PG&E 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

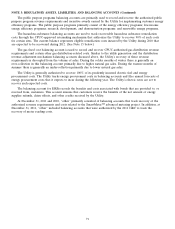

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

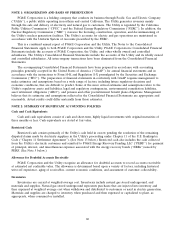

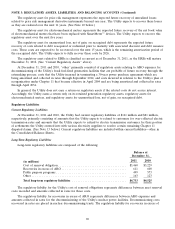

A reconciliation of the changes in the ARO liability is as follows:

(in millions)

ARO liability at December 31, 2009 ........................................ $1,593

Revision in estimated cash flows .......................................... (23)

Accretion ........................................................... 93

Liabilities settled ..................................................... (77)

ARO liability at December 31, 2010 ........................................ 1,586

Revision in estimated cash flows .......................................... 10

Accretion ........................................................... 100

Liabilities settled ..................................................... (87)

ARO liability at December 31, 2011 ........................................ $1,609

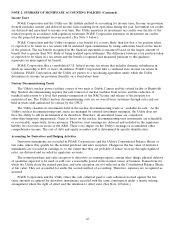

The Utility has identified the following AROs for which a reasonable estimate of fair value could not be made.

As a result, the Utility has not recorded a liability related to these AROs:

•Restoration of land to its pre-use condition under the terms of certain land rights agreements. Land rights,

communications equipment leases, and substation facilities will be maintained for the foreseeable future, and

therefore, the Utility cannot reasonably estimate the settlement date or range of settlement dates for the

obligations associated with these assets;

•Removal and proper disposal of lead-based paint contained in some Utility facilities. The Utility does not have

information available that specifies which facilities contain lead-based paint and, therefore, cannot reasonably

estimate the settlement date(s) associated with the obligations; and

•Removal of certain communications equipment from leased property, and retirement activities associated with

substation and certain hydroelectric facilities. The Utility will maintain and continue to operate its hydroelectric

facilities until the operation of a facility becomes uneconomical. The operation of the majority of the Utility’s

hydroelectric facilities is currently, and for the foreseeable future, expected to be economically beneficial.

Therefore, the settlement date cannot be determined at this time.

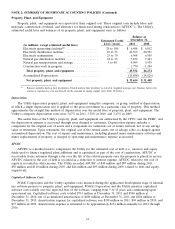

Impairment of Long-Lived Assets

PG&E Corporation and the Utility evaluate the carrying amounts of long-lived assets for impairment, based on

projections of undiscounted future cash flows, whenever events occur or circumstances change that may affect the

recoverability or the estimated life of long-lived assets. If this evaluation indicates that such cash flows are not

expected to fully recover the assets, the assets are written down to their estimated fair value. No significant

impairments were recorded in 2011, 2010, or 2009.

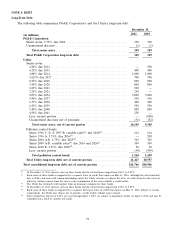

Gains and Losses on Debt Extinguishments

Gains and losses on debt extinguishments associated with regulated operations are deferred and amortized over

the remaining original amortization period of the debt reacquired, consistent with recovery of costs through regulated

rates. PG&E Corporation and the Utility recorded unamortized loss on debt extinguishments, net of gain, of

$186 million and $204 million at December 31, 2011 and 2010, respectively. The amortization expense related to this

loss was $18 million in 2011, $23 million in 2010, and $25 million in 2009. Deferred gains and losses on debt

extinguishments are recorded to current assets—regulatory assets and other noncurrent assets—regulatory assets in

the Consolidated Balance Sheets.

Gains and losses on debt extinguishments associated with unregulated operations are fully recognized at the time

such debt is reacquired and are reported as a component of interest expense.

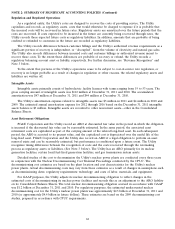

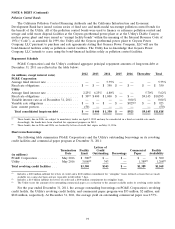

Accumulated Other Comprehensive Loss

Accumulated other comprehensive loss reports a measure for accumulated changes in equity of an enterprise

that result from transactions and other economic events, other than transactions with shareholders. The following

63