PG&E 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

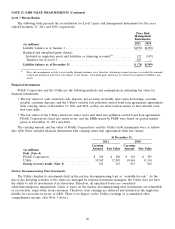

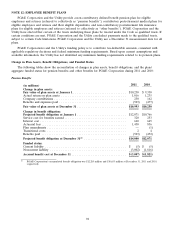

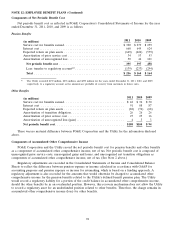

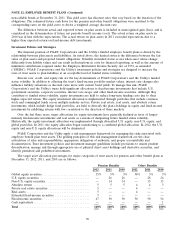

NOTE 12: EMPLOYEE BENEFIT PLANS (Continued)

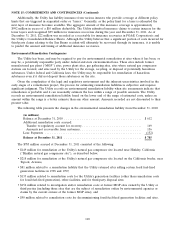

Benefits Payments and Receipts

As of December 31, 2011, the estimated benefits PG&E Corporation is expected to pay and federal subsidies it

is estimated to receive in each of the next five fiscal years, and in aggregate for the five fiscal years thereafter for

PG&E Corporation, are as follows:

Pension Other Federal Subsidy

(in millions)

2012 ............................ $ 547 $113 $ (6)

2013 ............................ 587 117 (7)

2014 ............................ 626 122 (8)

2015 ............................ 667 127 (8)

2016 ............................ 707 132 (9)

2017 - 2021 ....................... 4,075 733 (58)

There were no material differences between the estimated benefits expected to be paid by PG&E Corporation

and paid by the Utility for the years presented above. There were no material differences between the estimated

subsidies expected to be received by PG&E Corporation and received by the Utility for the years presented above.

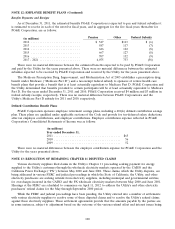

The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 establishes a prescription drug

benefit under Medicare (‘‘Medicare Part D’’) and a tax-exempt federal subsidy to sponsors of retiree health care

benefit plans that provide a benefit that is at least actuarially equivalent to Medicare Part D. PG&E Corporation and

the Utility determined that benefits provided to certain participants will be at least actuarially equivalent to Medicare

Part D. For the years ended December 31, 2011 and 2010, PG&E Corporation received $4 million and $3 million in

federal subsidy receipts, respectively. There was no material difference between PG&E Corporation’s and the

Utility’s Medicare Part D subsidy for 2011 and 2010, respectively.

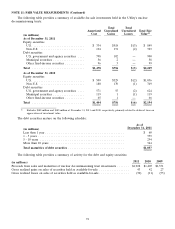

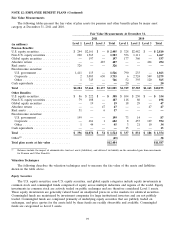

Defined Contribution Benefit Plans

PG&E Corporation sponsors employee retirement savings plans, including a 401(k) defined contribution savings

plan. These plans are qualified under applicable sections of the Code and provide for tax-deferred salary deductions,

after-tax employee contributions, and employer contributions. Employer contribution expense reflected in PG&E

Corporation’s Consolidated Statements of Income was as follows:

(in millions)

Year ended December 31,

2011 ...................................... $65

2010 ...................................... 56

2009 ...................................... 52

There were no material differences between the employer contribution expense for PG&E Corporation and the

Utility for the years presented above.

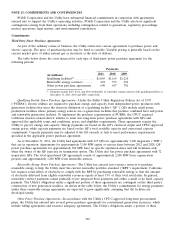

NOTE 13: RESOLUTION OF REMAINING CHAPTER 11 DISPUTED CLAIMS

Various electricity suppliers filed claims in the Utility’s Chapter 11 proceeding seeking payment for energy

supplied to the Utility’s customers through the wholesale electricity markets operated by the CAISO and the

California Power Exchange (‘‘PX’’) between May 2000 and June 2001. These claims, which the Utility disputes, are

being addressed in various FERC and judicial proceedings in which the State of California, the Utility, and other

electricity purchasers are seeking refunds from electricity suppliers, including municipal and governmental entities,

for overcharges incurred in the CAISO and the PX wholesale electricity markets between May 2000 and June 2001.

Hearings at the FERC are scheduled to commence on April 11, 2012 to address the Utility’s and other electricity

purchasers’ refund claims for the May through September 2000 period.

While the FERC and judicial proceedings have been pending, the Utility entered into a number of settlements

with various electricity suppliers to resolve some of these disputed claims and to resolve the Utility’s refund claims

against these electricity suppliers. These settlement agreements provide that the amounts payable by the parties are,

in some instances, subject to adjustment based on the outcome of the various refund offset and interest issues being

100