PG&E 2011 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and cash flows. Further, any future increase in the Utility’s environmental-related liabilities that are not

recoverable through rates, such as costs associated with its natural gas compressor station located in Hinkley,

California, could negatively affect PG&E Corporation’s and the Utility’s future financial condition, results of

operations, and cash flows.

•Authorized Rate of Return, Capital Structure, and Financing. Future changes in the Utility’s CPUC-authorized

ROE and capital structure would affect the amount of the Utility’s net income and the amount of PG&E

Corporation’s income available for common shareholders. The Utility’s capital structure for its electric and

natural gas distribution and electric generation rate base, consisting of 52% common equity and 48% debt and

preferred stock, and its authorized ROE of 11.35% will remain in effect through 2012. The CPUC will

determine the Utility’s future capital structure and ROE in the Utility’s next cost of capital proceeding. The

Utility will file its cost of capital application with the CPUC in April 2012. The Utility’s financing needs will

be affected by various factors, including changes to its authorized capital structure and rates of return, the

timing and amount of capital expenditures and operating expenses, collateral requirements, the amount of

costs related to natural gas matters that are not recovered through rates, and the amount of any penalties the

Utility may be required to pay. PG&E Corporation contributes equity to the Utility as needed by the Utility

to maintain its CPUC-authorized capital structure. PG&E Corporation’s and the Utility’s ability to access the

capital markets and the terms and rates of future financings, can be affected by changes in their credit ratings,

the outcome of the natural gas matters described above, general economic and market conditions, and other

factors. (See ‘‘Liquidity and Financial Resources’’ below.)

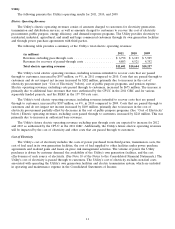

•The Timing and Outcome of Ratemaking and Other Regulatory Proceedings. The Utility’s revenues are affected

by the timing and outcome of rate case decisions. In 2011, the CPUC issued decisions that determine the

majority of the Utility’s base revenue requirements (i.e., revenues to own and operate the Utility’s assets) for

the next several years. The CPUC’s decision in the most recent GRC set revenue requirements for the

Utility’s electric and natural gas distribution and electric generation operations from 2011 through 2013. The

CPUC’s decision in the most recent GT&S rate case set revenue requirements for the Utility’s natural gas

transmission and storage operations from 2011 through 2014. On August 10, 2011, the FERC approved an

uncontested settlement of the Utility’s 13th TO rate case. (See ‘‘Results of Operations’’ below.) As soon as

July 2012, the Utility may file a notice of intent with the CPUC that will include a draft of the Utility’s GRC

application for the period beginning January 1, 2014. The Utility’s GRC application is planned for December

2012. From time to time, the Utility also files separate applications with the CPUC requesting authority to

recover costs for other projects, such as the Utility’s proposed pipeline safety enhancement plan. (See

‘‘Natural Gas Matters—CPUC Rulemaking Proceeding’’ below.) The Utility’s revenues will be affected by

whether and when the CPUC authorizes the Utility to recover such costs. The Utility also collects revenue

requirements to recover certain costs that the CPUC has authorized the Utility to pass through to customers,

such as electric procurement costs. The Utility’s recovery of these costs is often subject to compliance and

audit proceedings conducted by the CPUC which may result in the disallowance of costs previously recorded

for recovery. The outcome of these proceedings can be affected by many factors, including general economic

conditions, the level of customer rates, regulatory policies, and political considerations. (See ‘‘Risk Factors’’

below.)

6