PG&E 2011 Annual Report Download - page 87

Download and view the complete annual report

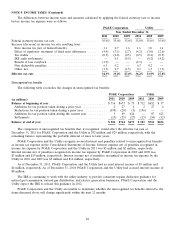

Please find page 87 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTE 9: INCOME TAXES (Continued)

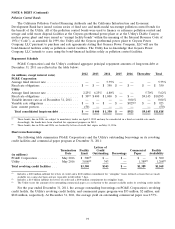

Tax settlements and years that remain subject to examination

In 2008, PG&E Corporation began participating in the Compliance Assurance Process (‘‘CAP’’), a real-time IRS

audit intended to expedite resolution of tax matters. The CAP audit culminates with a letter from the IRS indicating

its acceptance of the return. The IRS partially accepted the 2008 return, withholding two matters for further review.

In December 2010, the IRS accepted the 2009 tax return without change. In September 2011, the IRS partially

accepted the 2010 return, withholding two matters for further review. The IRS has not completed the CAP audit for

2011.

The most significant of the matters withheld for further review relates to a tax accounting method change filed

by PG&E Corporation to accelerate the amount of deductible repairs. The IRS and PG&E Corporation agreed to

wait for industry resolution of the method change before conducting an audit. In August 2011, the IRS issued new

guidance regarding the repairs deduction for electric transmission and distribution businesses for years ending on or

after December 31, 2010. The guidance was not applicable to tax years prior to 2010. In the fourth quarter 2011, the

IRS agreed to allow PG&E Corporation to file claims for 2008-2010 for the repairs method change. As a result,

PG&E Corporation made a cumulative adjustment for the repairs deduction for all of the applicable years, which

resulted in a decrease of $174 million to the unrecognized tax benefit in 2011.

In December 2011, the California Franchise Tax Board completed its audits of PG&E Corporation’s 2004 and

2005 combined California income tax returns, as well as the 1997-2007 amended income tax returns reflecting IRS

settlements for these years. In addition, the California statute of limitation for the 1997-2004 tax years expired on

December 31, 2011. PG&E Corporation recorded a tax benefit of $9 million as a result of the resolution of these

audits.

PG&E Corporation believes that the final resolution of open federal and California audits will not have a

material impact on its financial condition or results of operations.

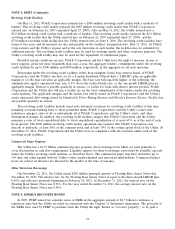

Loss carry forwards

As of December 31, 2011 and 2010, PG&E Corporation had approximately $17 million and $24 million,

respectively, of federal and California capital loss carry forwards based on filed tax returns, of which approximately

$16 million will expire if not used by December 31, 2012. For all periods presented, PG&E Corporation has provided

a full valuation allowance against its deferred income tax assets for capital loss carry forwards.

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (the ‘‘Tax Relief Act’’)

federal legislation that was signed into law on December 17, 2010, provides for full expensing for tax purposes of

qualified property, plant, and equipment placed in service from September 9, 2010 to December 31, 2011. The Tax

Relief Act increased PG&E Corporation’s federal net operating loss carry forwards. As of December 31, 2011,

PG&E Corporation had approximately $1.8 billion of federal net operating loss carry forwards and $10 million of tax

credit carry forwards, which will expire between 2029 and 2031. In addition, PG&E Corporation had approximately

$82 million of loss carry forwards related to charitable contributions, which will expire between 2013 and 2016.

PG&E Corporation believes it is more likely than not the tax benefits associated with the federal operating loss,

charitable contributions, and tax credit can be realized within the carry forward periods, therefore no valuation

allowance was recognized as of December 31, 2011. The amount of federal net operating loss carry forwards for

which a tax benefit from employee stock plans would be recorded in additional paid-in capital was approximately

$16 million as of December 31, 2011.

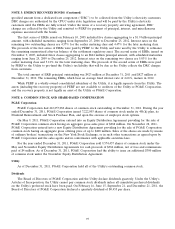

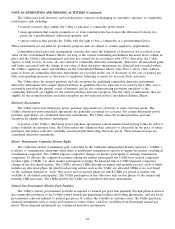

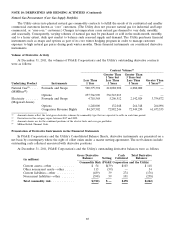

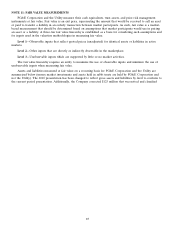

NOTE 10: DERIVATIVES AND HEDGING ACTIVITIES

Use of Derivative Instruments

The Utility and PG&E Corporation, mainly through its ownership of the Utility, face market risk primarily

related to electricity and natural gas commodity prices. All of the Utility’s risk management activities involving

derivatives reduce the volatility of commodity costs on behalf of its customers. The CPUC allows the Utility to

charge customer rates designed to recover the Utility’s reasonable costs of providing services, including the costs

related to price risk management activities.

83