PG&E 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

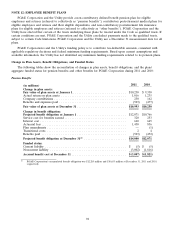

NOTE 12: EMPLOYEE BENEFIT PLANS (Continued)

Other Benefits

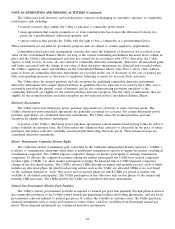

2011 2010

(in millions)

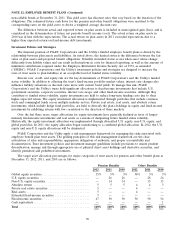

Change in plan assets:

Fair value of plan assets at January 1 ............................... $1,337 $1,169

Actual return on plan assets ....................................... 95 147

Company contributions .......................................... 137 94

Plan participant contribution ...................................... 52 49

Benefits and expenses paid ........................................ (130) (122)

Fair value of plan assets at December 31 ............................. $1,491 $1,337

Change in benefit obligation:

Benefit obligation at January 1 ..................................... $1,755 $1,511

Service cost for benefits earned .................................... 42 36

Interest cost .................................................. 91 88

Actuarial loss ................................................. 63 52

Plan amendments .............................................. — 128

Transitional costs ............................................... — 1

Benefits paid .................................................. (130) (113)

Federal subsidy on benefits paid .................................... 12 3

Plan participant contributions ...................................... 52 49

Benefit obligation at December 31 .................................. $1,885 $1,755

Funded status:

Noncurrent liability ............................................. $(394) $ (418)

Accrued benefit cost at December 31 ................................ $ (394) $ (418)

There was no material difference between PG&E Corporation and the Utility for the information disclosed

above.

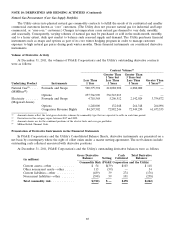

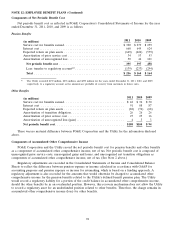

On February 16, 2010, the Utility amended its contributory postretirement medical plans for retirees to provide

for additional employer contributions towards retiree premiums. The plan amendment was accounted for as a plan

modification that required re-measurement of the accumulated benefit obligation, plan assets, and periodic benefit

costs. The inputs and assumptions used in re-measurement did not change significantly from December 31, 2009 and

did not have a material impact on the funded status of the plans. The re-measurement of the accumulated benefit

obligation and plan assets resulted in an increase to other postretirement benefits and a decrease to other

comprehensive income of $148 million. The impact to net periodic benefit cost was not material.

93