Priceline 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

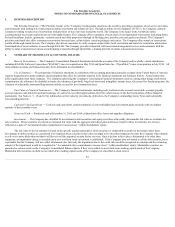

Tax Recovery Charge, Occupancy Taxes and State and Local Taxes

The Company provides an online travel service to facilitate online travel purchases by consumers from travel service providers, including

accommodation, rental car and airline ticket reservations, and sometimes as part of a vacation package reservation. For merchant model transactions, the Company

charges the consumer an amount intended to cover the taxes that the Company anticipates the travel service provider will owe and remit to the local taxing

authorities ("tax recovery charge"). Tax rate information for calculating the tax recovery charge is provided to the Company by the travel service providers.

In certain taxing jurisdictions, the Company is required by passage of a new statute or by court order to collect and remit certain taxes (local occupancy

tax, general excise and/or sales tax) imposed upon its margin and/or service fee. In those jurisdictions, the Company is collecting and remitting tax as required.

The tax recovery charge and occupancy and other related taxes collected from customers and remitted to those jurisdictions are reported on a net basis in the

Consolidated Statement of Operations. Except in those jurisdictions, the Company does not charge the customer or remit occupancy or other related taxes based on

its margin or service fee, because the Company believes that such taxes are not owed on its compensation for its services (see Note 15 ).

Advertising - Online — Online advertising expenses consist primarily of the costs of (1) search engine keyword purchases; (2) referrals from meta-search

and travel research websites; (3) affiliate programs; and (4) banner, pop-up and other Internet and mobile advertisements. Online advertising expense is generally

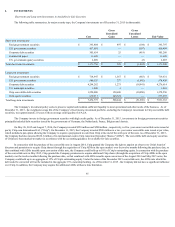

recognized as incurred. Included in "Accrued expenses and other current liabilities" in the Consolidated Balance Sheets are accrued online advertising liabilities of

$188.2 million and $164.0 million at December 31, 2015 and 2014 , respectively.

Advertising - Offline — Offline advertising expenses are primarily related to the Company's Booking.com, KAYAK and priceline.com businesses and

primarily consist of television advertising. The Company expenses advertising production costs the first time the advertising is broadcast.

Sales and Marketing — Sales and marketing expenses consist primarily of (1) credit card processing fees associated with merchant transactions; (2) fees

paid to third parties that provide call center, website content translations and other services; (3) customer relations costs; (4) public relations costs; (5) provisions

for bad debt, primarily related to agency accommodation commission receivables; and (6) provisions for credit card chargebacks.

Personnel — Personnel expenses consist of compensation to the Company's personnel, including salaries, stock-based compensation, bonuses, payroll

taxes and employee health benefits. Included in "Accrued expenses and other current liabilities" in the Consolidated Balance Sheets are accrued compensation

liabilities of $186.1 million and $159.0 million at December 31, 2015 and 2014 , respectively.

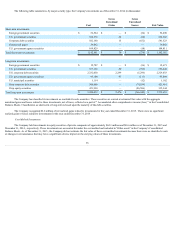

Stock-Based Compensation — Stock-based compensation is recognized in the financial statements based upon fair value. The fair value of performance

share units and restricted stock units is determined based on the number of units or shares, as applicable, granted and the quoted price of the Company's common

stock as of the grant date or acquisition date. Stock-based compensation related to performance share units reflects the estimated probable outcome at the end of

the performance period. The fair value of employee stock options assumed in acquisitions was determined using the Black Scholes model and the market value of

the Company's common stock at the respective acquisition dates. Fair value is recognized as expense on a straight line basis, net of estimated forfeitures, over the

employee requisite service period.

The benefits of tax deductions in excess of recognized compensation costs are reported as a credit to additional paid-in capital and as financing cash

flows, but only when such excess tax benefits are realized by a reduction to current taxes payable. See Note 3 for further information on stock-based awards.

Information Technology — Information technology expenses consist primarily of: (1) software license and system maintenance fees; (2) data

communications and other expenses associated with operating our services; (3) outsourced data center costs; and (4) payments to outside consultants.

Income Taxes — The Company accounts for income taxes under the asset and liability method. The Company records the estimated future tax effects of

temporary differences between the tax bases of assets and liabilities and amounts reported in the Consolidated Balance Sheets, as well as operating loss and tax

credit carryforwards. Deferred taxes are classified as noncurrent on the balance sheet.

87