PG&E 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

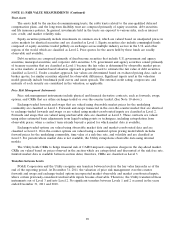

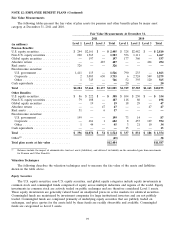

NOTE 12: EMPLOYEE BENEFIT PLANS (Continued)

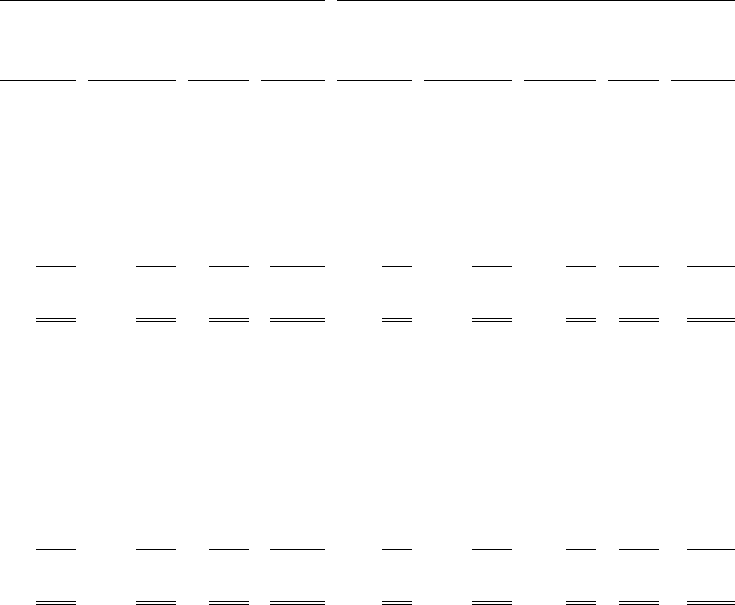

Level 3 Reconciliation

The following table is a reconciliation of changes in the fair value of instruments for pension and other benefit

plans that have been classified as Level 3 for the years ended December 31, 2011 and 2010:

Pension Benefits Other Benefits

Corporate Other Corporate Other

Absolute fixed- fixed- Absolute fixed- fixed- Real

return income income Total return income income assets Total

(in millions)

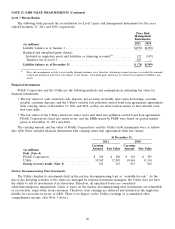

Balance as of January 1, 2010 . . $340 $531 $190 $1,061 $32 $124 $17 $ — $ 173

Actual return on plan assets:

Relating to assets still held at

the reporting date ....... 44 52 5 101 415—— 19

Relating to assets sold during

the period ............. 5 5 5 15 1(2)—— (1)

Purchases, issuances, sales, and

settlements .............. 105 (39) (80) (14) 10 (8) (7) —(5)

Balance as of December 31,

2010 ................... $494 $549 $120 $1,163 $47 $129 $10 $ — $ 186

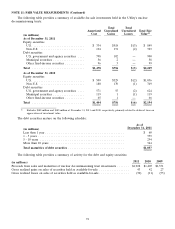

Actual return on plan assets:

Relating to assets still held at

the reporting date ....... 5 57 (2) 60 116—— 17

Relating to assets sold during

the period ............. 2 — 1 3—(2) —— (2)

Purchases, issuances, sales, and

settlements

Purchases ............... — 79 2 81 — 34 — 6 40

Settlements .............. (14) (35) (58) (107) (1) (30) (5) —(36)

Transfers out of Level 3 ...... ——(63) (63) —(146) (5) —(151)

Balance as of December 31,

2011 ................... $487 $650 $ — $1,137 $47 $ 1 $— $ 6 $ 54

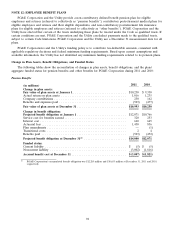

Cash Flow Information

Employer Contributions

PG&E Corporation and the Utility contributed $230 million to the pension benefit plans and $137 million to the

other benefit plans in 2011. These contributions are consistent with PG&E Corporation’s and the Utility’s funding

policy, which is to contribute amounts that are tax-deductible and consistent with applicable regulatory decisions and

federal minimum funding requirements. None of these pension or other benefits were subject to a minimum funding

requirement requiring a cash contribution in 2011. The Utility’s pension benefits met all the funding requirements

under ERISA. PG&E Corporation and the Utility expect to make total contributions of approximately $286 million

and $109 million to the pension plan and other postretirement benefit plans, respectively, for 2012.

99