PG&E 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 15: COMMITMENTS AND CONTINGENCIES

PG&E Corporation and the Utility have substantial financial commitments in connection with agreements

entered into to support the Utility’s operating activities. PG&E Corporation and the Utility also have significant

contingencies arising from their operations, including contingencies related to guarantees, regulatory proceedings,

nuclear operations, legal matters, and environmental remediation.

Commitments

Third-Party Power Purchase Agreements

As part of the ordinary course of business, the Utility enters into various agreements to purchase power and

electric capacity. The price of purchased power may be fixed or variable. Variable pricing is generally based on the

current market price of either natural gas or electricity at the date of delivery.

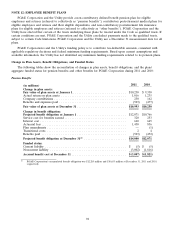

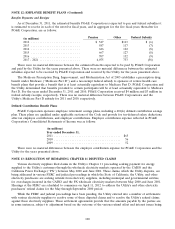

The table below shows the costs incurred for each type of third-party power purchase agreement for the

following periods:

Payments

2011 2010 2009

(in millions)

Qualifying facilities(1) ........... $1,069 $1,164 $1,210

Renewable energy contracts ...... 622 573 362

Other power purchase agreements . 690 657 701

(1) Payments include $297, $321, and $344 attributable to renewable energy contracts with qualifying facilities at

December 31, 2011, 2010 and 2009, respectively.

Qualifying Facility Power Purchase Agreements—Under the Public Utility Regulatory Policies Act of 1978

(‘‘PURPA’’), electric utilities are required to purchase energy and capacity from independent power producers with

generation facilities that meet the statutory definition of a qualifying facility (‘‘QF’’). QFs include small power

production facilities whose primary energy sources are co-generation facilities that produce combined heat and power

and renewable generation facilities. To implement the purchase requirements of PURPA, the CPUC required

California investor-owned electric utilities to enter into long-term power purchase agreements with QFs and

approved the applicable terms and conditions, prices, and eligibility requirements. These agreements require the

Utility to pay for energy and capacity. Energy payments are based on the QF’s electrical output and CPUC-approved

energy prices, while capacity payments are based on the QF’s total available capacity and contractual capacity

commitment. Capacity payments may be adjusted if the QF exceeds or fails to meet performance requirements

specified in the applicable power purchase agreement.

As of December 31, 2011, the Utility had agreements with 217 QFs for approximately 3,400 megawatts (‘‘MW’’)

that are in operation. Agreements for approximately 3,100 MW expire at various dates between 2012 and 2028. QF

power purchase agreements for approximately 300 MW have no specific expiration dates and will terminate only

when the owner of the QF exercises its termination option. The Utility also has power purchase agreements with 72

inoperative QFs. The total operational QF agreements consist of approximately 2,200 MW from cogeneration

projects and approximately 1,200 MW from renewable sources.

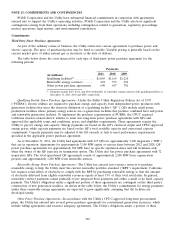

Renewable Energy Power Purchase Agreements—The Utility has entered into various contracts to purchase

renewable energy to help the Utility meet the current renewable portfolio standard (‘‘RPS’’) requirement. California

law requires retail sellers of electricity to comply with the RPS by purchasing renewable energy so that the amount

of electricity delivered from eligible renewable resources equals at least 33% of their total retail sales. In general,

renewable contract payments consist primarily of per megawatt hour payments and either a small or no fixed capacity

payment. The Utility’s obligations under a significant portion of these agreements are contingent on the third party’s

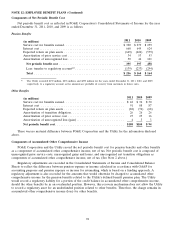

construction of new generation facilities. As shown in the table below, the Utility’s commitments for energy payments

under these renewable energy agreements are expected to grow significantly, assuming that the facilities are

developed timely.

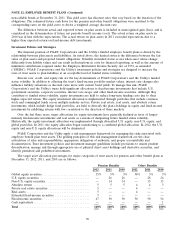

Other Power Purchase Agreements—In accordance with the Utility’s CPUC-approved long-term procurement

plans, the Utility has entered into several power purchase agreements for conventional generation resources, which

include tolling agreements and resource adequacy agreements. The Utility’s obligations under a portion of these

102