Priceline 2015 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

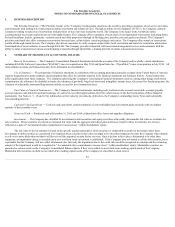

long-term investments on the Company's Consolidated Balance Sheets based on the maturity date of the debt security. See Notes 4 and 5 for further detail of

investments.

Equity investments without readily determinable fair values, in companies over which the Company does not have the ability to exercise significant

influence, are accounted for using the cost method of accounting and classified within "Other assets" in the Consolidated Balance Sheets. Under the cost method,

investments are carried at cost and are adjusted to fair value only for other-than-temporary declines in fair value.

Property and Equipment — Property and equipment are stated at cost less accumulated depreciation and amortization. Depreciation and amortization of

property and equipment is computed on a straight-line basis over the estimated useful lives of the assets or, when applicable, the life of the lease, whichever is

shorter.

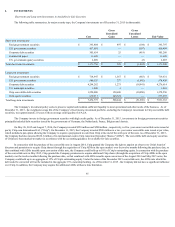

Website and Software Capitalization — Certain direct development costs associated with website and internal-use software are capitalized and include

external direct costs of services and payroll costs for employees devoting time to the software projects principally related to website and mobile app development,

including support systems, software coding, designing system interfaces and installation and testing of the software. These costs are recorded as property and

equipment and are generally amortized over a period of two to five years beginning when the asset is substantially ready for use. Costs incurred for enhancements

that are expected to result in additional features or functionality are capitalized and amortized over the estimated useful life of the enhancements. Costs incurred

during the preliminary project stage, as well as maintenance and training costs, are expensed as incurred. Capitalized costs associated with website and internal-use

software were $44.2 million and $20.9 million for the years ended December 31, 2015 and 2014, respectively. Costs for 2015 reflect a full year of activity for

OpenTable compared to a partial year's activity in 2014 and higher development costs for priceline.com.

Goodwill — The Company accounts for acquired businesses using the purchase method of accounting which requires that the assets acquired and

liabilities assumed be recorded at the date of acquisition at their respective fair values. Any excess of the purchase price over the estimated fair values of the net

assets acquired is recorded as goodwill. The Company's Consolidated Financial Statements reflect an acquired business starting at the date of the acquisition.

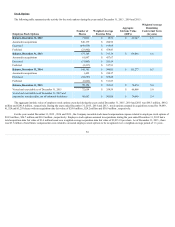

Goodwill is not subject to amortization and is reviewed at least annually for impairment, or earlier if an event occurs or circumstances change and there is

an indication of impairment. The Company tests goodwill at a reporting unit level. The fair value of the reporting unit is compared to its carrying value, including

goodwill. Fair values are determined based on discounted cash flows, market multiples and/or appraised values and are based on market participant assumptions.

An impairment is recorded to the extent that the implied fair value of goodwill is less than the carrying value of goodwill. See Note 9 for further information.

Impairment of Long-Lived Assets and Intangible Assets — The Company reviews long-lived assets and amortizable intangible assets for impairment

whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. The assessment of possible impairment is

based upon the Company's ability to recover the carrying value of the assets from the estimated undiscounted future net cash flows, before interest and taxes, of the

related operations. The amount of impairment loss, if any, is measured as the excess of the carrying value of the asset over the present value of estimated future

cash flows, using a discount rate commensurate with the risks involved and based on assumptions representative of market participants.

Agency Revenues

Agency revenues are derived from travel-related transactions where the Company is not the merchant of record and where the prices of the travel services

are determined by third parties. Agency revenues include travel commissions, global distribution system ("GDS") reservation booking fees related to certain travel

services, travel insurance fees and customer processing fees and are reported at the net amounts received, without any associated cost of revenue. Such revenues

are generally recognized by the Company when the consumers complete their travel.

Merchant Revenues and Cost of Merchant Revenues

Merchant revenues and related cost of revenues are derived from services where the Company is the merchant of record and therefore charges the

customer's credit card and subsequently pays the travel service provider for the services provided.

85