Priceline 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

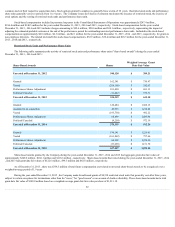

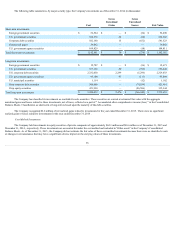

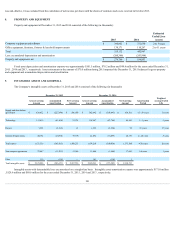

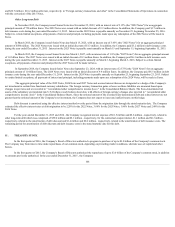

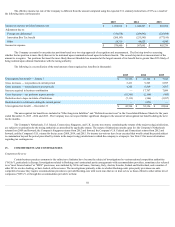

The annual estimated amortization expense for intangible assets for the next five years and thereafter is expected to be as follows (in thousands):

2016 $ 168,444

2017 161,207

2018 142,638

2019 132,192

2020 124,651

Thereafter 1,438,401

$ 2,167,533

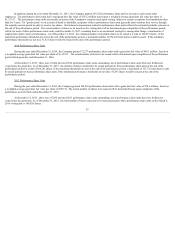

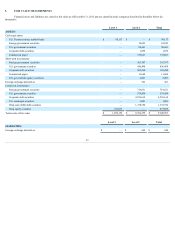

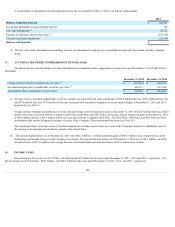

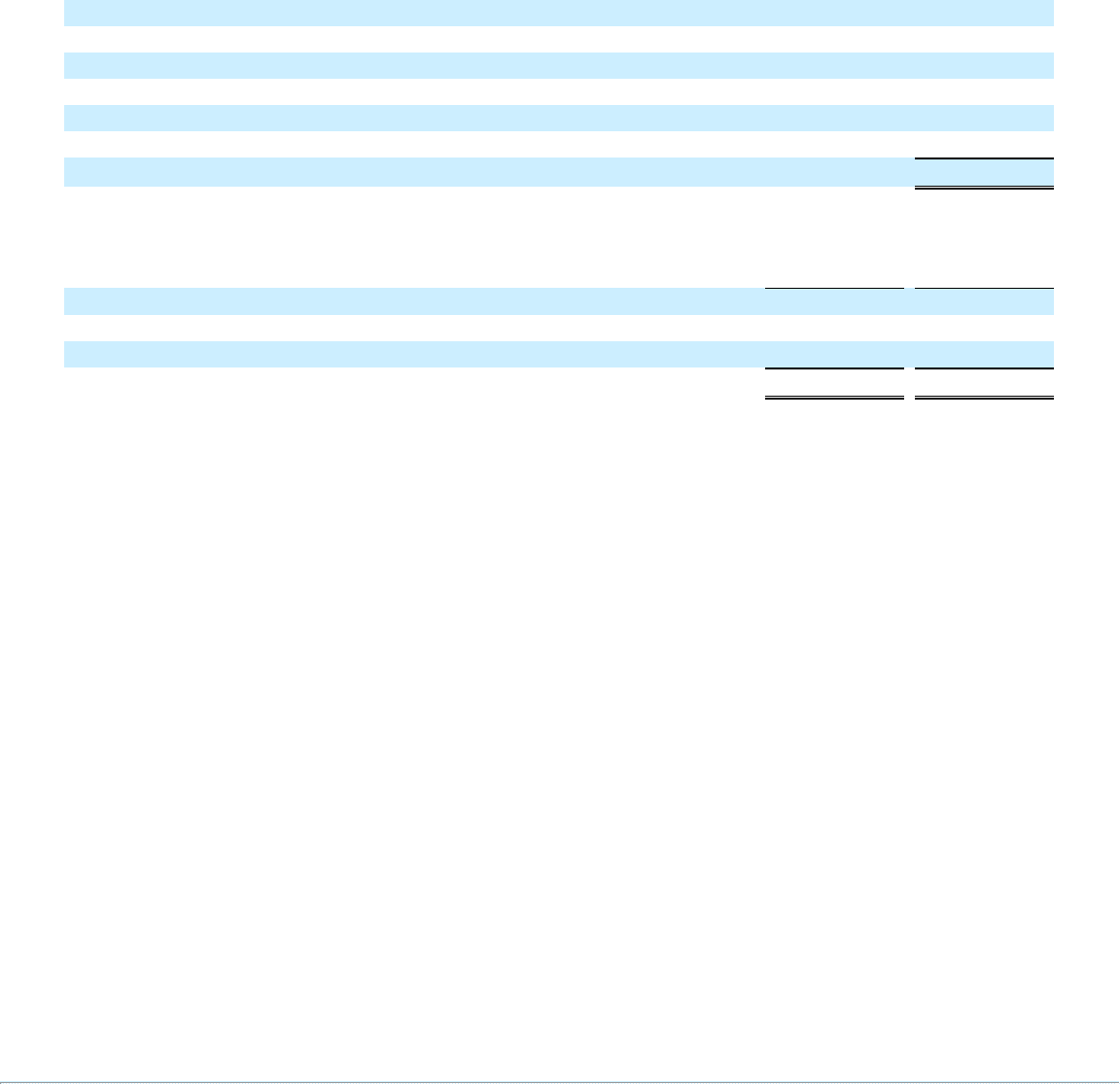

A roll-forward of goodwill for the years ended December 31, 2015 and 2014 consisted of the following (in thousands):

2015

2014

Balance, beginning of year $ 3,326,474

$ 1,767,912

Acquisitions 74,584

1,590,829

Currency translation adjustments (26,058)

(32,267)

Balance, end of year $ 3,375,000

$ 3,326,474

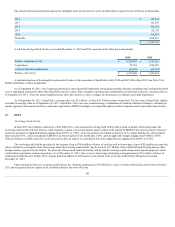

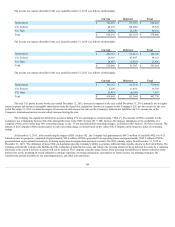

A substantial portion of the intangibles and goodwill relates to the acquisition of OpenTable in July 2014 and KAYAK in May 2013. See Note 19 for

further information on these acquisitions.

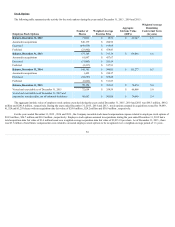

As of September 30, 2015 , the Company performed its annual goodwill impairment testing using standard valuation techniques and concluded that there

was no impairment of goodwill. Other than OpenTable, the fair values of the Company's reporting units substantially exceeded their respective carrying values as

of September 30, 2015 . Since the annual impairment test, there have been no events or changes in circumstances to indicate a potential impairment.

As of September 30, 2015 , OpenTable’s carrying value was $2.5 billion , of which $1.5 billion relates to goodwill. The fair value of OpenTable slightly

exceeded its carrying value as of September 30, 2015 . OpenTable’s fair value was estimated using a combination of standard valuation techniques, including an

income approach (discounted cash flows) and market approaches (EBITDA multiples of comparable publicly-traded companies and for precedent transactions).

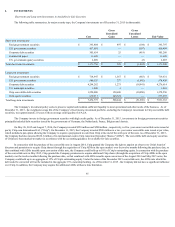

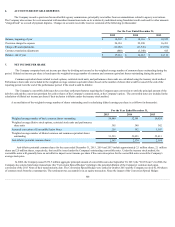

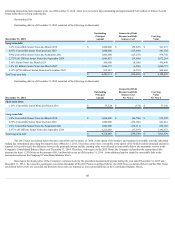

10 . DEBT

Revolving Credit Facility

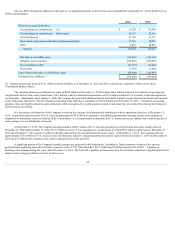

In June 2015, the Company entered into a $2.0 billion five -year unsecured revolving credit facility with a group of lenders. Borrowings under the

revolving credit facility will bear interest, at the Company’s option, at a rate per annum equal to either (i) the adjusted LIBOR for the interest period in effect for

such borrowing plus an applicable margin ranging from 0.875% to 1.50% ; or (ii) the greatest of (a) Bank of America, N.A.'s prime lending rate, (b) the federal

funds rate plus 0.5% , and (c) an adjusted LIBOR for an interest period of one month plus 1.00% , plus an applicable margin ranging from 0.00% to 0.50% .

Undrawn balances available under the revolving credit facility are subject to commitment fees at the applicable rate ranging from 0.085% to 0.20% .

The revolving credit facility provides for the issuance of up to $70.0 million of letters of credit as well as borrowings of up to $50.0 million on same-day

notice, referred to as swingline loans. Borrowings under the revolving credit facility may be made in U.S. Dollars, Euros, British Pounds Sterling and any other

foreign currency agreed to by the lenders. The proceeds of loans made under the facility will be used for working capital and general corporate purposes, which

could include acquisitions or share repurchases. As of December 31, 2015 , there were no borrowings outstanding and approximately $2.5 million of letters of

credit issued under this new facility. The Company paid $4.0 million in debt issuance costs related to the revolving credit facility during the year ended

December 31, 2015 .

Upon entering into this new revolving credit facility, the Company terminated its $1.0 billion five -year revolving credit facility entered into in October

2011 and recognized interest expense of $1.0 million related to the write-off of the

102