Priceline 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

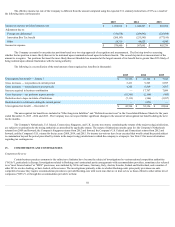

repurchased 2,468,259 shares of its common stock in the open market for an aggregate cost of $3.0 billion related to this authorization.

In the second quarter of 2013, the Company's Board of Directors authorized a program to purchase $1.0 billion of the Company's common stock, in

addition to amounts previously authorized. In the second quarter of 2013 , the Company repurchased 431,910 shares for an aggregate cost of $345.5 million in

privately negotiated, off-market transactions and in the third and fourth quarters of 2014, the Company repurchased 114,645 share of its common stock in privately

negotiated, off-market transactions and 438,897 shares of its common stock in the open market for aggregate costs of $147.3 million and $500.0 million ,

respectively, related to this authorization. In the first quarter of 2015, the Company repurchased 5,813 shares for $7.2 million , which was the remaining amount of

this authorization.

In the third quarter of 2013, the Company repurchased 484,361 shares for an aggregate cost of $459.2 million . These shares were covered under the

Company's remaining authorizations as of December 31, 2012 to repurchase common stock.

In October 2013, the Company settled Conversion Spread Hedges and received 42,160 shares of common stock, with a fair value of $43.1 million , from

the counterparties (see Note 7 for further detail on the Conversion Spread Hedges).

The Board of Directors has given the Company the general authorization to repurchase shares of its common stock to satisfy employee withholding tax

obligations related to stock-based compensation. In the years ended December 31, 2015 , 2014 and 2013 , the Company repurchased 65,849 , 77,761 , and 113,503

shares at an aggregate cost of $81.9 million , $103.1 million and $78.8 million , respectively, to satisfy employee withholding taxes related to stock-based

compensation.

As of December 31, 2015 , there were 12,427,945 shares of the Company's common stock held in treasury.

12 . REDEEMABLE NONCONTROLLING INTERESTS

On May 18, 2010, the Company, through its wholly-owned subsidiary, priceline.com International Ltd. ("PIL"), paid $108.5 million , net of cash

acquired, to purchase a controlling interest of the outstanding equity of TravelJigsaw Holdings Limited (now known as rentalcars.com), a Manchester, U.K.-based

international rental car reservation service. Certain key members of rentalcars.com's management team retained a noncontrolling ownership interest in

rentalcars.com. In addition, certain key members of the management team of Booking.com purchased a 3% ownership interest in rentalcars.com from PIL in

June 2010 (together with rentalcars.com management's investment, the "Redeemable Shares"). The holders of the Redeemable Shares had the right to put their

shares to PIL and PIL had the right to call the shares in each case at a purchase price reflecting the fair value of the Redeemable Shares at the time of exercise.

Subject to certain exceptions, one-third of the Redeemable Shares were subject to the put and call options in each of 2011, 2012 and 2013, respectively, during

specified option exercise periods.

In April 2012 and 2011, in connection with the exercise of call and put options, PIL purchased a portion of the shares underlying redeemable

noncontrolling interests for an aggregate purchase price of approximately $61.1 million and $13.0 million , respectively. As a result of the April 2011 purchase, the

redeemable noncontrolling interests in rentalcars.com were reduced from 24.4% to 19.0% . As a result of the April 2012 purchase, the redeemable noncontrolling

interests in rentalcars.com were further reduced to 12.7% . In April 2013, in connection with the exercise of the March 2013 call and put options, PIL purchased

the remaining outstanding shares underlying redeemable noncontrolling interests for an aggregate purchase price of approximately $192.5 million .

Redeemable noncontrolling interests were measured at fair value, both at the date of acquisition and subsequently at each reporting period. The

redeemable noncontrolling interests were reported in the Consolidated Balance Sheets in mezzanine equity in "Redeemable noncontrolling interests."

107