reservations.

The Company also accrues for costs associated with merchant transactions made on its websites by individuals using fraudulent credit cards and for other amounts

"charged back" as a result of payment disputes. Changes in accounts receivable reserves consisted of the following (in thousands):

For the Year Ended December 31,

2015

2014

2013

Balance, beginning of year $ 14,212

$ 14,116

$ 10,322

Provision charged to expense 24,324

22,990

16,451

Charge-offs and adjustments (22,682)

(21,546)

(13,072)

Currency translation adjustments (840)

(1,348)

415

Balance, end of year $ 15,014

$ 14,212

$ 14,116

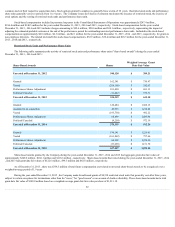

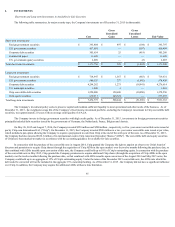

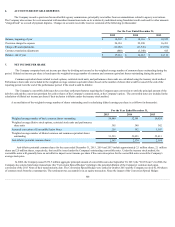

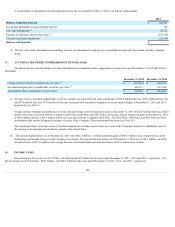

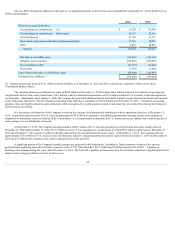

7. NET INCOME PER SHARE

The Company computes basic net income per share by dividing net income by the weighted-average number of common shares outstanding during the

period. Diluted net income per share is based upon the weighted-average number of common and common equivalent shares outstanding during the period.

Common equivalent shares related to stock options, restricted stock units, and performance share units are calculated using the treasury stock method.

Performance share units are included in the weighted-average common equivalent shares based on the number of shares that would be issued if the end of the

reporting period were the end of the performance period, if the result would be dilutive.

The Company's convertible debt issues have net share settlement features requiring the Company upon conversion to settle the principal amount of the

debt for cash and the conversion premium for cash or shares of the Company's common stock, at the Company's option. The convertible notes are included in the

calculation of diluted net income per share if their inclusion is dilutive under the treasury stock method.

A reconciliation of the weighted-average number of shares outstanding used in calculating diluted earnings per share is as follows (in thousands):

For the Year Ended December 31,

2015

2014

2013

Weighted average number of basic common shares outstanding 50,940

52,301

50,924

Weighted average dilutive stock options, restricted stock units and performance

share units 395

340

382

Assumed conversion of Convertible Senior Notes 258

382

1,107

Weighted average number of diluted common and common equivalent shares

outstanding 51,593

53,023

52,413

Anti-dilutive potential common shares 2,563

2,574

2,384

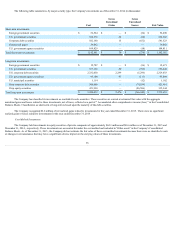

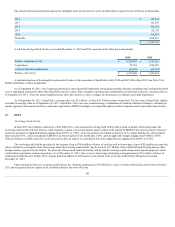

Anti-dilutive potential common shares for the years ended December 31, 2015 , 2014 and 2013 include approximately 2.1 million shares, 2.1 million

shares and 2.0 million shares, respectively, that could be issued under the Company's outstanding convertible notes. Under the treasury stock method, the

convertible notes will generally have an anti-dilutive impact on net income per share if the conversion prices for the convertible notes exceed the Company's

average stock price.

In 2006, the Company issued $172.5 million aggregate principal amount of convertible notes due September 30, 2013 (the "2013 Notes"). In 2006, the

Company also entered into hedge transactions (the "Conversion Spread Hedges") relating to the potential dilution of the Company's common stock upon

conversion of the 2013 Notes at their stated maturity date. The Conversion Spread Hedges were settled in October 2013 and the Company received 42,160 shares

of common stock from the counterparties. The settlement was accounted for as an equity transaction. Since the impact of the Conversion Spread Hedges

100