PG&E 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 PG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTE 3: REGULATORY ASSETS, LIABILITIES, AND BALANCING ACCOUNTS

Regulatory Assets

Current Regulatory Assets

At December 31, 2011 and 2010, the Utility had current regulatory assets of $1,090 million and $599 million,

respectively, consisting primarily of ERBs, price risk management regulatory assets, the Utility’s retained generation

regulatory assets, and the electromechanical meters regulatory asset. The regulatory asset for ERBs of $336 million

represents the refinancing of the regulatory asset provided for in the Chapter 11 Settlement Agreement. The Utility

expects to fully recover this asset by the end of 2012 when the ERBs mature. (See Note 5 below.) The current

portion of price risk management regulatory assets of $450 million represents the expected future recovery of

unrealized losses related to price risk management derivative instruments over the next year. (See Note 10 below.)

The Utility expects to recover these losses, as part of its energy procurement costs, as they are realized over the next

year. The current portion of the Utility’s retained generation regulatory assets of $62 million represents the

amortization of underlying generation facilities expected to be recovered within the next 12 months. (See ‘‘Long-Term

Regulatory Assets’’ below.) The current portion of the Utility’s regulatory asset that represents the net book value of

electromechanical meters of $49 million is expected to be recovered within the next 12 months.

Long-Term Regulatory Assets

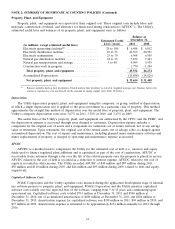

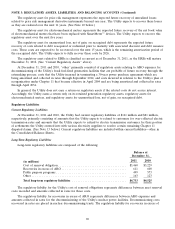

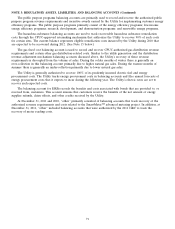

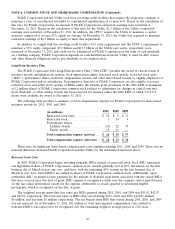

Long-term regulatory assets are composed of the following:

Balance at

December 31,

2011 2010

(in millions)

Pension benefits ................... $2,899 $1,759

Deferred income taxes ............... 1,444 1,250

Utility retained generation ............ 613 666

Environmental compliance costs ........ 520 450

Price risk management ............... 339 424

Electromechanical meters ............. 247 —

Unamortized loss, net of gain, on

reacquired debt .................. 163 181

Energy recovery bonds ............... — 735

Other ........................... 281 381

Total long-term regulatory assets ....... $6,506 $5,846

The regulatory asset for pension benefits represents the cumulative differences between amounts recognized for

ratemaking purposes and amounts recognized in accordance with GAAP, which also includes amounts that otherwise

would be recorded to accumulated other comprehensive loss in the Consolidated Balance Sheets. (See Note 12

below.)

The regulatory asset for deferred income taxes represents deferred income tax benefits previously passed

through to customers. The CPUC requires the Utility to pass through certain tax benefits to customers by reducing

rates, thereby ignoring the effect of deferred taxes. Based on current regulatory ratemaking and income tax laws, the

Utility expects to recover these regulatory assets over average plant depreciation lives of 1 to 45 years.

In connection with the Chapter 11 Settlement Agreement, the CPUC authorized the Utility to recover

$1.2 billion of costs related to the Utility’s retained generation assets. The individual components of these regulatory

assets are being amortized over the respective lives of the underlying generation facilities, consistent with the period

over which the related revenues are recognized. The weighted average remaining life of the assets is 13 years.

The regulatory asset for environmental compliance costs represents the cumulative differences between amounts

recognized for ratemaking purposes and amounts recognized in accordance with GAAP. The Utility expects to

recover these costs over the next 32 years, as the environmental compliance work is performed. (See Note 15 below.)

68