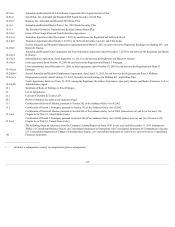

Priceline 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

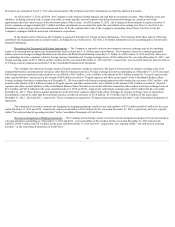

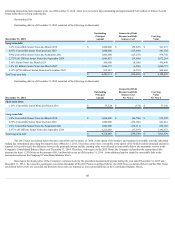

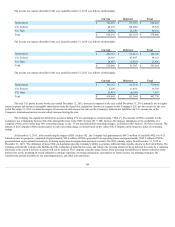

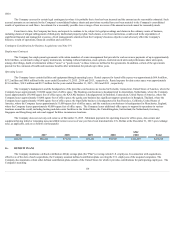

The income tax expense (benefit) for the year ended December 31, 2015 is as follows (in thousands):

Current

Deferred

Total

International $ 526,052

$ (17,789)

$ 508,263

U.S. Federal 88,237

(68,696)

19,541

U.S. State 24,006

25,150

49,156

Total $ 638,295

$ (61,335)

$ 576,960

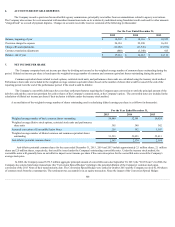

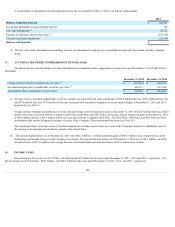

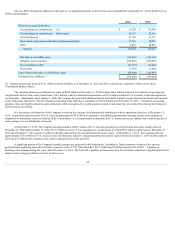

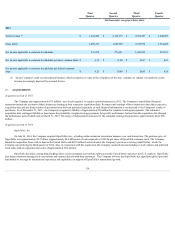

The income tax expense (benefit) for the year ended December 31, 2014 is as follows (in thousands):

Current

Deferred

Total

International $ 496,719

$ (10,613)

$ 486,106

U.S. Federal 10,316

47,847

58,163

U.S. State 28,953

(5,527)

23,426

Total $ 535,988

$ 31,707

$ 567,695

The income tax expense (benefit) for the year ended December 31, 2013 is as follows (in thousands):

Current

Deferred

Total

International $ 396,162

$ (16,314)

$ 379,848

U.S. Federal 5,250

11,454

16,704

U.S. State 13,431

(6,244)

7,187

Total $ 414,843

$ (11,104)

$ 403,739

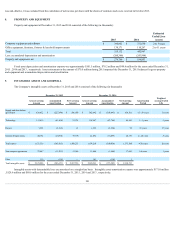

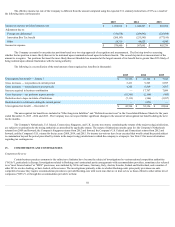

The total U.S. pretax income for the year ended December 31, 2015, decreased compared to the year ended December 31, 2014, primarily due to higher

interest expense and increased intangible amortization from the OpenTable acquisition. Income tax expense on the Company's U.S. pre-tax income for the year

ended December 31, 2015, includes the impact of increases in state income tax rates on the Company's deferred tax liabilities and U.S. income tax on the

Company's international interest income which increased during the year.

The Company has significant deferred tax assets including U.S. net operating loss carryforwards ("NOLs"). The amount of NOLs available for the

Company's use is limited by Section 382 of the Internal Revenue Code ("IRC Section 382 "). IRC Section 382 imposes limitations on the availability of a

company's NOLs after a more than 50% ownership change occurs. It was determined that ownership changes, as defined in IRC Section 382 have occurred. The

amount of the Company's NOLs incurred prior to each ownership change is limited based on the value of the Company on the respective dates of ownership

change.

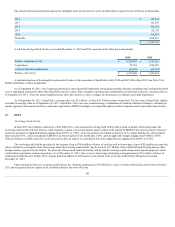

At December 31, 2015 , after considering the impact of IRC Section 382 , the Company had approximately $847.9 million of available NOL's for U.S.

federal income tax purposes, comprised of approximately $25.6 million of NOLs generated from operating losses and approximately $822.3 million of NOLs

generated from equity-related transactions, including equity-based compensation and stock warrants. The NOLs mainly expire from December 31, 2019 to

December 31, 2021. The utilization of these NOLs is dependent upon the Company's ability to generate sufficient future taxable income in the United States. The

Company periodically evaluates the likelihood of the realization of deferred tax assets, and reduces the carrying amount of these deferred tax assets by a valuation

allowance to the extent it believes a portion will not be realized. The Company considers many factors when assessing the likelihood of future realization of the

deferred tax assets, including its recent cumulative earnings experience by taxing jurisdiction, expectations of future income, tax planning strategies, the

carryforward periods available for tax reporting purposes, and other relevant factors.

109