PG&E 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

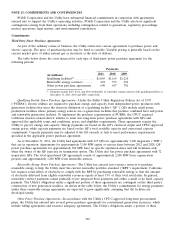

NOTE 15: COMMITMENTS AND CONTINGENCIES (Continued)

Other Commitments

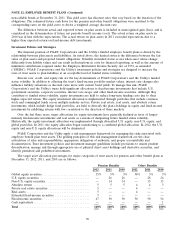

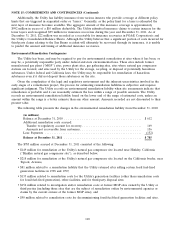

The Utility has other commitments relating to operating leases. At December 31, 2011, the future minimum

payments related to these commitments were as follows:

(in millions)

2012 .................................................. $ 30

2013 .................................................. 27

2014 .................................................. 20

2015 .................................................. 16

2016 .................................................. 15

Thereafter .............................................. 81

Total .................................................. $189

Payments for other commitments relating to operating leases amounted to $27 million in 2011, $25 million in

2010, and $22 million in 2009. PG&E Corporation and the Utility had operating leases on office facilities expiring at

various dates from 2012 to 2022. Certain leases on office facilities contain escalation clauses requiring annual

increases in rent ranging from 1% to 4%. The rentals payable under these leases may increase by a fixed amount

each year, a percentage of a base year, or the consumer price index. Most leases contain extension options ranging

between one and five years.

Underground Electric Facilities

At December 31, 2011, the Utility was committed to spending approximately $292 million for the conversion of

existing overhead electric facilities to underground electric facilities. These funds are conditionally committed

depending on the timing of the work, including the schedules of the respective cities, counties, and communications

utilities involved. The Utility expects to spend approximately $61 million to $86 million each year in connection with

these projects. Consistent with past practice, the Utility expects that these capital expenditures will be included in

rate base as each individual project is completed and recoverable in rates charged to customers.

Contingencies

PG&E Corporation

PG&E Corporation retains a guarantee related to certain obligations of its former subsidiary, National Energy &

Gas Transmission, Inc. (‘‘NEGT’’), that were issued to the purchaser of an NEGT subsidiary company in 2000.

PG&E Corporation’s primary remaining exposure relates to any potential environmental obligations that were known

to NEGT at the time of the sale but not disclosed to the purchaser, and is limited to $150 million. PG&E

Corporation has not received any claims nor does it consider it probable that any claims will be made under the

guarantee. PG&E Corporation believes that if it were required to satisfy its obligations under this guarantee any

required payments would not have a material impact on its financial condition, results of operations, or cash flows.

Utility

Spent Nuclear Fuel Storage Proceedings

Under federal law, the U.S. Department of Energy (‘‘DOE’’) was required to dispose of spent nuclear fuel and

high-level radioactive waste from electric utilities with commercial nuclear power plants no later than January 31,

1998, in exchange for fees paid by the utilities. The DOE failed to meet its contractual obligation to dispose of

nuclear waste from the Utility’s nuclear generating facility at Diablo Canyon and its retired facility at Humboldt Bay

(‘‘Humboldt Bay Unit 3’’). As a result, the Utility constructed an interim dry cask storage facility to store spent fuel

at Diablo Canyon through at least 2024.

105