Priceline 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

negatively impacted by an accrual recorded in the first quarter of 2013 of approximately $20.5 million (including estimated interest and penalties) for travel

transaction taxes, principally related to unfavorable rulings in the State of Hawaii and the District of Columbia, partially offset by a credit in the fourth quarter of

2013 of $6.3 million, principally related to a favorable agreement and ruling in the District of Columbia.

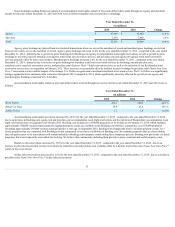

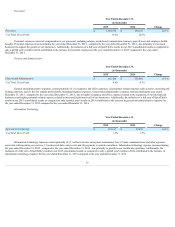

Operating Expenses

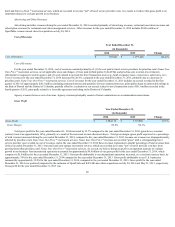

Advertising

Year Ended December 31,

(in thousands)

2014

2013

Change

Online Advertising $ 2,360,221

$ 1,798,645

31.2%

% of Total Gross Profit 31.1%

31.5%

Offline Advertising $ 231,309

$ 127,459

81.5%

% of Total Gross Profit 3.0%

2.2%

Online advertising expenses primarily consist of the costs of (1) search engine keyword purchases; (2) referrals from meta-search and travel research

websites; (3) affiliate programs; and (4) banner, pop-up and other Internet and mobile advertisements. For the year ended December 31, 2014, online advertising

expenses increased 31.2%, compared to the year ended December 31, 2013, primarily to generate increased gross bookings. Online advertising as a percentage of

gross profit for the year ended December 31, 2014 benefited from the inclusion of KAYAK and OpenTable because they spend a lower percentage of gross profit

on online advertising than our other brands. Also, our consolidated results exclude intercompany advertising by our brands on KAYAK since the acquisition on

May 21, 2013. In addition, the share of our business coming directly to our websites with no associated online advertising expense increased during the year ended

December 31, 2014. These favorable impacts were almost entirely offset for the year ended December 31, 2014 by (1) a year-over-year decline in advertising ROIs

and (2) brand mix within The Priceline Group as Booking.com, agoda.com and rentalcars.com grew faster than priceline.com and typically spend a higher

percentage of gross profit on online advertising.

Offline advertising expenses are primarily related to our Booking.com, KAYAK and priceline.com businesses and primarily consist of television

advertising. For the year ended December 31, 2014, offline advertising increased 81.5% compared to the year ended December 31, 2013, due to the launch of

offline advertising campaigns by Booking.com in Germany, the United Kingdom and Canada in 2014 and Australia in the fourth quarter of 2013, as well as

incremental offline advertising by KAYAK. Offline advertising growth for the year ended December 31, 2014 was also impacted by the inclusion of KAYAK in

our consolidated results since its acquisition on May 21, 2013.

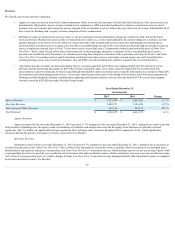

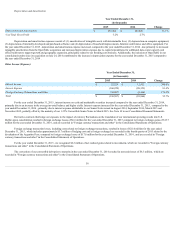

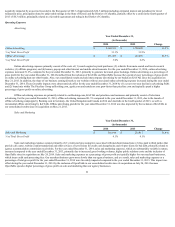

Sales and Marketing

Year Ended December 31,

(in thousands)

2014

2013

Change

Sales and Marketing $ 310,910

$ 235,817

31.8%

% of Total Gross Profit 4.1%

4.1%

Sales and marketing expenses consist primarily of (1) credit card processing fees associated with merchant transactions; (2) fees paid to third parties that

provide call center, website content translations and other services; (3) provisions for credit card chargebacks; and (4) provisions for bad debt, primarily related to

agency accommodation commission receivables. For the year ended December 31, 2014, sales and marketing expenses, which are substantially variable in nature,

increased compared to the year ended December 31, 2013, primarily due to increased gross booking volumes, higher public relations costs and the inclusion of

OpenTable since its acquisition on July 24, 2014. Sales and marketing expenses as a percentage of gross profit are typically higher for our merchant businesses,

which incur credit card processing fees. Our merchant business grew more slowly than our agency business, and as a result, sales and marketing expenses as a

percentage of total gross profit for the year ended December 31, 2014 were favorably impacted compared to the year ended December 31, 2013. This impact was

offset during the year ended December 31, 2014 by the inclusion of OpenTable in our consolidated results since its acquisition on July 24, 2014 because

OpenTable spends a higher percentage of gross profit on sales and marketing than our agency businesses.

61