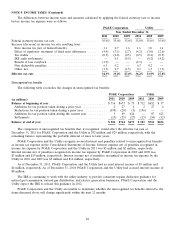

PG&E 2011 Annual Report Download - page 91

Download and view the complete annual report

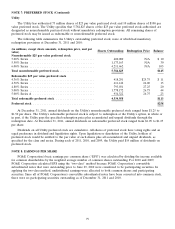

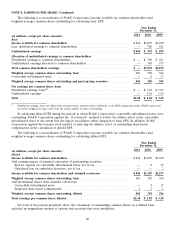

Please find page 91 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTE 11: FAIR VALUE MEASUREMENTS

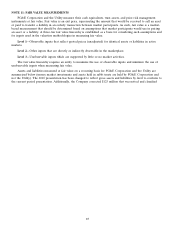

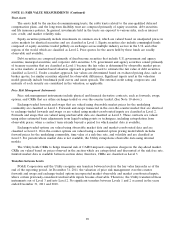

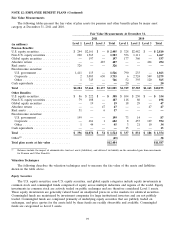

PG&E Corporation and the Utility measure their cash equivalents, trust assets, and price risk management

instruments at fair value. Fair value is an exit price, representing the amount that would be received to sell an asset

or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-

based measurement that should be determined based on assumptions that market participants would use in pricing

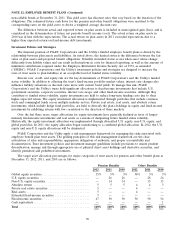

an asset or a liability. A three-tier fair value hierarchy is established as a basis for considering such assumptions and

for inputs used in the valuation methodologies in measuring fair value:

Level 1—Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active

markets.

Level 2—Other inputs that are directly or indirectly observable in the marketplace.

Level 3—Unobservable inputs which are supported by little or no market activities.

The fair value hierarchy requires an entity to maximize the use of observable inputs and minimize the use of

unobservable inputs when measuring fair value.

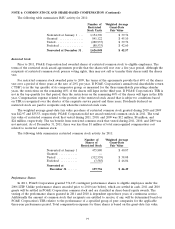

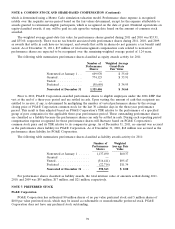

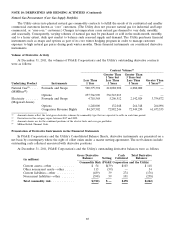

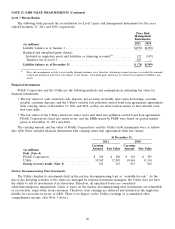

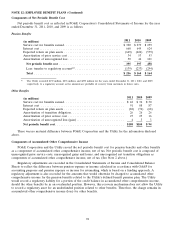

Assets and liabilities measured at fair value on a recurring basis for PG&E Corporation and the Utility are

summarized below (money market investments and assets held in rabbi trusts are held by PG&E Corporation and

not the Utility). The 2010 presentation has been changed to reflect gross assets and liabilities by level to conform to

the current period presentation. Additionally, the Company corrected $125 million that was netted and classified

87