PG&E 2011 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S&P’s downgrade reflects its view that PG&E Corporation and the Utility are beginning a multiyear rebuilding

of the Utility’s gas operations, customer reputation, and regulatory relationships following the San Bruno accident.

S&P affirmed a stable outlook for PG&E Corporation and the Utility as of December 2011.

On September 30, 2011, Moody’s Investors Service affirmed the ratings of and stable outlook for PG&E

Corporation and the Utility.

The credit ratings downgrade had no impact on the principal balance, principal payments, interest rates, or fees

related to PG&E Corporation’s and the Utility’s long-term debt outstanding at the time of the downgrade.

Dividends

The dividend policies of PG&E Corporation and the Utility are designed to meet the following three objectives:

•Comparability: Pay a dividend competitive with the securities of comparable companies based on payout ratio

(the proportion of earnings paid out as dividends) and, with respect to PG&E Corporation, yield

(i.e., dividend divided by share price);

•Flexibility: Allow sufficient cash to pay a dividend and to fund investments while avoiding having to issue new

equity unless PG&E Corporation’s or the Utility’s capital expenditure requirements are growing rapidly and

PG&E Corporation or the Utility can issue equity at reasonable cost and terms; and

•Sustainability: Avoid reduction or suspension of the dividend despite fluctuations in financial performance

except in extreme and unforeseen circumstances.

The Boards of Directors of PG&E Corporation and the Utility have each adopted a target dividend payout ratio

range of 50% to 70% of earnings from operations. Earnings from operations are calculated on an adjusted basis to

exclude the impact of items that management believes do not reflect the normal course of operations. Earnings from

operations are not a substitute or alternative for consolidated net income presented in accordance with GAAP.

Dividends paid by PG&E Corporation and the Utility are expected to remain in the lower end of the target payout

ratio range so that more internal funds are readily available to support the Utility’s capital investment needs. Each

Board of Directors retains authority to change the respective common stock dividend policy and dividend payout

ratio at any time, especially if unexpected events occur that would change its view as to the prudent level of cash

conservation. No dividend is payable unless and until declared by the applicable Board of Directors.

In addition, the CPUC requires that the PG&E Corporation Board of Directors give first priority to the Utility’s

capital requirements, as determined to be necessary and prudent to meet the Utility’s obligation to serve or to

operate the Utility in a prudent and efficient manner, in setting the amount of dividends.

The Boards of Directors must also consider the CPUC requirement that the Utility maintain, on average, its

CPUC-authorized capital structure including a 52% equity component.

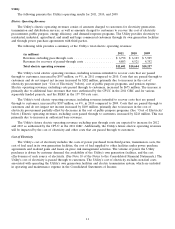

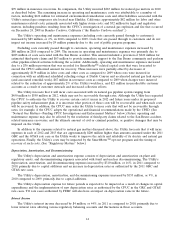

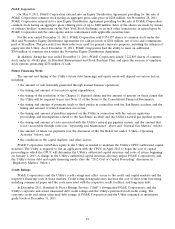

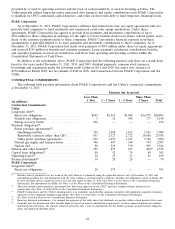

The following table summarizes PG&E Corporation’s and the Utility’s dividends paid:

2011 2010 2009

(in millions)

PG&E Corporation:

Common stock dividends paid ................................. $704 $662 $590

Common stock dividends reinvested in Dividend Reinvestment and Stock

Purchase Plan ........................................... 24 18 17

Utility:

Common stock dividends paid ................................. $716 $716 $624

Preferred stock dividends paid ................................. 14 14 14

On December 21, 2011, the Board of Directors of PG&E Corporation (‘‘Board’’) declared dividends of $0.455

per share, totaling $188 million, of which $182 million was paid on January 15, 2012 to shareholders of record on

December 30, 2011. The remaining $6 million was reinvested under the Dividend Reinvestment and Stock Purchase

Plan.

On December 21, 2011, the Board of Directors of the Utility declared dividends on its outstanding series of

preferred stock, payable on February 15, 2012, to shareholders of record on January 31, 2012.

19