Priceline 2015 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2015 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

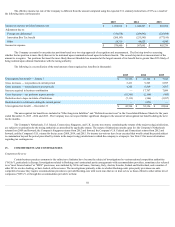

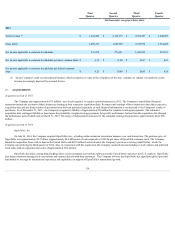

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

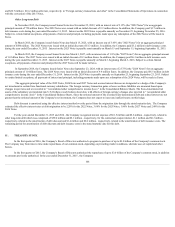

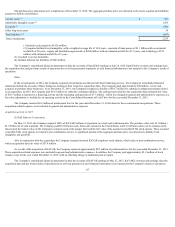

(In thousands, except per share data)

2014

Total revenues (1) $ 1,641,802

$ 2,123,575

$ 2,836,497

$ 1,840,097

Gross profit 1,406,471

1,882,996

2,619,978

1,674,685

Net income applicable to common stockholders 331,218

576,451

1,062,253

451,831

Net income applicable to common stockholders per basic common share $ 6.35

$ 11.00

$ 20.27

$ 8.65

Net income applicable to common stockholders per diluted common

share $ 6.25

$ 10.89

$ 20.03

$ 8.56

(1) As the Company's retail accommodation business, which recognizes revenue at the completion of the stay, continues to expand, our quarterly results

become increasingly impacted by seasonal factors.

19 . ACQUISITIONS

Acquisition activity in 2015

The Company paid approximately $75 million , net of cash acquired, to acquire certain businesses in 2015. The Company's consolidated financial

statements include the accounts of these businesses starting at their respective acquisition dates. Revenues and earnings of these businesses since their respective

acquisition date and pro forma results of operations have not been presented separately as such financial information is not material to the Company's results of

operations. As of December 31, 2015 , the Company recognized a liability of approximately $9 million for estimated contingent payments. The estimated

acquisition-date contingent liability is based upon the probability-weighted average payments for specific performance factors from the acquisition date through

the performance period which ends at March 31, 2019. The range of undiscounted outcomes for the estimated contingent payments is approximately $0 to $90

million .

Acquisition activity in 2014

OpenTable, Inc.

On July 24, 2014, the Company acquired OpenTable, Inc., a leading online restaurant reservation business, in a cash transaction. The purchase price of

OpenTable was approximately $2.5 billion (approximately $2.4 billion net of cash acquired) or $103.00 per share of OpenTable common stock. The Company

funded the acquisition from cash on hand in the United States and $995 million borrowed under the Company's previous revolving credit facility, which the

Company repaid during the third quarter of 2014. Also, in connection with this acquisition, the Company assumed unvested employee stock options and restricted

stock units with an acquisition fair value of approximately $95 million .

OpenTable has built a strong brand helping diners secure restaurant reservations online across the United States and select non-U.S. markets. OpenTable

also helps restaurants manage their reservations and connect directly with their customers. The Company believes that OpenTable has significant global potential

and intends to leverage its international experience and capabilities in support of OpenTable's international growth.

116