PG&E 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 13: RESOLUTION OF REMAINING CHAPTER 11 DISPUTED CLAIMS (Continued)

considered by the FERC. The settlement amounts, net of deductions for contingencies based on the outcome of the

various refund offset and interest issues being considered by the FERC, will continue to be refunded to customers in

rates. Additional settlement discussions with other electricity suppliers are ongoing. Any net refunds, claim offsets, or

other credits that the Utility receives from energy suppliers through resolution of the remaining disputed claims,

either through settlement or the conclusion of the various FERC and judicial proceedings, will also be refunded to

customers.

At December 31, 2011 and December 31, 2010, the Utility held $320 million and $512 million in escrow,

respectively, including interest earned, for payment of the remaining net disputed claims. These amounts are

included within restricted cash on the Consolidated Balance Sheets.

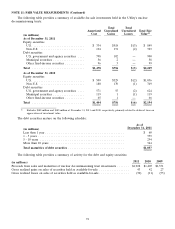

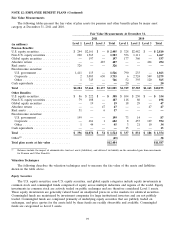

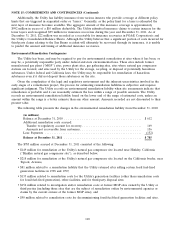

The following table presents the changes in the remaining net disputed claims liability:

(in millions)

Balance at December 31, 2010 ............................... $934

Interest accrued ......................................... 28

Less: supplier settlements .................................. (114)

Balance at December 31, 2011 ............................... $ 848

At December 31, 2011, the Utility’s net disputed claims liability was $848 million, consisting of $673 million of

remaining disputed claims (classified on the Consolidated Balance Sheets within accounts payable—disputed claims

and customer refunds) and interest accrued at the FERC-ordered rate of $669 million (classified on the Consolidated

Balance Sheets within interest payable) partially offset by accounts receivable from the CAISO and the PX of

$494 million (classified on the Consolidated Balance Sheets within accounts receivable—other).

Interest accrues on the net disputed claims liability at the FERC-ordered rate, which is higher than the rate

earned by the Utility on the escrow balance. Although the Utility has been collecting the difference between the

accrued interest and the earned interest from customers, this amount is not held in escrow. If the amount of interest

accrued at the FERC-ordered rate is greater than the amount of interest ultimately determined to be owed with

respect to disputed claims, the Utility would refund to customers any excess net interest collected from customers.

The amount of any interest that the Utility may be required to pay will depend on the final amounts to be paid by

the Utility with respect to the disputed claims and when such interest is paid.

NOTE 14: RELATED PARTY AGREEMENTS AND TRANSACTIONS

The Utility and other subsidiaries provide and receive various services to and from their parent, PG&E

Corporation, and among themselves. The Utility and PG&E Corporation exchange administrative and professional

services in support of operations. Services provided directly to PG&E Corporation by the Utility are priced at the

higher of fully loaded cost (i.e., direct cost of good or service and allocation of overhead costs) or fair market value,

depending on the nature of the services. Services provided directly to the Utility by PG&E Corporation are generally

priced at the lower of fully loaded cost or fair market value, depending on the nature and value of the services.

PG&E Corporation also allocates various corporate administrative and general costs to the Utility and other

subsidiaries using agreed-upon allocation factors, including the number of employees, operating and maintenance

expenses, total assets, and other cost allocation methodologies. Management believes that the methods used to

allocate expenses are reasonable and meet the reporting and accounting requirements of its regulatory agencies.

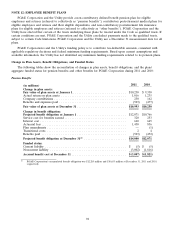

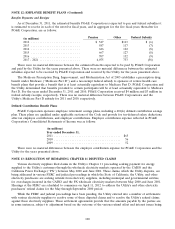

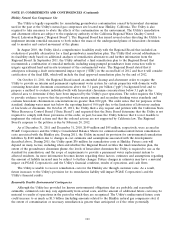

The Utility’s significant related party transactions were as follows:

Year Ended

December 31,

2011 2010 2009

(in millions)

Utility revenues from:

Administrative services provided to PG&E Corporation ............. $ 6 $ 7 $ 5

Utility expenses from:

Administrative services received from PG&E Corporation ............ $49 $55 $62

Utility employee benefit due to PG&E Corporation ................ 33 27 3

At December 31, 2011 and December 31, 2010, the Utility had a receivable of $21 million and $89 million,

respectively, from PG&E Corporation included in accounts receivable—other and other noncurrent assets—other on

the Utility’s Consolidated Balance Sheets, and a payable of $13 million and $16 million, respectively, to PG&E

Corporation included in accounts payable—other on the Utility’s Consolidated Balance Sheets.

101