PG&E 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

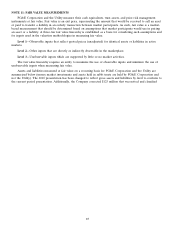

NOTE 11: FAIR VALUE MEASUREMENTS (Continued)

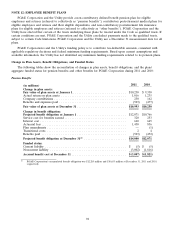

Level 3 Reconciliation

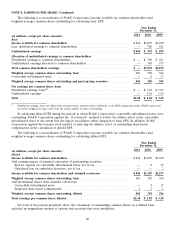

The following table presents the reconciliation for Level 3 price risk management instruments for the years

ended December 31, 2011 and 2010, respectively:

Price Risk

Management

Instruments

2011 2010

(in millions)

Liability balance as of January 1 ..................................... $(399) $(250)

Realized and unrealized gains (losses):

Included in regulatory assets and liabilities or balancing accounts(1) .......... 122 (149)

Transfers out of Level 3 ......................................... 203 —

Liability balance as of December 31 .................................. $ (74) $(399)

(1) Price risk management activity is recoverable through customer rates, therefore, balancing account revenue is recorded for amounts

settled and purchased and there is no impact to net income. Unrealized gains and losses are deferred in regulatory liabilities and

assets.

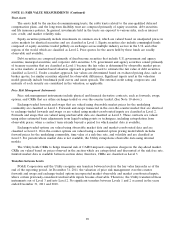

Financial Instruments

PG&E Corporation and the Utility use the following methods and assumptions in estimating fair value for

financial instruments:

• The fair values of cash, restricted cash, deposits, net accounts receivable, short-term borrowings, accounts

payable, customer deposits, and the Utility’s variable rate pollution control bond loan agreements approximate

their carrying values at December 31, 2011 and 2010, as they are short-term in nature or have interest rates

that reset daily.

• The fair values of the Utility’s fixed rate senior notes and fixed rate pollution control bond loan agreements,

PG&E Corporation’s fixed rate senior notes, and the ERBs issued by PERF were based on quoted market

prices at December 31, 2011 and 2010.

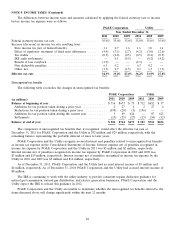

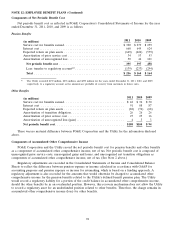

The carrying amount and fair value of PG&E Corporation’s and the Utility’s debt instruments were as follows

(the table below excludes financial instruments with carrying values that approximate their fair values):

At December 31,

2011 2010

Carrying Carrying

Amount Fair Value Amount Fair Value

(in millions)

Debt (Note 4)

PG&E Corporation ...................... $ 349 $ 380 $ 349 $ 383

Utility ................................ 10,545 12,543 10,444 11,314

Energy recovery bonds (Note 5) ............. 423 433 827 862

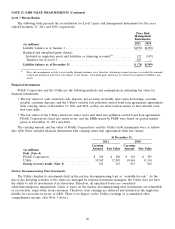

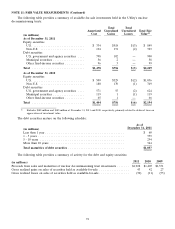

Nuclear Decommissioning Trust Investments

The Utility classifies its investments held in the nuclear decommissioning trust as ‘‘available-for-sale.’’ As the

day-to-day investing activities of the trusts are managed by external investment managers, the Utility does not have

the ability to sell its investments at its discretion. Therefore, all unrealized losses are considered

other-than-temporary impairments. Gains or losses on the nuclear decommissioning trust investments are refundable

or recoverable, respectively, from customers. Therefore, trust earnings are deferred and included in the regulatory

liability for recoveries in excess of ARO. There is no impact on the Utility’s earnings or accumulated other

comprehensive income. (See Note 3 above.)

90