Priceline 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

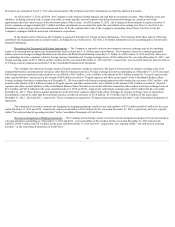

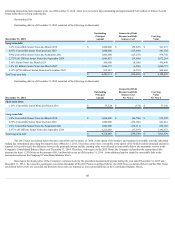

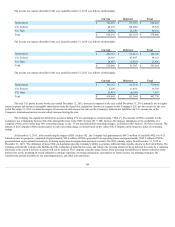

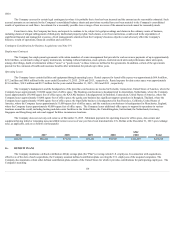

A reconciliation of redeemable noncontrolling interests for the year ended December 31, 2013 is as follows (in thousands):

2013

Balance, beginning of period $ 160,287

Net income attributable to noncontrolling interests 135

Fair value adjustments (1) 42,522

Purchase of subsidiary shares at fair value (1) (192,530)

Currency translation adjustments (10,414)

Balance, end of period $ —

(1) The fair value of the redeemable noncontrolling interests was determined by industry peer comparable analysis and a discounted cash flow valuation

model.

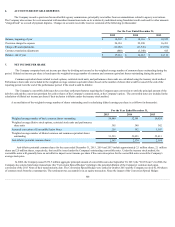

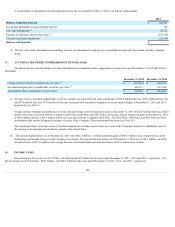

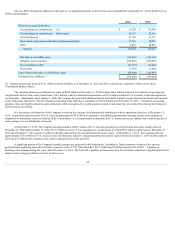

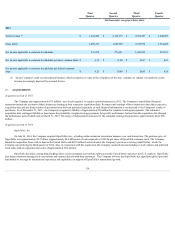

13 . ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

The table below provides the balances for each classification of accumulated other comprehensive income (loss) as of December 31, 2015 and 2014 (in

thousands):

December 31, 2015

December 31, 2014

Foreign currency translation adjustments, net of tax (1) $ (217,263)

$ (102,758)

Net unrealized gain (loss) on marketable securities, net of tax (2) 462,115

(157,144)

Accumulated other comprehensive income (loss) $ 244,852

$ (259,902)

(1) Foreign currency translation adjustments, net of tax, includes net losses from fair value adjustments of $34.8 million after tax ( $52.6 million before tax)

and $37.8 million after tax ( $57.8 million before tax) associated with derivatives designated as net investment hedges at December 31, 2015 and 2014 ,

respectively (see Note 5 ).

Foreign currency translation adjustments, net of tax, includes foreign currency transaction gains at December 31, 2015 of $126.8 million after tax ( $220.5

million before tax) associated with the Company's 2022 Notes, 2024 Notes and 2027 Notes and foreign currency transaction gains at December 31, 2014

of $48.3 million after tax ( $83.8 million before tax) associated with the Company's 2024 Notes. The 2022 Notes, 2024 Notes and 2027 Notes are Euro-

denominated debt and are designated as hedges of certain of the Company's Euro-denominated net assets (see Note 10 ).

The remaining balance in foreign currency translation adjustments excludes income taxes as a result of the Company's intention to indefinitely reinvest

the earnings of its international subsidiaries outside of the United States.

(2) The unrealized gains before tax at December 31, 2015 were $456.1 million , of which unrealized gains of $481.3 million were exempt from tax in the

Netherlands and unrealized losses of $25.2 million were taxable. The unrealized losses before tax at December 31, 2014 were $164.7 million , of which

unrealized losses of $134.6 million were exempt from tax in the Netherlands and unrealized losses of $30.1 million were taxable.

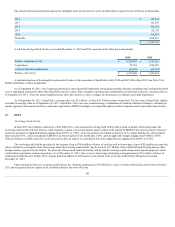

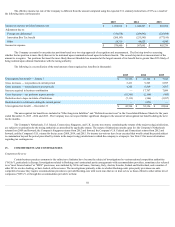

14 . INCOME TAXES

International pre-tax income was $3.1 billion , $2.9 billion and $2.2 billion for the years ended December 31, 2015 , 2014 and 2013 , respectively. U.S.

pre-tax income was $35.4 million , $98.4 million , and $48.5 million for the years ended December 31, 2015 , 2014 , and 2013 , respectively.

108