PG&E 2011 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

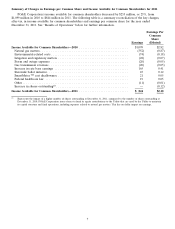

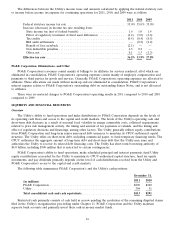

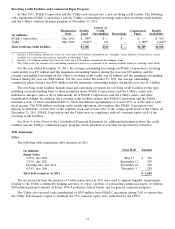

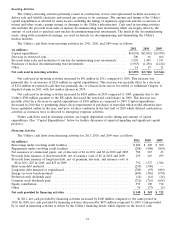

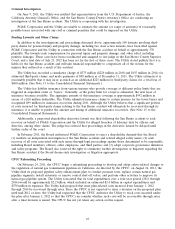

Revolving Credit Facilities and Commercial Paper Program

In May 2011, PG&E Corporation and the Utility each entered into a new revolving credit facility. The following

table summarizes PG&E Corporation’s and the Utility’s outstanding borrowings under their revolving credit facilities

and the Utility’s commercial paper program at December 31, 2011:

Letters of

Termination Facility Credit Commercial Facility

Date Limit Outstanding Borrowings Paper Availability

(in millions)

PG&E Corporation ........... May 2016 $ 300(1) $ — $ — $ — $ 300

Utility ..................... May 2016 3,000(2) 343 — 1,389(3) 1,268(3)

Total revolving credit facilities .............. $3,300 $343 $ — $1,389 $1,568

(1) Includes a $100 million sublimit for letters of credit and a $100 million commitment for ‘‘swingline’’ loans, defined as loans that are made

available on a same-day basis and are repayable in full within 7 days.

(2) Includes a $1.0 billion sublimit for letters of credit and a $300 million commitment for swingline loans.

(3) The Utility treats the amount of its outstanding commercial paper as a reduction to the amount available under its revolving credit facility.

For the year ended December 31, 2011, the average outstanding borrowings on PG&E Corporation’s revolving

credit facility was $53 million and the maximum outstanding balance during the year was $75 million; and the

average outstanding borrowings on the Utility’s revolving credit facility was $2 million and the maximum outstanding

balance during the year was $208 million. For the year ended December 31, 2011, the average outstanding

commercial paper balance was $818 million and the maximum outstanding balance during the year was $1.4 billion.

The revolving credit facilities include usual and customary covenants for revolving credit facilities of this type,

including covenants limiting liens to those permitted under PG&E Corporation’s and the Utility’s senior note

indentures, mergers, sales of all or substantially all of PG&E Corporation’s and the Utility’s assets, and other

fundamental changes. In addition, the revolving credit facilities require that PG&E Corporation and the Utility

maintain a ratio of total consolidated debt to total consolidated capitalization of at most 65% as of the end of each

fiscal quarter. The $300 million revolving credit facility agreement also requires that PG&E Corporation own,

directly or indirectly, at least 80% of the common stock and at least 70% of the voting capital stock of the Utility. At

December 31, 2011, PG&E Corporation and the Utility were in compliance with all covenants under each of the

revolving credit facilities.

See Note 4 of the Notes to the Consolidated Financial Statements for additional information about the credit

facilities and the Utility’s commercial paper program, which information is hereby incorporated by reference.

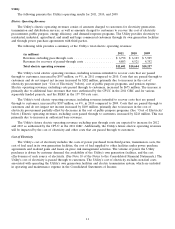

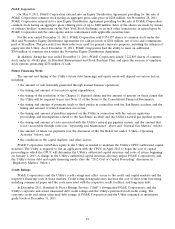

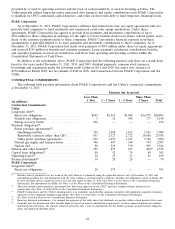

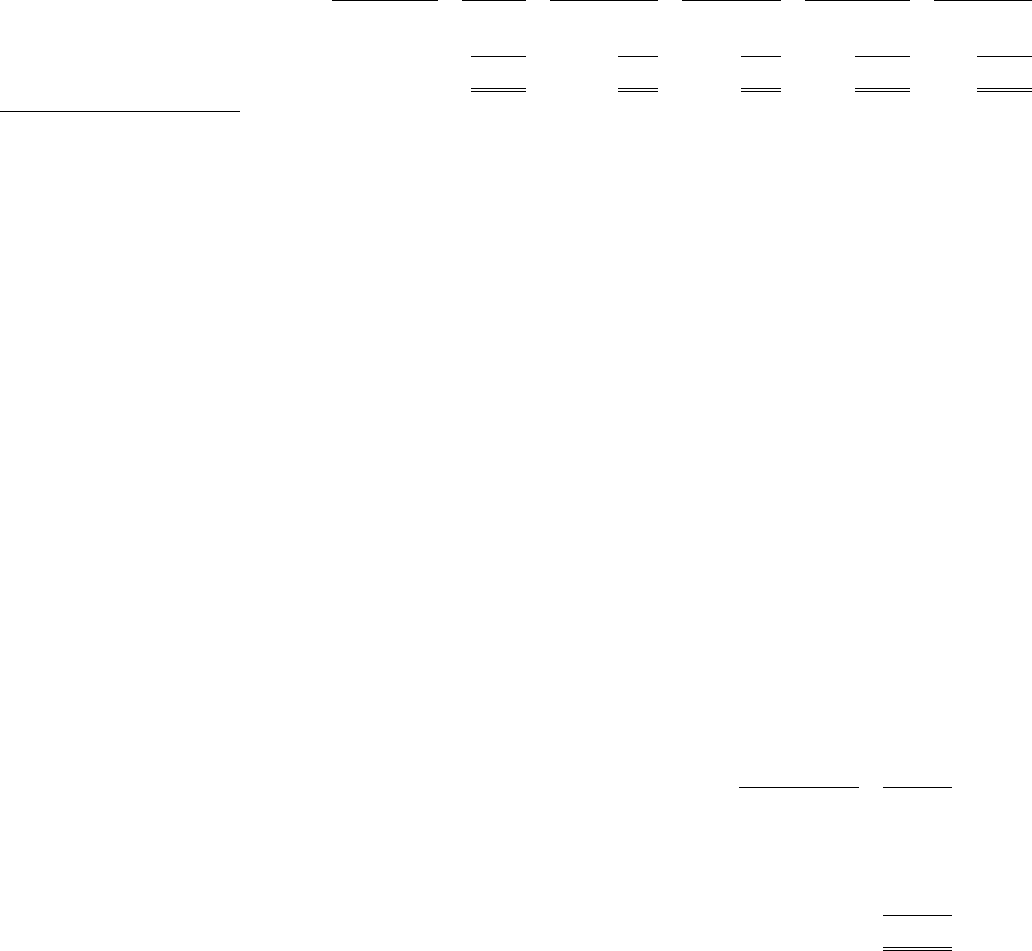

2011 Financings

Utility

The following table summarizes debt issuances in 2011:

Issue Date Amount

(in millions)

Senior Notes

4.25%, due 2021 ....................................... May 13 $ 300

3.25%, due 2021 ....................................... September 12 250

Floating rate, due 2012 .................................. November 22 250

4.50%, due 2041 ....................................... December 1 250

Total debt issuances in 2011 ................................ $ 1,050

The net proceeds from the issuance of Utility senior notes in 2011 were used to support liquidity requirements

relating to the Utility’s commodity hedging activities, to repay a portion of outstanding commercial paper, to redeem

$200 million principal amount of Series 1996 A pollution control bonds, and for general corporate purposes.

The Utility also received cash contributions of $555 million from PG&E Corporation during 2011 to ensure that

the Utility had adequate capital to maintain the 52% common equity ratio authorized by the CPUC.

17