PG&E 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 4: DEBT (Continued)

Pollution Control Bonds

The California Pollution Control Financing Authority and the California Infrastructure and Economic

Development Bank have issued various series of fixed rate and multi-modal tax-exempt pollution control bonds for

the benefit of the Utility. All of the pollution control bonds were used to finance or refinance pollution control and

sewage and solid waste disposal facilities at the Geysers geothermal power plant or at the Utility’s Diablo Canyon

nuclear power plant and were issued as ‘‘exempt facility bonds’’ within the meaning of the Internal Revenue Code of

1954 (‘‘Code’’), as amended. In 1999, the Utility sold the Geysers geothermal power plant to Geysers Power

Company, LLC pursuant to purchase and sale agreements stating that Geysers Power Company, LLC will use the

bond-financed facilities solely as pollution control facilities. The Utility has no knowledge that Geysers Power

Company, LLC intends to cease using the bond-financed facilities solely as pollution control facilities.

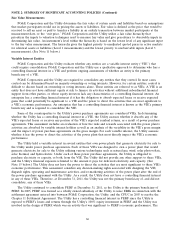

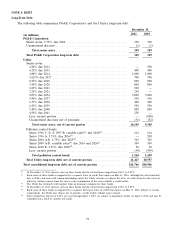

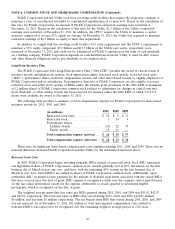

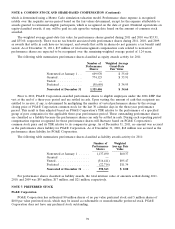

Repayment Schedule

PG&E Corporation’s and the Utility’s combined aggregate principal repayment amounts of long-term debt at

December 31, 2011 are reflected in the table below:

2012 2013 2014 2015 2016 Thereafter Total

(in millions, except interest rates)

PG&E Corporation

Average fixed interest rate .................. ——5.75% —— —5.75%

Fixed rate obligations ..................... $ — $ — $ 350 $ — $ — $ — $ 350

Utility

Average fixed interest rate .................. 2.25% 6.25% 4.80% —— 5.70% 5.62%

Fixed rate obligations ..................... $ 50

(1) $ 400 $ 1,000 $ — $ — $9,145 $10,595

Variable interest rate as of December 31, 2011 . . . —— ——0.04% — 0.04%

Variable rate obligations ................... $ — $ — $ — $ — $923(2) $ — $ 923

Less: current portion ...................... (50) — ——— — (50)

Total consolidated long-term debt ........... $ — $ 400 $ 1,350 $ — $923 $9,145 $11,818

(1) These bonds, due in 2026, are subject to mandatory tender on April 2, 2012 and may be remarketed in a fixed or variable rate mode.

Accordingly, the bonds have been classified for repayment purposes in 2012.

(2) These bonds, due in 2016 and 2026, are backed by letters of credit that expire on May 31, 2016.

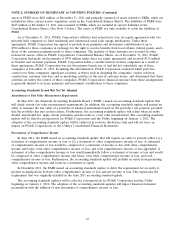

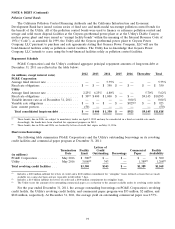

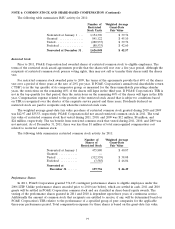

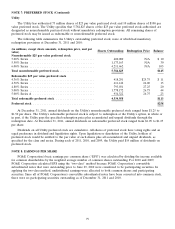

Short-term Borrowings

The following table summarizes PG&E Corporation’s and the Utility’s outstanding borrowings on its revolving

credit facilities and commercial paper program at December 31, 2011:

Letters of

Termination Facility Credit Commercial Facility

Date Limit Outstanding Borrowings Paper Availability

(in millions)

PG&E Corporation ........... May 2016 $ 300(1) $ — $ — $ — $ 300

Utility ..................... May 2016 3,000(2) 343 — 1,389(3) 1,268(3)

Total revolving credit facilities ... $3,300 $343 $ — $1,389 $1,568

(1) Includes a $100 million sublimit for letters of credit and a $100 million commitment for ‘‘swingline’’ loans, defined as loans that are made

available on a same-day basis and are repayable in full within 7 days.

(2) Includes a $1.0 billion sublimit for letters of credit and a $300 million commitment for swingline loans.

(3) The Utility treats the amount of its outstanding commercial paper as a reduction to the amount available under its revolving credit facility.

For the year ended December 31, 2011, the average outstanding borrowings on PG&E Corporation’s revolving

credit facility, the Utility’s revolving credit facility, and commercial paper program was $53 million, $2 million, and

$818 million, respectively. At December 31, 2011, the average yield on outstanding commercial paper was 0.57%.

73